/Charles%20River%20Laboratories%20International%20Inc_%20logo-%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $7.7 billion, Charles River Laboratories International, Inc. (CRL) is a global, full-service contract research organization that supports the early stages of drug discovery and development. Through its three segments: Research Models and Services (RMS); Discovery and Safety Assessment (DSA); and Manufacturing Solutions, the company provides essential products and services to pharmaceutical, biotechnology, academic, and government clients worldwide.

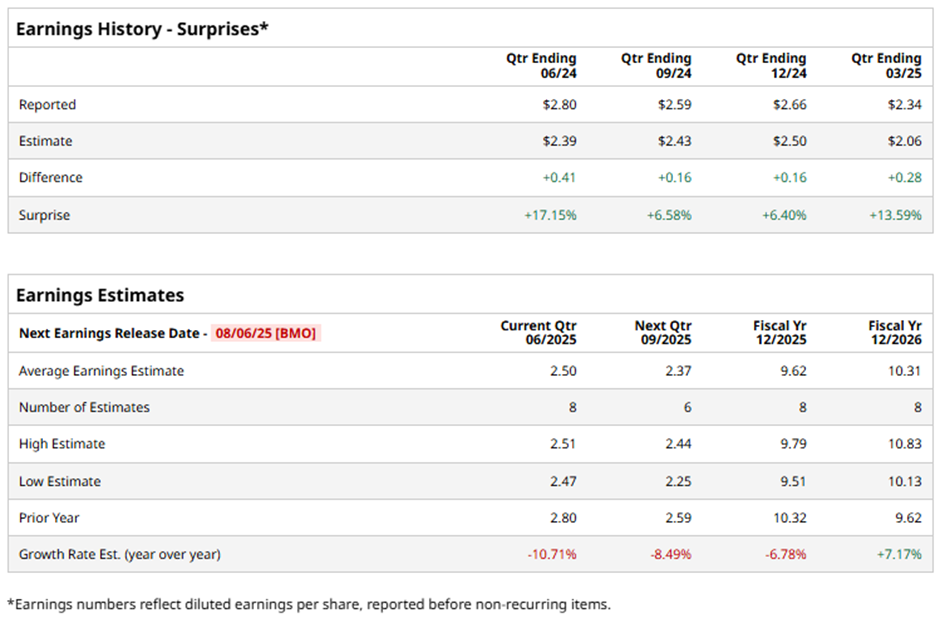

The Wilmington, Massachusetts-based company is slated to announce its fiscal Q2 2025 earnings results before the market opens on Wednesday, Aug. 6. Ahead of the event, analysts expect CRL to report an adjusted EPS of $2.50, down 10.7% from $2.80 in the year-ago quarter. However, the company has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts expect the medical research equipment and services provider to report adjusted EPS of $9.62, a decline of 6.8% from $10.32 in fiscal 2024. Nevertheless, looking forward to fiscal 2026, adjusted EPS is expected to grow 7.2% year-over-year to $10.31.

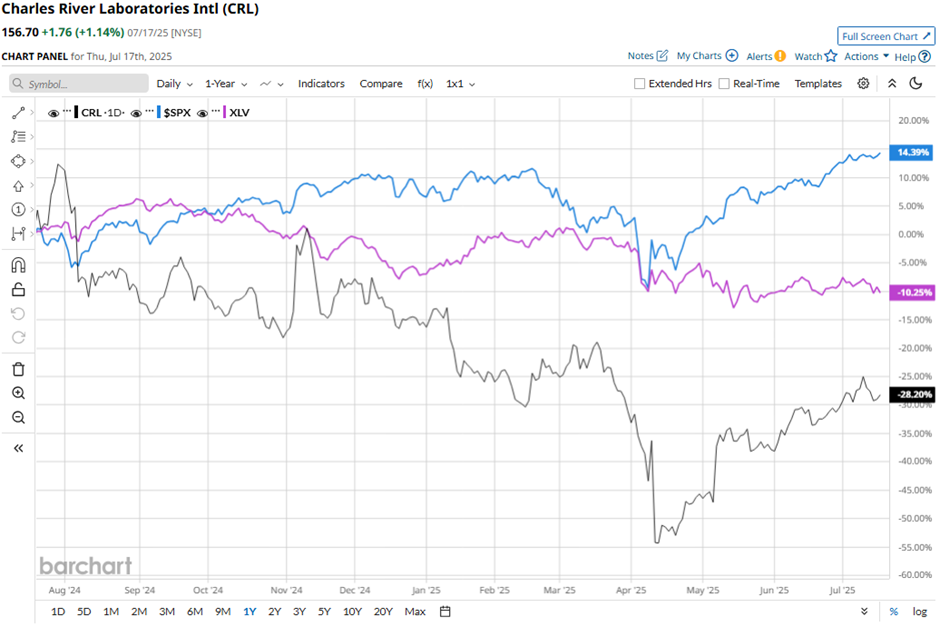

Shares of CRL have dipped nearly 30% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 12.7% rise and the Health Care Select Sector SPDR Fund's (XLV) 11.8% decline over the same period.

Shares of Charles River Laboratories surged 18.7% on May 7 after the company raised its 2025 adjusted profit per share forecast to $9.30 - $9.80, citing stronger-than-expected demand in its Discovery and Safety Assessment segment. The stock rally was also driven by better-than-expected Q1 2025 adjusted EPS of $2.34 and revenue of $984.2 million, and news of a strategic business review following a settlement with activist investor Elliott Management.

Analysts' consensus rating on Charles River Laboratories stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 15 analysts covering the stock, five recommend a "Strong Buy” and 10 give a "Hold" rating. This configuration is more bullish than three months ago, with one analyst suggesting a "Strong Buy."

As of writing, the stock is trading below the average analyst price target of $162.93.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.