"When it is time to buy stocks, you won't want to."

- Walter Deemer

"Buy to the sound of cannons, sell to the sound of trumpets."

- Nathan Mayer Rothschild

"Price has a way of changing sentiment."

- The Divine Ms M (Helene Meisler)

Equities exhibited a dramatic decline in January and this past week's drop was as swift and deep as anything we have witnessed in many years.

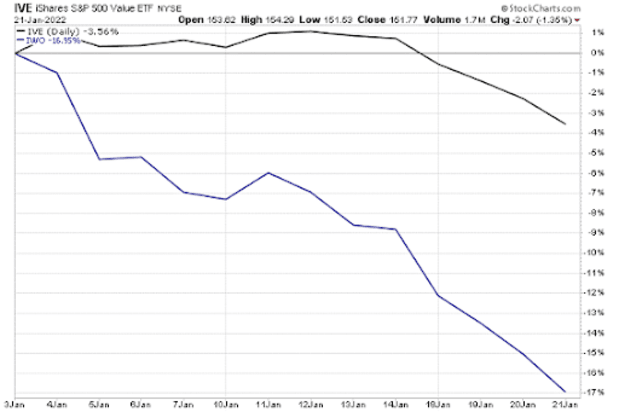

Coming into Monday, the S&P 500 was down by about 8.3% in January and the Nasdaq Index had fallen by over 13%. However, as bad as those declines were, they belie the much more precipitous drops in many equities.

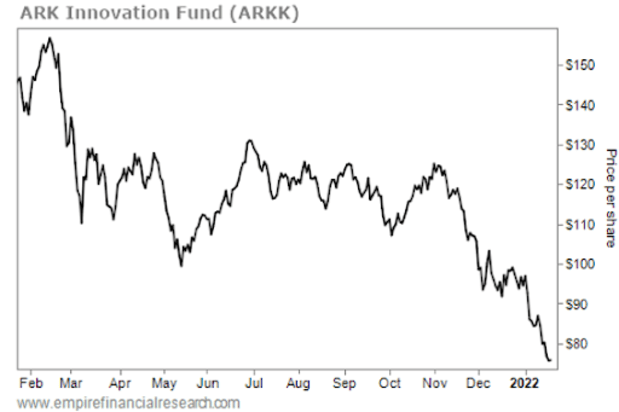

As stated, many stocks have fallen considerably more than the indexes. The most penalized have been profitless, high-growth "concept" stocks. Cathie Wood's ARK Innovation Fund (ARKK) is an excellent proxy for this category of speculative stocks -- it is down by over 55% from its peak a year ago and the drop in the share price has accelerated in recent days:

Small growth stocks (iShares Russell 2000 Growth ETF (IWO)) have declined by an astonishing 17% in the last 13 trading days.

I am neither a dedicated bear nor a dedicated bull. Rather, I approach markets based on our calculation of upside reward vs. downside risk.

On that score, I have been of the view that equities, in general, were overpriced relative to the apparent risks I have steadily outlined in my Daily Diary on Real Money Pro over the last few months. I expressed this clearly in a column of a week ago, Could the Setup for 2022 Portend an End to the 12-Year Bull Run?

Reflecting those concerns, I have been conservatively positioned -- waiting for stocks to fall and for opportunities to arise.

In light of the recent market decline, I have raised my net long exposure. Beginning after the market closed last Thursday and throughout Friday I added to my net long exposure, as outlined in my comments in the Daily Diary on early Friday morning.

I am still at an extremely conservative posture but the move is reflective of the notion that a number of stocks we monitor have moved into attractive buying levels.

The market's ungracious decline in the past week has been brutal -- unmercifully so for a large number of stocks. Some of the equities that I have wanted to buy and had been expensively priced have now reached more attractive price levels and appear to provide excellent upside rewards relative to downside risk.

Warren Buffett famously said, "In the short run the market is a voting machine and in the long run it is a weighing machine." Though the market has recently been in panic/freefall and voting thumbs down, water, ultimately, seeks its own level. The same applies to selected stock prices and valuations, which in the fullness of time could appreciate meaningfully from current levels.

That said, I continue to hold to some of the concerns I have expressed over the last six months -- rising and sustained inflation, the Federal Reserve's pivot, continued supply-chain and logistical problems, geopolitical threats, and other economic worries. However, with stock prices deflating so rapidly we have to ask ourselves to what extent are our concerns beginning to be discounted?

Second-Level Thinking Produces Better Market Returns

I agree with my friend Oaktree Capital's Howard Marks who declares in his book "The Most Important Thing" that, in order to achieve superior investment returns, second-level thinking (over first-level thinking) produces superior investment returns.

