/Cincinnati%20Financial%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Cincinnati Financial Corporation (CINF) is an Ohio-based property and casualty insurer that operates through a network of independent agents across multiple states. With a market cap of $25.5 billion, the company provides a wide range of insurance products, including commercial, personal, excess and surplus lines, life insurance, and annuities.

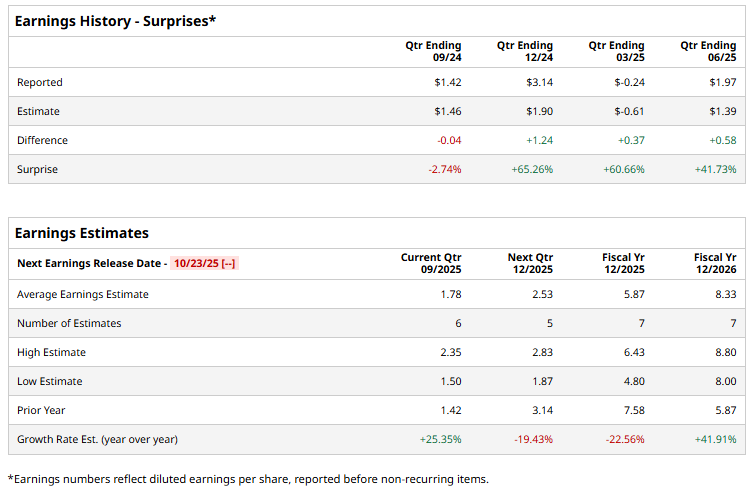

The insurance company is poised to announce its fiscal Q3 earnings results soon. Ahead of this event, analysts expect the company to report a profit of $1.78 per share, up 23.4% from $1.42 per share in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in three of the past four quarters, while missing on one occasion.

For fiscal 2025, analysts expect CINF to report an EPS of $5.87, down 22.6% year over year from $7.58 in fiscal 2024. However, in FY2026, the company’s EPS is expected to rebound, increasing 41.9% annually to $8.33.

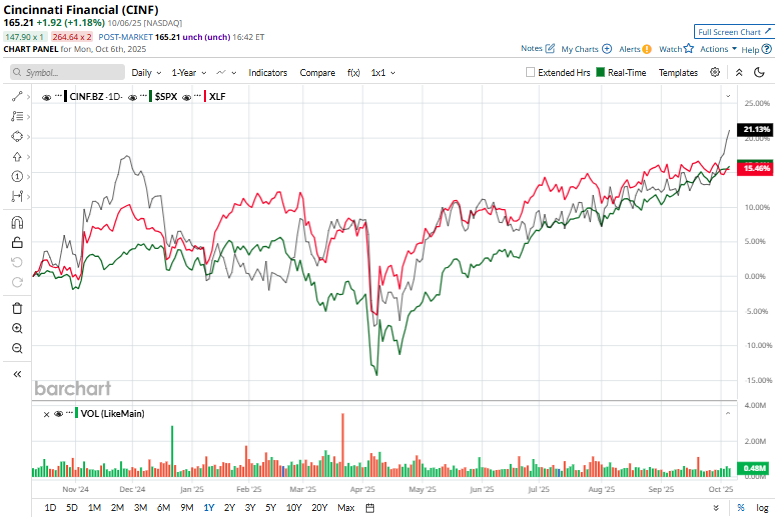

CINF stock has grown 19.1% over the past 52 weeks, outperforming the Financial Select Sector SPDR Fund’s (XLF) 17.6% surge and the S&P 500 Index’s ($SPX) 17.2% uptick during the same time frame.

Cincinnati Financial released its Q2 results on Jul. 28 and its shares gained 3.6%. The company observed a notable 15% growth in premiums earned, along with a solid increase in investment gains and other revenues. Its overall topline came in at $3.2 billion, up a massive 27.7% year-over-year. Moreover, the company observed notable margin improvements during the quarter, resulting in a staggering 52.7% year-over-year surge in non-GAAP operating income per share to $1.97, beating the consensus estimates by 41.7%

Wall Street analysts are reasonably bullish about CINF’s stock, with a "Moderate Buy" rating overall. Among 10 analysts covering the stock, three recommend "Strong Buy," one suggests a “Moderate Buy,” and six suggest a “Hold.” CINF is currently trading above the average analyst price target of $163.33.