/Capital%20One%20Financial%20Corp_%20bank%20exterior-by%20Brett_Hondow%20via%20iStock.jpg)

McLean, Virginia-based Capital One Financial Corporation (COF) focuses on consumer and commercial lending as well as deposit origination. It provides various financial products and services to consumers, small businesses, and commercial clients through its subsidiaries. With a market cap of $137.1 billion, Capital One’s operations span North America and internationally.

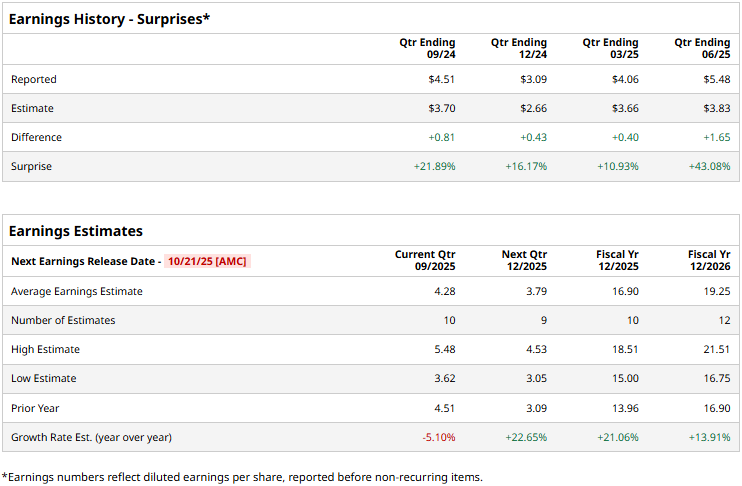

The financial sector giant is set to announce its third-quarter results after the market closes on Tuesday, Oct. 21. Ahead of the event, analysts expect COF to report an adjusted profit of $4.28 per share, down 5.1% from $4.51 per share reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, COF is expected to deliver an adjusted EPS of $16.90, up 21.1% from $13.96 in 2024. In fiscal 2026, its earnings are expected to soar 13.9% year-over-year to $19.25 per share.

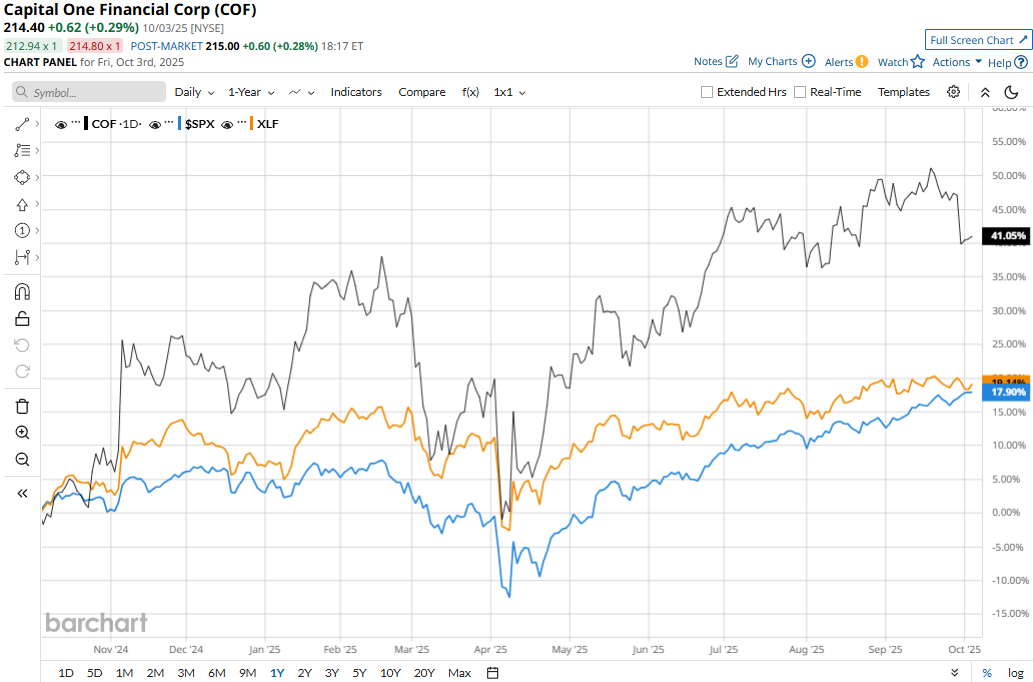

COF stock prices have soared 47.7% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 17.8% surge and the Financial Select Sector SPDR Fund’s (XLF) 19.7% gains during the same time frame.

Capital One Financial’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q2 results on Jul. 22. The company reported a massive 22.6% year-over-year surge in gross interest income to $13.8 billion. Further, the company observed notable expansion in net interest margin, leading to a 32.5% surge in net interest income (NII) to $10 billion. However, the company’s NII post deduction of provisions for credit losses came in at a negative $1.4 billion.

On May 18, COF completed the acquisition of Discover, which significantly impacted provisions. Nonetheless, it was expected, and the company’s overall topline surpassed the Street’s expectations. Moreover, the company’s adjusted EPS soared 74.5% year-over-year to $5.48, surpassing the consensus estimates by 43.1%.

Analysts remain optimistic about the stock’s prospects. COF maintains a consensus “Strong Buy” rating overall. Of the 24 analysts covering the stock, opinions include 16 “Strong Buys,” two “Moderate Buys,” and six “Holds.” Its mean price target of $254 suggests an 18.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.