First-level thinking is simplistic and superficial, and just about everyone can do it -- a bad sign for anything involving an attempt at superiority. All the first-level thinker needs is an opinion about the future, as in "The outlook for the company is favorable, meaning the stock will go up." Second-level thinking is deep, complex, and convoluted: The second-level thinker takes a great many things into account:

- What is the range of likely future outcomes?

- Which outcome do I think will occur?

- What's the probability I'm right?

- What does the consensus think?

- How does my expectation differ from the consensus?

- How does the current price for the asset comport with the consensus view of the future, and with mine?

- Is the consensus psychology that's incorporated in the price too bullish or bearish?

Howard Marks writes that first-level thinking says, "I think the company's earnings will fall; sell." Second-level thinking says, "I think the company's earnings will fall less than people expect, and the pleasant surprise will lift the stock; buy."

Howard's views on second-level thinking may apply to today's market as a whole:

First-level thinking says, "The market faces a host of headwinds; let's sell the market." Second-level thinking says, "There are headwinds but everyone knows the headwinds and they have been partially discounted in market prices; let's buy the market."

The issue, of course, is to what degree have our concerns been discounted? And that's the hard part.

We do know that sentiment, moving from optimism to pessimism, and stock prices, having materially fallen, both indicate that some of our concerns are now becoming adopted by the consensus and, to some degree, have been discounted.

We also know that when the market feels the worst, it is often an opportunity to buy, for as a former Putnam Management associate of mine, Walt Deemer, once said, "When it is time to buy, you won't want to."

I wonder whether that time -- to buy -- is rapidly approaching.

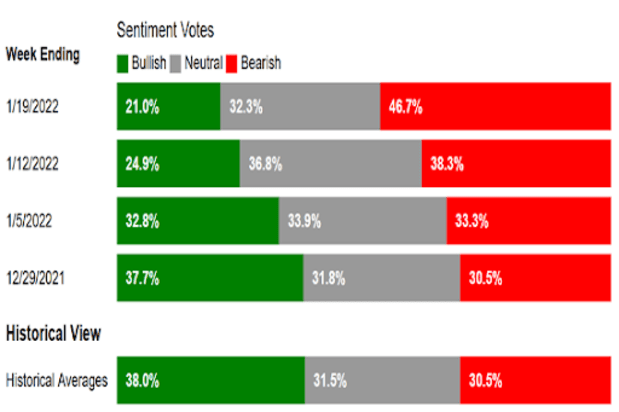

And, not surprisingly coincident with the swift drop in stock prices in January, retail investor sentiment has abruptly turned negative over the last two weeks.

This chart of AAII Investor Sentiment demonstrates the heightened negativity:

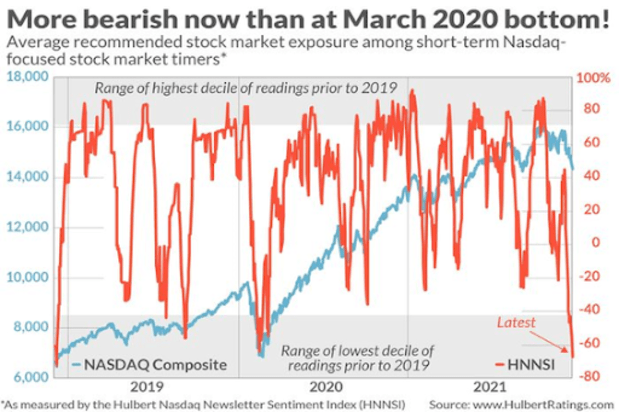

The Hulbert Sentiment Index is at the most bearish reading since March 2020:

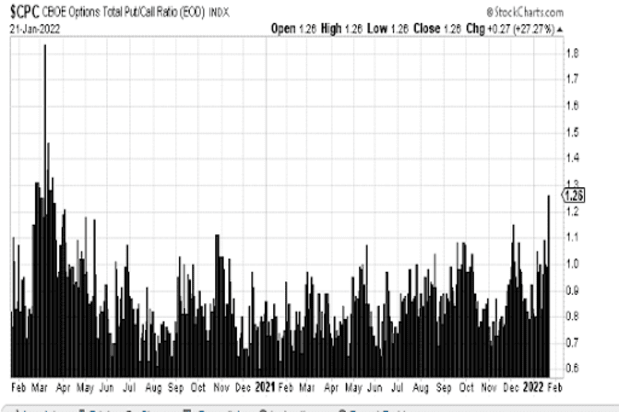

Coincident with a sharp drop in prices and another measure of intensifying negativity, the total put/call ratio has climbed to the highest level since spring, 2020 (from Helene Meisler):

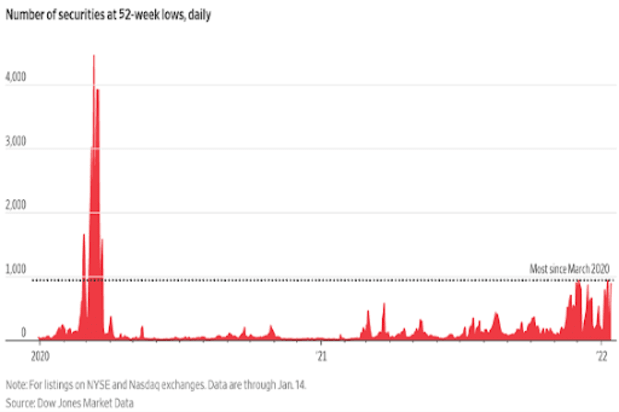

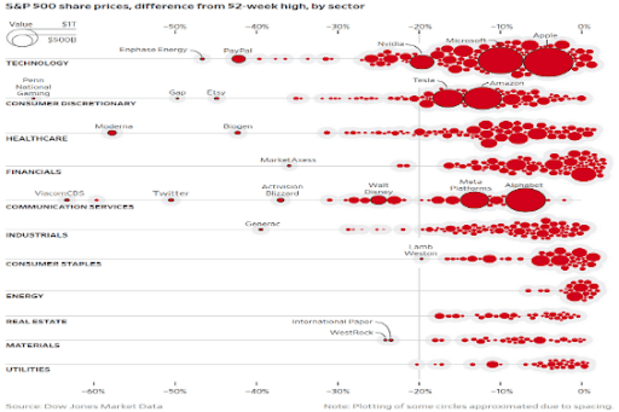

As to stock prices slowly incorporating and discounting our concerns, we can see the underlying weakness in these two charts in this Wall Street Journal article, "Giant Stock Swings Kick Off 2022" (h/t Whitney Tilson for pointing this out to me).

The first shows the surge over the past couple of months in stocks hitting 52-week lows each day:

And the second shows how much each stock is below its 52-week high, by market cap and sector:

Month to date, the Nasdaq is off to the worst start to a year in its history -- and that includes the deflation of the dot.com boom and in the middle of The Great Recession of 2008-09:

2022 (through Jan. 21): -13.1%

2008: -11.5%

2016: -10.7%

2009: -8.6%

1996: -5.1%

The breathtaking January drop in the Nasdaq is further documented and put into a historical perspective in the chart below -- constructed at the close of trading last Wednesday.

If we take into account the substantial declines of Thursday and Friday, the Nasdaq correction is over 17.5%, the fourth-worst correction since The Great Financial Crisis. At 65 days, including Thursday and Friday, it’s already longer than the average post-Great Financial Crisis Nasdaq correction of 53 days:

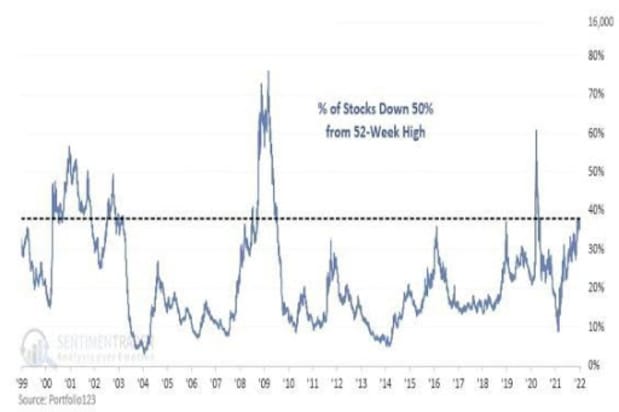

Last month in Could This Portend the End of the 12 Year Bull Market?, I exhibited a chart that showed the carnage in the Nasdaq. Since then, that carnage has intensified with the number of Nasdaq Index issues down by greater than 50% from their highs having climbed from 39% to 42%.

From the 2008 financial crisis, only March 12-April 8, 2020 saw more stocks down 50% or more:

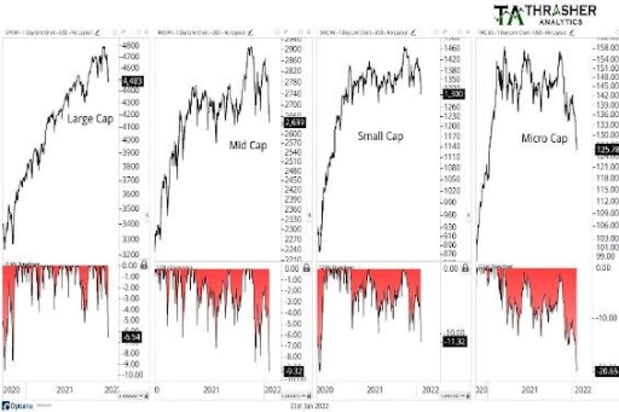

Anyone who has invested in "concept," meme, biotech, and smaller-cap stocks has realized that the nearly unprecedented pain has been deep as the decline intensified as last week came to a close. The charts below indicate that the smaller the market capitalization, the larger the correction:

