Valued at a market cap of $28.4 billion, Atmos Energy Corporation (ATO) is a fully regulated natural gas company based in Dallas, Texas. It provides natural gas distribution, transmission, and storage services to over 3 million customers across eight states, primarily in the South and Midwest regions. It is scheduled to announce its fiscal Q4 earnings for 2025 after the market closes on Wednesday, Nov. 5.

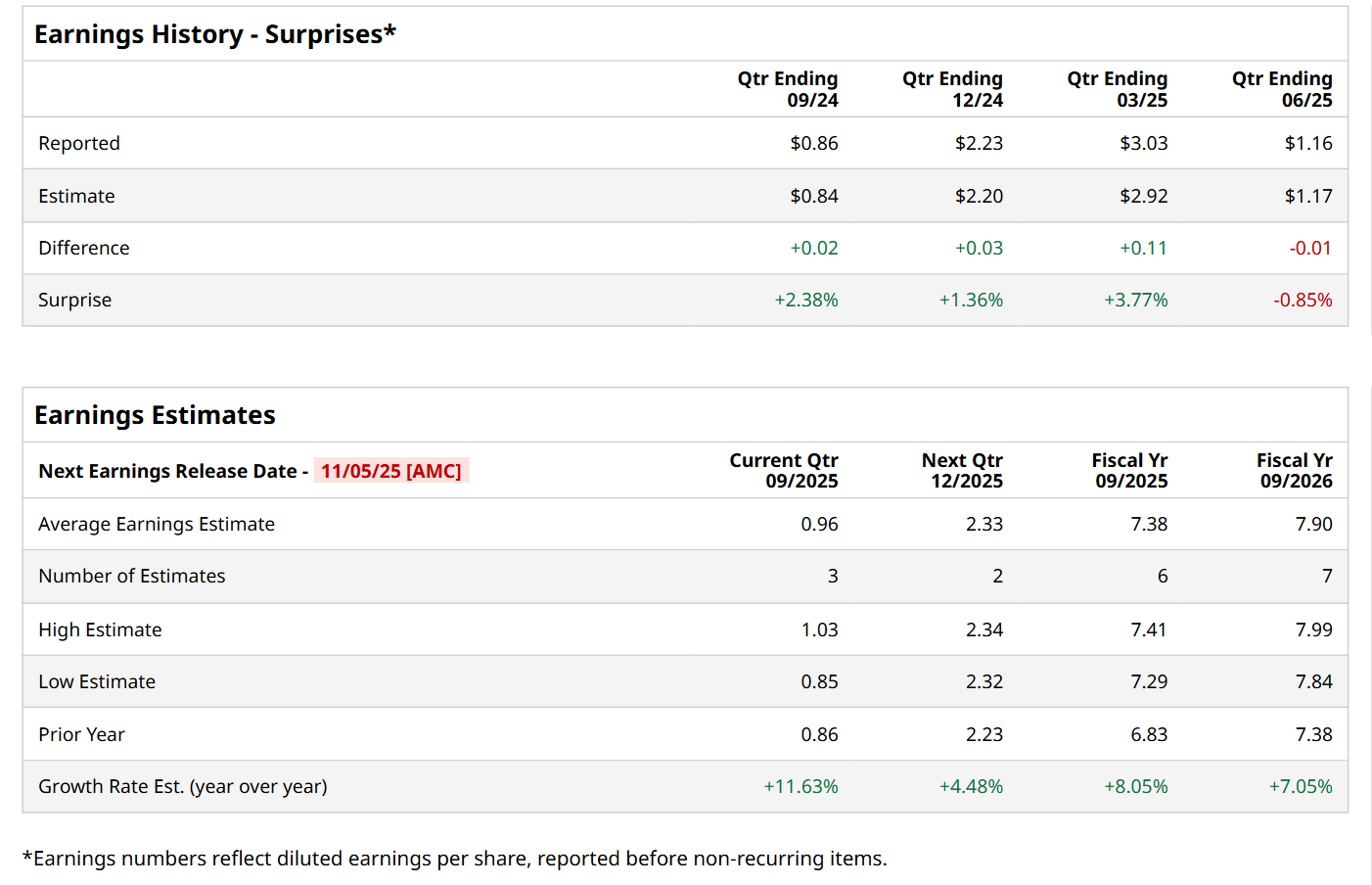

Ahead of this event, analysts expect this utility company to report a profit of $0.96 per share, up 11.6% from $0.86 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. In Q3, ATO’s EPS of $1.16 fell short of the forecasted figure by a penny.

For fiscal 2025, analysts expect ATO to report a profit of $7.38 per share, up 8.1% from $6.83 per share in fiscal 2024. Furthermore, its EPS is expected to grow 7.1% year-over-year to $7.90 in fiscal 2026.

