Valued at a market cap of $17.3 billion, Alliant Energy Corporation (LNT) is a utility holding company that provides regulated electric and natural gas services. The Madison, Wisconsin-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

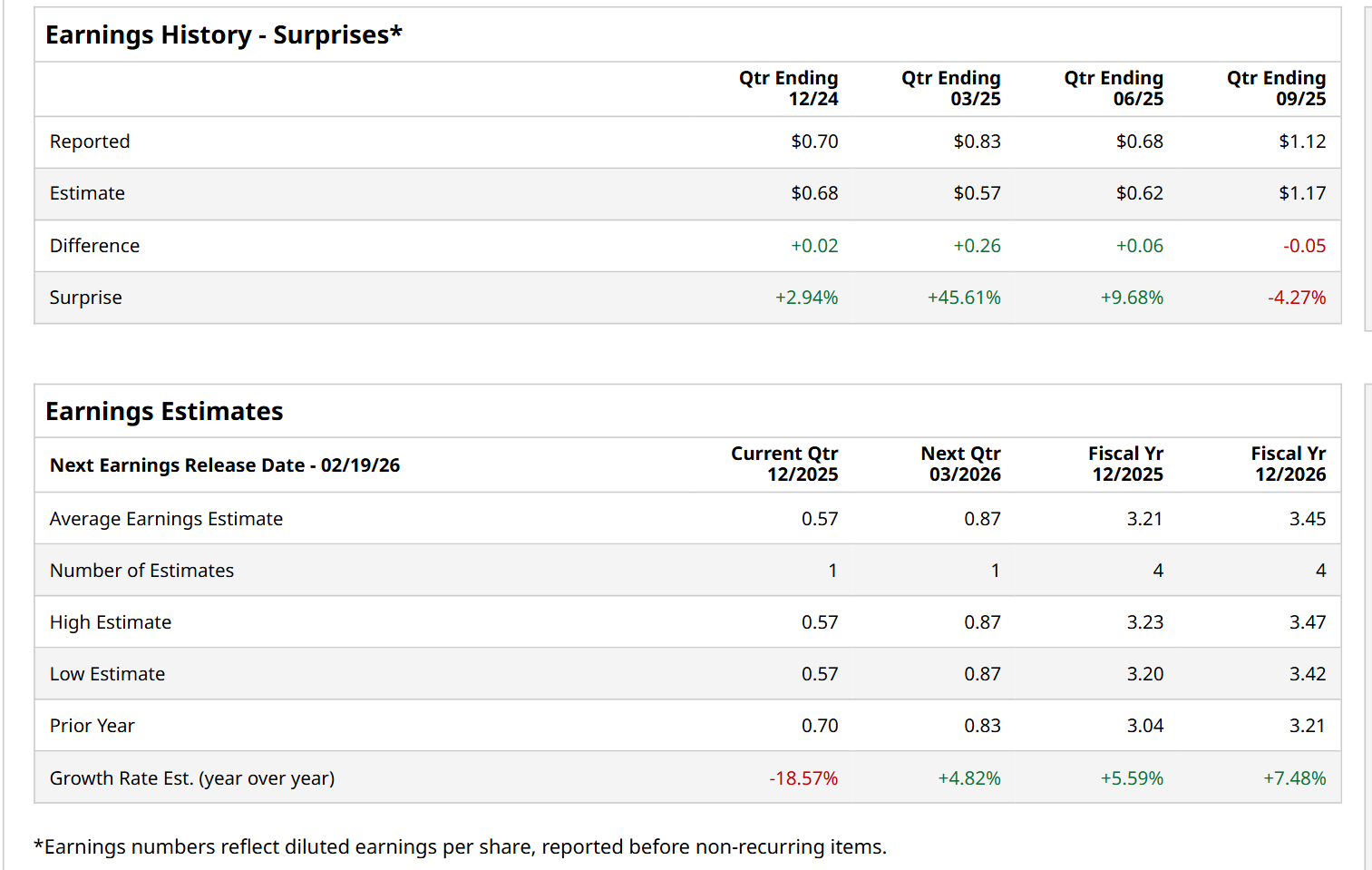

Ahead of this event, analysts expect this utility company to report a profit of $0.57 per share, down 18.6% from $0.70 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.12 per share in the previous quarter fell short of the consensus estimates by 4.3%.

For the current fiscal year, ending in December, analysts expect LNT to report a profit of $3.21 per share, up 5.6% from $3.04 per share in fiscal 2024. Its EPS is expected to further grow 7.5% year-over-year to $3.45 in fiscal 2026.

