Valued at a market cap of $9.7 billion, The Campbell's Company (CPB) is a top multinational food company best known for its iconic soups and popular packaged food brands. Headquartered in Camden, New Jersey, Campbell’s portfolio includes Campbell’s, Prego, V8, Pepperidge Farm, and Snyder’s of Hanover.

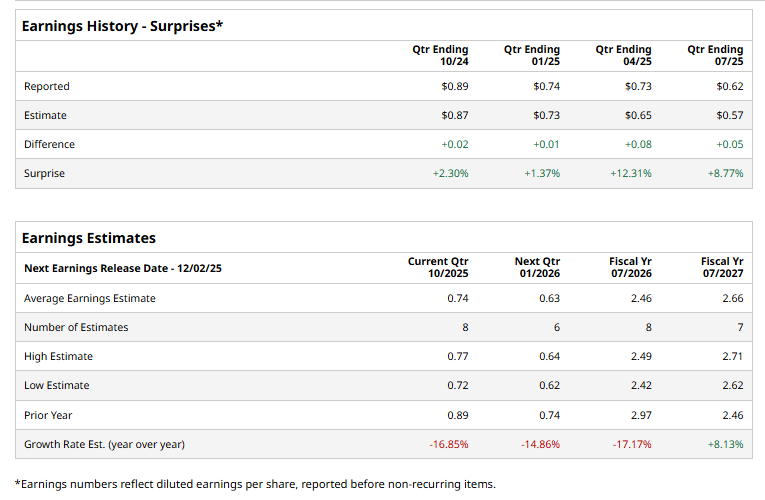

CPB is expected to announce its fiscal Q1 2026 earnings results shortly. Ahead of this event, analysts expect Campbell to report adjusted earnings of $0.74 per share, a 16.9% decline from $0.89 per share in the year-ago quarter. However, the company has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts expect Campbell to report an adjusted EPS of $2.46, down 17.2% from $2.97 in fiscal 2025. But, adjusted EPS is projected to rise 8.1% annually to $2.66 in fiscal 2027.

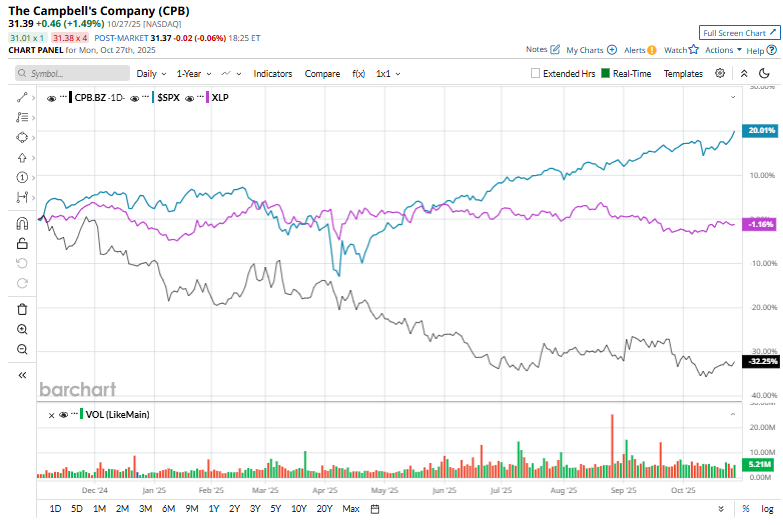

CPB stock has declined 33.3% over the past 52 weeks, trailing both the S&P 500 Index's ($SPX) 18.4% surge and the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% return over the same period.

On Oct. 14, Campbell shares rose 1.8% after Bernstein analyst Alexia Burland Howard reaffirmed a “Buy” rating on the stock with a price target of $39. The upbeat call reflected optimism around the company’s steady demand for its core soup and snack brands, along with ongoing cost-control efforts and pricing initiatives.

Analysts' consensus view on Campbell’s stock is cautious, with a "Hold" rating overall. Among 19 analysts covering the stock, two recommend a "Strong Buy," 13 suggest "Hold," one advises "Moderate Sell," and three "Strong Sells." Its mean price target of $33.83 indicates an upswing potential of 7.8% from the prevailing market prices.