/Henry%20Schein%20Inc_%20sign%20outside%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $8.2 billion, Henry Schein, Inc. (HSIC) is a leading global provider of healthcare products and services, specializing in serving office-based dental and medical practitioners. Headquartered in Melville, New York, the company operates in 33 countries and territories, employing over 25,000 Team Schein members worldwide.

Companies valued between $2 billion and $10 billion are generally classified as “mid-cap stocks," and Henry Schein fits this criterion perfectly. With a selection of more than 120,000 branded products and Henry Schein private-label offerings, the company supports more than 1 million customers globally. Additionally, its integrated approach, extensive product offerings, and commitment to ethical business practices position it as a prominent player in the healthcare industry.

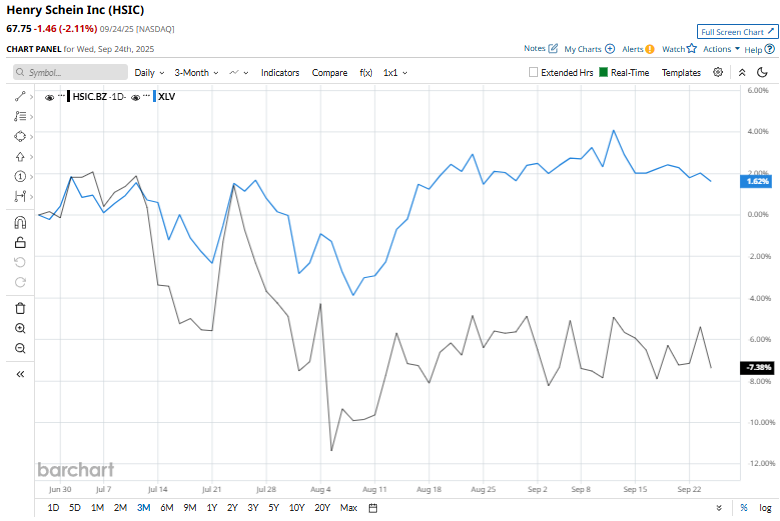

However, Henry Schein currently trades 17.9% below its 52-week high of $82.49 recorded on Feb. 5. HSIC's stock has dropped 6.8% over the past three months, lagging behind the Health Care Select Sector SPDR Fund's (XLV) 2% rise over the same time frame.

Longer term, Henry Schein’s stock has plunged 2.1% on a YTD basis, whereas XLV has decreased marginally. Moreover, shares of HSIC have slumped 4.2% over the past 52 weeks, underperforming the ETF’s 11.5% returns over the same time frame.

The stock has slipped below its 50-day and 200-day moving averages since the end of July, indicating a downtrend.

Shares of HSIC fell 7.4% on Aug. 5 after the company reported Q2 2025 earnings. While its adjusted EPS of $1.10 fell short of Wall Street forecasts, revenue of $3.2 billion beat expectations. The earnings miss was driven by sluggish demand for U.S. dental products, as high interest rates, inflation, and lower spending on non-urgent procedures like orthodontics and high-end restoratives weighed on performance.

In the healthcare sector, top rival Cardinal Health, Inc. (CAH), has notably outperformed HSIC stock. Shares of CAH have gained 30.7% on a YTD basis and climbed 40.3% over the past 52 weeks.

Nevertheless, among the 15 analysts covering the HSIC stock, the consensus rating is a “Moderate Buy.” Its mean price target of $73.23 suggests an 8.1% upside potential from current price levels.