/Henry%20Schein%20Inc_%20sign%20outside%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $8.3 billion, Henry Schein, Inc. (HSIC) is a leading global distributor of healthcare products and services. The company serves dental and medical practitioners, laboratories, government and institutional clinics, and alternate care sites, while also offering technology and value-added services to support practice management and patient care.

Shares of the Melville, New York-based company have underperformed the broader market over the past 52 weeks. HSIC stock has decreased 2.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. Moreover, shares of the company have declined 1.3% on a YTD basis, compared to SPX's 8.7% rise.

Looking closer, Henry Schein stock has experienced a milder decline than the Health Care Select Sector SPDR Fund's (XLV) 10.9% drop over the past 52 weeks.

Despite posting better-than-expected Q2 2025 revenue of $3.2 billion, shares of HSIC tumbled 7.4% on Aug. 5 after the company reported adjusted EPS of $1.10, missing Wall Street forecasts. The shortfall was driven by softer U.S. dental product demand, weighed down by high interest rates, inflation, and reduced spending on non-urgent procedures such as orthodontics and high-end restoratives.

For the fiscal year ending in December 2025, analysts expect HSIC's adjusted EPS to grow 1.9% year-over-year to $4.83. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

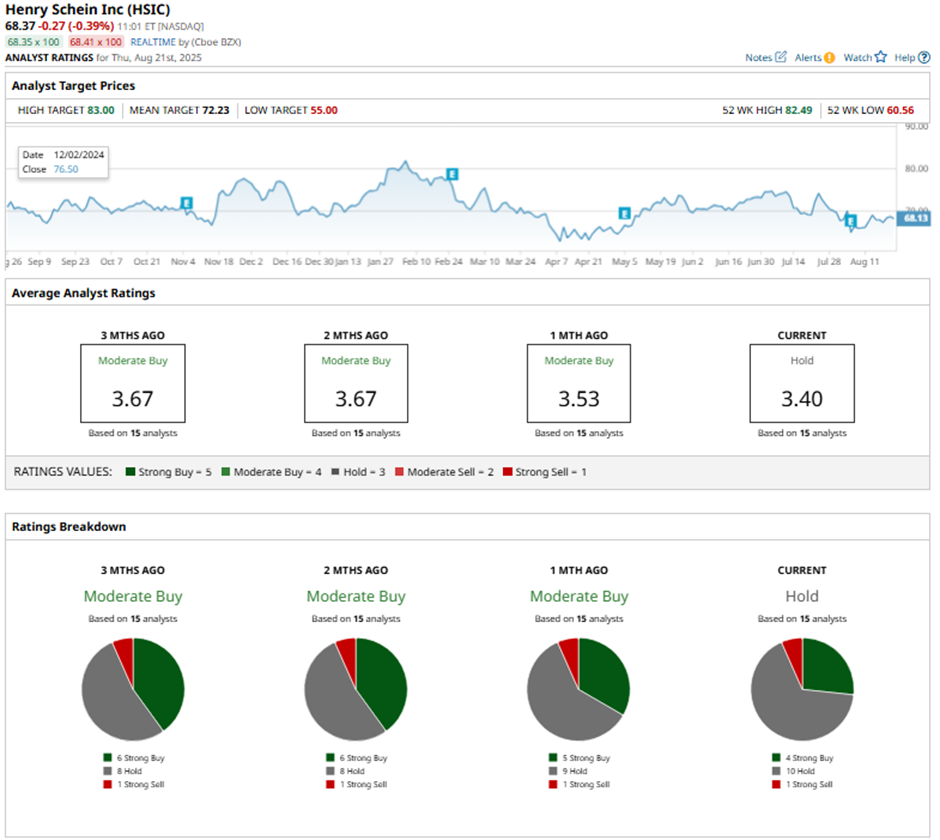

Among the 15 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, 10 “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, with six “Strong Buy” ratings on the stock.

On May 6, Barrington analyst Michael Petusky lowered Henry Schein’s price target to $86 while maintaining an “Outperform" rating.

The mean price target of $72.23 represents a 5.6% premium to HSIC’s current price levels. The Street-high price target of $83 suggests a 21.4% potential upside.