Helen of Troy Limited (NASDAQ:HELE) reported worse-than-expected first-quarter financial results and issued second-quarter guidance below estimates on Thursday.

The company reported first quarter adjusted earnings per share of 41 cents, missing the analyst consensus estimate of 90 cents. Quarterly sales of $371.655 million (down 10.8% year over year), missed the Street view of $398.205 million.

"The first quarter was challenging, with tariff-related impacts making up approximately 8 percentage points of the 10.8% consolidated revenue decline, said interim CEO Brian L. Grass.

Helen of Troy said it now expects to reduce its cost of goods sold exposed to China tariffs to less than 25% by the end of fiscal 2026.

The company expects second-quarter adjusted EPS between 45 cents and 60 cents, significantly below the $1.17 analyst estimate. Helen of Troy also projects revenue between $408 million and $432 million, missing the Street forecast of $474.97 million.

Helen of Troy shares fell 5.9% to close at $22.55 on Friday.

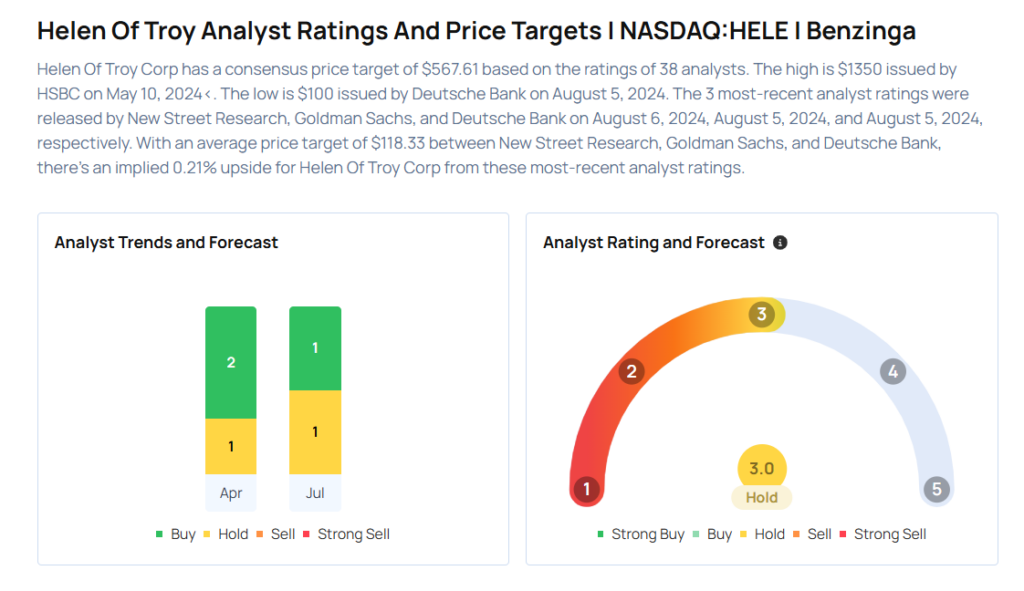

These analysts made changes to their price targets on Helen of Troy following earnings announcement.

- Canaccord Genuity analyst Susan Anderson downgraded Helen Of Troy from Buy to Hold and lowered the price target from $47 to $26.

- UBS analyst Peter Grom maintained Helen Of Troy with a Neutral and lowered the price target from $32 to $29.

Considering buying HELE stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock