/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Today, heavy unusual trading in Intel Corp. (INTC) put options that are out-of-the-money (OTM) could spell trouble for INTC stock over the next month. The company's Q2 results yesterday did not encourage investors.

INTC stock is trading at $20.63, down over 8% today. This is down from its high of $23.82 on July 10, $25.92 on March 18, as well as $27.29 on Feb. 18.

Investors in the heavy INTC put options today may be betting that the stock will hit another low after its recent results.

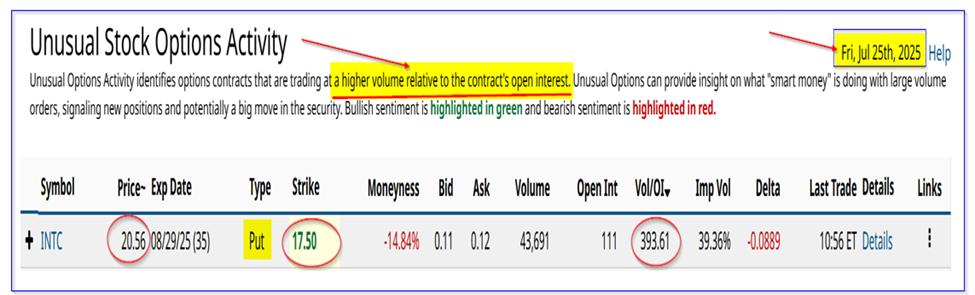

This can be seen in today's Barchart Unusual Stock Options Activity Report (see below). It shows that almost 44,000 put contracts have traded at the $17.50 put option strike price expiring Aug. 29, 2025 (35 days to expiry or DTE).

That amount of put trading volume is almost 394 times the prior number of put contracts outstanding. That is huge!

It implies that institutional investors are piling into these put contracts, either on the buy side or shorting them for income (or maybe both).

Buyers expect INTC to fall below $17.38 (i.e., $17.50-$0.12), or down over 15.7% in the next month. That would be below even its low in early April ($18.13 on April 8). So, they must be very bearish on INTC.

But short-sellers of these put options are happy to potentially be assigned to buy shares at $17.50 per share. In return, they receive 0.63% in immediate income (i.e., $0.11/$17.50).

One thing is for sure. No one is excited about Intel's dreary Q2 results.

Poor Q2 Results

Intel reported that Q2 revenue rose just 0.2% YoY to $12.9 billion. Management posed this as a success since it was $1.1 billion over its April 2025 outlook estimate. Fine, but what about profits?

Its operating income was a loss of $3.176 billion, which was much worse than last year's operating income loss of about $2 billion (-$1.964b).

Moreover, its free cash flow (FCF) was negative (i.e., an outflow of cash) of -$1.05 billion in Q2 (vs. +$8.155 billion positive last year). For the half-year, its FCF was a cash drain of negative $5.87 billion.

The company has not been FCF positive since Q3 2023, or 7 quarters ago (and then it was only $71 million).

In fact, management said in its prepared remarks that,

“…our last full year of positive adjusted free cash flow was 2021. That is completely unacceptable. ”

However, the company said it has lowered capex spending by $5 billion for this year and expects to lower operating expenses. The problem is it still can't forecast when FCF will turn positive.

As a result, it's very difficult to post a positive outlook on INTC stock. In fact, it may not even be a good outcome for the company to lower its capex spending.

Where Analysts Stand

Most analysts are negative on INTC stock. For example, 40 out of 45 analysts surveyed by Yahoo! Finance have a “Hold” recommendation. The average price target is just $21.83.

Stock Analysis reports that the average analyst shows just a +2.91% revenue forecast for the next 5 years. The consensus of 29 analysts is “Hold.”

I expect that after today's results, more analysts will produce" Sell" recommendations on INTC.

That could be another reason why there is so much interest in these out-of-the-money (OTM) put options.

Summary

Institutional investors with long investments in INTC (obviously as a turnaround play) may be hedging their bets by buying insurance with these OTM puts.

After all, it costs less than 1.0% to insure their portfolio risk that INTC stock does not fall more than 15% in the next 35 days. But, even more importantly, it will provide some offset against a 5% or 10% decline in the next month.

Investors in these puts as a directional play may want to assess the potential risk here. A lot of bad news is already in the stock. Going long these puts (not as a hedge against a long investment in INTC) is clearly a speculative investment. Investors could lose 100% of their bet.

However, some investors may find shorting these puts a better play. After all, it will provide a 0.63% yield over the next month. These investors must be prepared, however, to buy shares at $17.50 per share if INTC falls to that level by Aug. 29.