With a market cap of $26.4 billion, Arlington-based AvalonBay Communities, Inc. (AVB) is a leading U.S. real estate investment trust (REIT) that develops, owns, and manages high-quality apartment communities in major metropolitan areas such as New York, California, Washington, D.C., and the Pacific Northwest. The company operates over 315 communities with around 97,000 apartment homes and continues to expand into high-growth markets like Texas, Florida, and North Carolina.

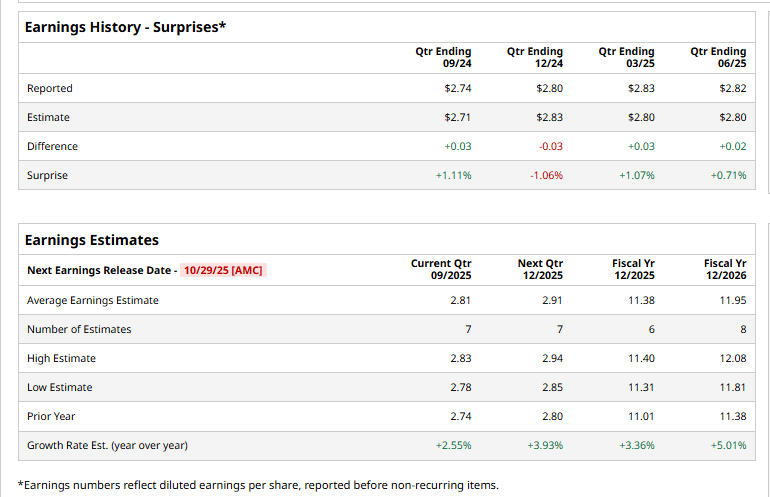

AVB is scheduled to report its Q3 earnings on Thursday, Oct. 29. Ahead of the event, analysts expect the company to report an AFFO of $2.81 per share, up 2.6% year-over-year from $2.74 per share in the same quarter last year. The company has surpassed Wall Street's bottom-line estimates in three of the past four quarters, while missing on one occasion.

For the current year, analysts expect AVB to report an AFFO of $11.38, up 3.4% from $11.01 in fiscal 2024. Moreover, the AFFO is expected to rise 5% annually to $11.95 in FY 2026.

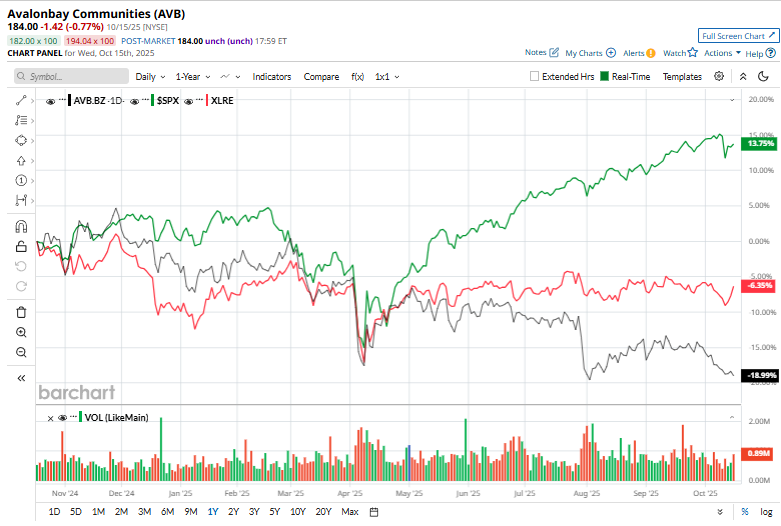

AVB stock has declined 17.7% over the past 52 weeks, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 5.4% surge and the S&P 500 Index’s ($SPX) 14.7% uptick during the same time frame.

On Jul. 30, AVB shares closed down more than 3% after reporting its Q2 results. Its FFO per share of $2.82 surpassed Wall Street expectations of $2.80. The company’s revenue was $760.2 million, missing Wall Street forecasts of $761.7 million. Looking ahead, AvalonBay provided a full-year FFO guidance range of $11.19 to $11.59 per share, indicating confidence in sustained rental demand, disciplined expense management, and continued development contributions.

Wall Street analysts are fairly upbeat about AVB’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, seven recommend "Strong Buy," two suggests a “Moderate Buy,” and 16 a “Hold.” AVB’s average analyst price target of $216.60 indicates a potential upside of 17.7% from the current levels.