Inflation and Consumer Spending Remains a Concern

Ultimately, my mandate in running a hedge fund is to construct a portfolio of equities with attractive reward vs. risk potential superimposed with a fundamental macroeconomic viewpoint and its likely impact on the overall markets.

Given the magnitude and swiftness of the market's carnage and the developing individual equity opportunities, I should probably consider becoming more aggressive than we were late last week when we committed an additional 10% of our reserves into stocks.

However, while we want to be greedy when others are fearful, I remain concerned about inflation, and the consequences of a slowdown in consumer spending, the margin vulnerability to U.S. corporations, a slowing economy in response to the upcoming pivot by the Federal Reserve, and geopolitical threats, etc.

Moreover, I remain concerned that the changing market structure, in which levered price momentum-based products and strategies that know nothing about value but everything about price dominate trading, could result in even more selling over the near term as stocks continue to weaken and as the senior indices have breached -- to the downside -- important moving average levels and levels of support.

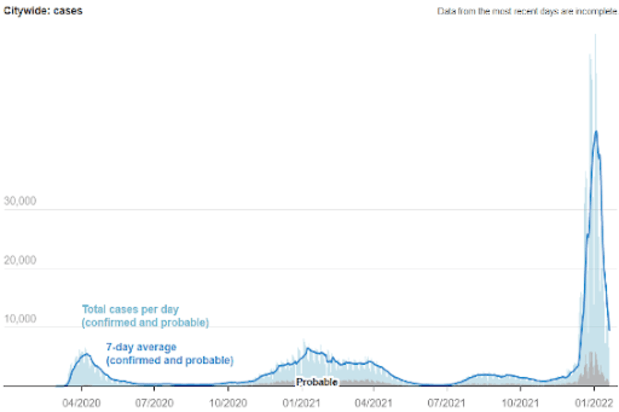

On the positive side of the ledger is that our view that Omicron, though infectious, is not virulent, is gaining credibility. Importantly, the pandemic is over and is now an epidemic. Nationwide cases and hospitalizations have peaked and are starting to decline rapidly. Here is the New York City data (h/t again to Whitney Tilson) in which cases are down about 80% from their peak of a mere three weeks ago:

So, it is likely that the supply-chain problems, which have certainly contributed to higher inflation, will begin to be relieved over the next few months.

Again, the question we ask ourselves today -- as we try to incorporate second-level thinking -- is to what degree have these concerns been discounted in some individual stocks who have declined considerably?

Remember, we began the year defensively and our thinking -- in The Portend column previously mentioned – was that we would see a valuation reset lower in the U.S. stock market of about 15%. In only three weeks we have already seen a lot of that in the 8% and 13% declines in the S&P and Nasdaq indices. Notably, the expected 15% reduction in price/earnings ratios has already been far eclipsed in a number of individual equities -- some of which I now find attractive to buy.

Some Stocks Have Become Buys

To summarize my current views:

* In a short period of only three weeks investors have grown fearful, integrating many of the concerns I have expressed over the last six months.

* In duration and amount, the January decline in stock prices is almost unprecedented historically.

* Coincident with lower stock prices and valuations, investor sentiment has deteriorated markedly and, by many gauges, is moving towards a negative extreme.

* Many individual stocks have suffered far greater declines than the averages -- some are approaching or already have moved into attractive buying levels.

As we suggested a week ago, The Era of Irresponsible Bullishness is obviously over, but that doesn't mean that certain stocks represent good value.

For now, I have settled on a plan to very slowly commit some additional cash reserves into the markets when I see further superior reward vs. risk opportunities develop.

I will not likely rush to commit my still sizable cash reserves but I will be opportunistic in searching for values and we will be closely monitoring whether, and how, the fundamental backdrop changes relative to our expectations.

This commentary originally appeared on Real Money Pro on Jan. 24. Click here to learn about this dynamic market information service for active traders and receive Doug Kass's Daily Diary and columns from Paul Price, Bret Jensen, and others each day.

At the time of publication, Doug Kass was long SPY, QQQ, IWM, XBI, PYPL, DKNG, PENN, DIS, NFLX, UPLD, FB, NVDA, MSFT, SONO, ELAN, BA, JPM, and GS.