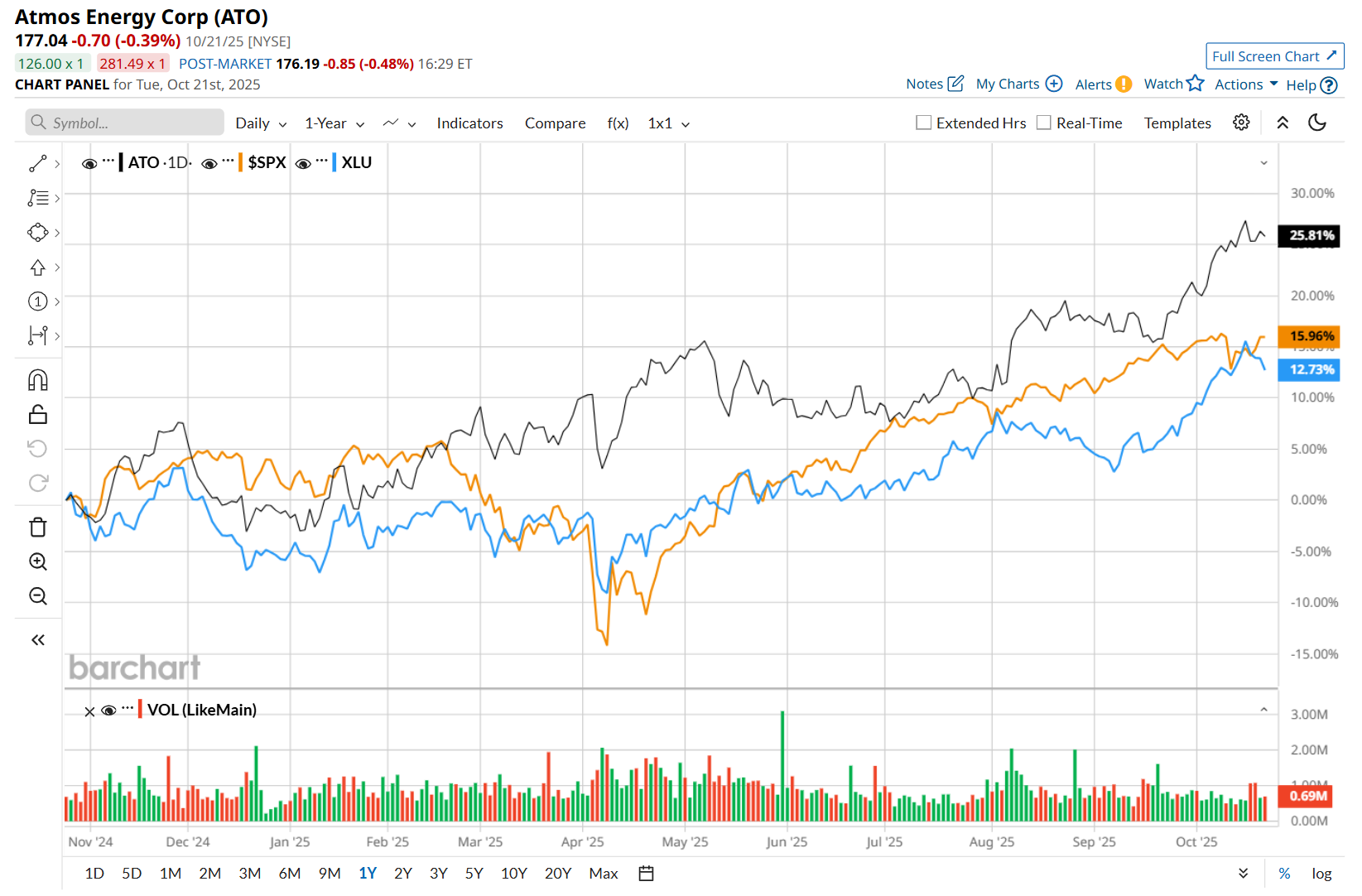

Shares of ATO have rallied 24.5% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 15.1% return and the Utilities Select Sector SPDR Fund’s (XLU) 11% rise over the same time frame.

Atmos Energy delivered its Q3 results on Aug. 6. Although the company’s EPS of $1.16 came in below expectations, its shares rose 3.6% in the following trading session. The rally was likely driven by an increase in ATO’s fiscal 2025 guidance. It now expects EPS in the range of $7.35 to $7.45, signaling confidence in future growth. Additionally, the company’s total operating revenue increased 19.6% year-over-year to $838.8 million, supported by strong performance across its operations. Its distribution segment revenue grew 21.1%, while pipeline and storage revenue climbed 8.7%, reflecting healthy demand and ongoing infrastructure investments.

Wall Street analysts are moderately optimistic about ATO’s stock, with an overall "Moderate Buy" rating. Among 14 analysts covering the stock, three recommend "Strong Buy," one indicates a “Moderate Buy," and 10 suggest "Hold.” While the company is trading above its mean price target of $171.54, its Street-high price target of $185 indicates a 4.5% premium to its current price levels.