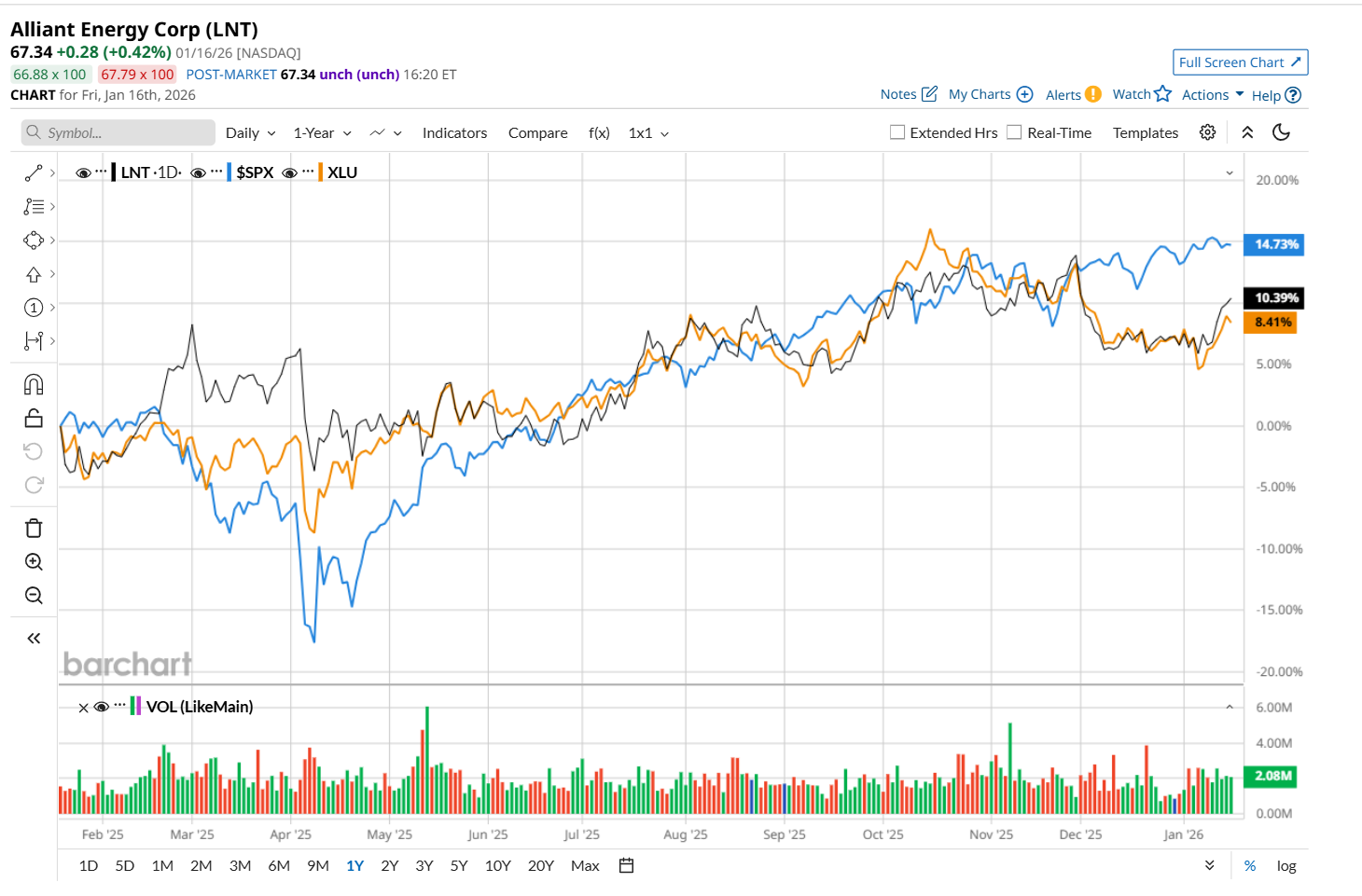

LNT has gained 12.1% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% return over the same time frame. However, zooming in further, it has outpaced the State Street Utilities Select Sector SPDR ETF’s (XLU) 10.2% uptick over the same time period.

LNT posted its Q3 results on Nov. 6, and its shares closed up marginally in the following trading session. Due to a 12.5% increase in electric utility revenues, the company’s total revenue improved 11.9% year-over-year to $1.2 billion. On the other hand, its ongoing EPS declined 2.6% from the year-ago quarter to $1.12, missing analyst estimates by 4.3%. The earnings shortfall was primarily driven by higher other operation and maintenance expenses, depreciation, and financing costs. Nonetheless, despite the bottom-line miss, LNT announced fiscal 2026 earnings guidance of $3.36 to $3.46 per share, continuing its robust 10-year track record of compound annual earnings growth of 6%, bolstering investor confidence.

Wall Street analysts are moderately optimistic about LNT’s stock, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, six recommend "Strong Buy," four indicate "Hold,” and one suggests a "Strong Sell” rating. The mean price target for LNT is $72.33, indicating a 7.4% potential upside from the current levels.