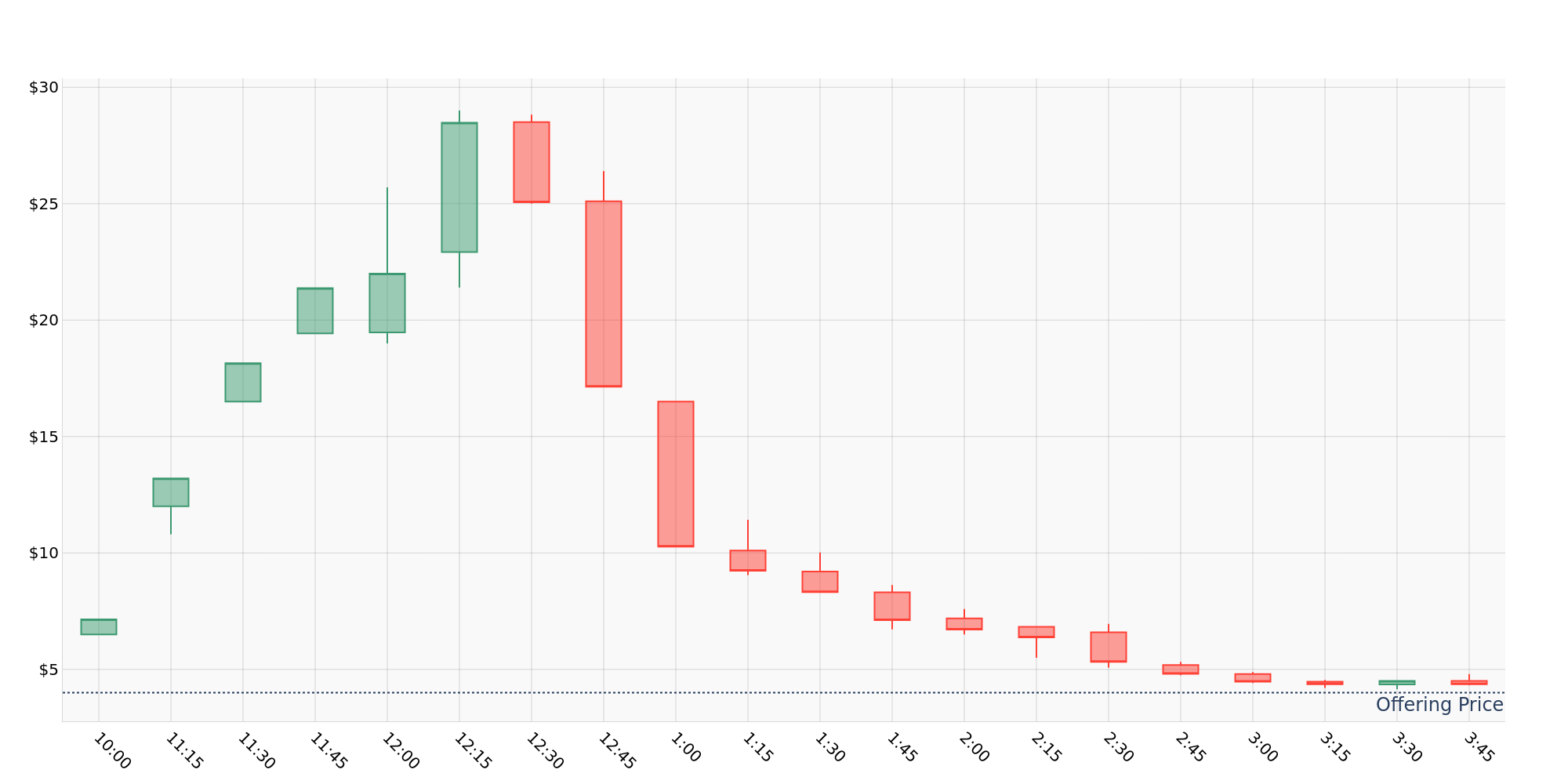

AUSTIN GOLD CORP (NYSE:AUST) opened up its shares for public trading for the first time since it filed for IPO in October 2021. The company agreed to initially offer 3.27 million shares to the public at a $4.00 per share. On its first day of trading, the stock fell 32.77% from its opening price of $6.5 to its closing price of $4.37.

AUSTIN GOLD CORP Performance On First Day of Trading

About AUSTIN GOLD CORP and It's IPO

Austin Gold is a gold exploration company focused on gold targets and making district-scale gold discoveries in Nevada.

For its IPO, AUST agreed to offer 3.27 million shares at a price of $4.00 per share, with an insider lock-up period of 180 days, ending on October 31, 2022.

An insider lock-up period is a period of time after a company first goes public where major shareholders are not allowed to sell their shares. The insider lock-up period makes sure that the market does not get oversupplied with shares of the company.

Traders may short the stock leading up to the lockup-period expiration date in hopes that the price will fall due to an increase in supply of shares. Retail traders should be watching this stock's short interest as it moves closer to lockup expiration.

See also: Benzinga's Most Shorted Stocks

This article was generated by Benzinga's automated content engine and reviewed by an editor.