/Berkshire%20Hathaway%20Inc_%20%20logo%20and%20money%20background-%20by%20photo_gonzo%20via%20Shutterstock.jpg)

Valued at a market cap of $1.1 trillion, Berkshire Hathaway Inc. (BRK-B) is a multinational conglomerate that owns a diverse range of businesses and investments spanning sectors including insurance, energy, manufacturing, transportation, retail, and financial services. The Omaha, Nebraska-based company is scheduled to announce its fiscal Q3 2025 earnings in the near future.

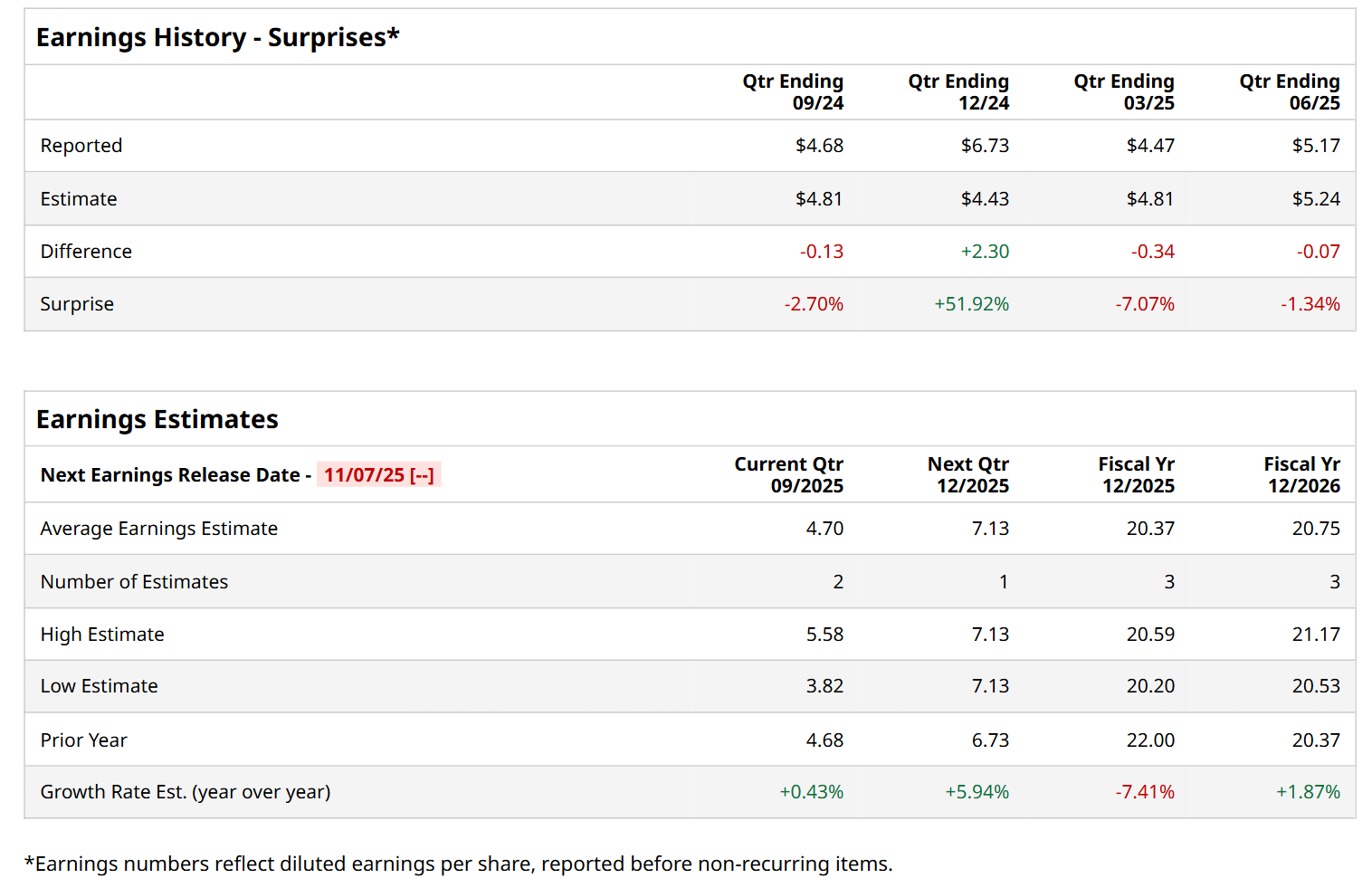

Ahead of this event, analysts expect this insurance company to report a profit of $4.70 per share, marginally up from $4.68 per share in the year-ago quarter. The company has missed Wall Street’s earnings estimates in three of the last four quarters, while surpassing on another occasion. In Q2, BRK.B’s EPS of $5.17 fell short of the consensus estimates by 1.3%.

For fiscal 2025, analysts expect BRK.B to report a profit of $20.37 per share, down 7.4% from $22 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 1.9% year-over-year to $20.75 in fiscal 2026.

Berkshire Hathaway has gained 7.2% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.2% return and the Financial Select Sector SPDR Fund’s (XLF) 11.9% uptick over the same time frame.

On Aug. 2, Berkshire Hathaway released its Q2 results, and its shares tumbled 2.9% in the following trading session. Due to lower insurance sales and service revenues, the company’s overall revenue declined 1.2% year-over-year to $92.5 billion. Moreover, its operating earnings also dropped 3.8% from the year-ago quarter to $11.2 billion, driven by a 12% fall in insurance underwriting income.

Wall Street analysts are moderately optimistic about BRK.B’s stock, with an overall "Moderate Buy" rating. Among seven analysts covering the stock, three recommend "Strong Buy," and four suggest "Hold.” The mean price target for BRK.B is $536.75, implying a 9.5% potential upside from the current levels.