Opendoor Technologies (OPEN) yesterday announced that it had hired Shopify’s Chief Operating Officer, Kaz Nejatian, as its new CEO. The online real estate platform stock surged 80% on the news.

In Thursday trading, more than 1.05 billion shares of its stock traded, nearly three times the average daily volume. More importantly, as it relates to my commentary on unusual options activity, the stock's options volume was 3.77 million on the day, over three times the average daily volume.

Opendoor had 44 unusually active calls and 41 puts yesterday. Although the put-call ratio volume ratio was 0.55, a bullish indicator, the even balance between the unusually active calls and puts suggests there is a bullish-bearish divide about the company's outlook despite the positive news.

If you’re an options investor, yesterday’s action was like being a kid in a candy store.

I’m neither bullish nor bearish about its stock. However, the unusual options activity provided good bets for those on both sides of the argument.

Have an excellent weekend.

The Bullish Quick Take

Not only did Opendoor hire a new CEO from one of the most successful e-commerce companies in the world, but it also announced that co-founders Keith Rabois and Eric Wu would rejoin the company's board.

Rabois and Wu, along with Ian Wong and Justin Ross, co-founded Opendoor in 2013.

As far as I know, Rabois has never served on the board since becoming a public company in 2020. He is a managing partner at Khosla Ventures, who owned 8% of Opendoor when it went public in 2020. Rabois will be Chairman.

As for Wu, he served as CEO from 2013 until stepping down in 2022 to lead the firm’s Marketplace division. He was also Chairman from 2020 to 2022.

Lead independent director Eric Feder said about the co-founders’ return, “Rabois and Wu, who co-founded Opendoor in 2013, will inject the ‘founder DNA’ and energy at a pivotal moment for Opendoor. They are passionate about our community and we’re excited to welcome them back to the Board,” Feder stated in Opendoor’s press release announcing the news.

In addition to the CEO and board announcements, Wu and Khosla Ventures are investing $40 million in the company to accelerate its growth.

The hiring of the Shopify COO is a sign that the board and its major shareholders want the company to accelerate its use of AI to make the buying and selling of homes more efficient, while doing so in a cost-responsible manner.

While analysts are generally bearish about OPEN stock -- only one out of 12 rates it a Buy -- the meme stock crowd appear to see better days ahead.

The Bearish Quick Take

Despite the nearly $5 a share gain yesterday, it's important to remember that this is a company whose stock has lost 74% of its value since hitting an all-time high of $39.24 in February 2021.

The former CEO, Carrie Wheeler, was pushed out in August after Canadian hedge fund manager Eric Jackson argued that the company needed to make a big push into AI to accelerate Opendoor’s global expansion.

The reality is that as of June 30, Opendoor had a $3.84 billion accumulated deficit on its balance sheet. The deficit as of March 31, 2021, the company’s first full quarter as a public company, was $1.31 billion. In four years, the accumulated deficit has nearly tripled.

Since going public, its gross margins have never been higher than 9.1% -- they were 8% in the latest 12 months ended June 30. It’s hard to fathom how Nejatian will deliver higher gross margins from the current business model.

While Nejatian may turn out to be the second coming, an 80% jump in Opendoor’s share price from hopeful news seems like a stretch.

The Bullish Options Strategy

While I’ve said I’m neither bullish nor bearish, I’m admittedly leaning towards the latter. The pathway to consistent profits seems too insurmountable.

But I guess that’s why they’ve provided the new CEO with potential compensation of $2.78 billion should he get the share price to $33. If. If. If.

Let’s assume that you’re confident he can do so. Using yesterday’s unusual options activity, here’s the options strategy to implement.

If you owned the stock before yesterday’s big move, a protective collar is a good play here. This strategy involves buying an OTM (out of the money) put option and selling an OTM call option. The purpose is to protect your downside after yesterday’s big move.

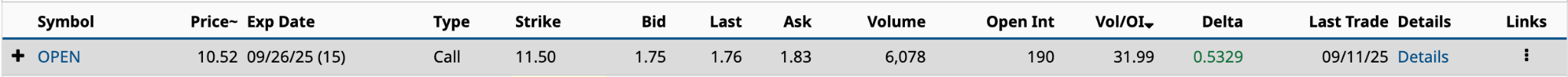

Based on yesterday’s unusual call options activity, the Sept. 26 $11.50 strike had the highest Volume-to-Open-Interest (Vol/OI) ratio of 31.99.

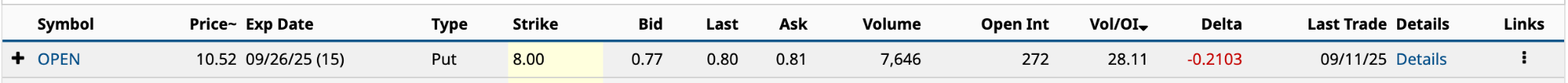

Now I need to find an OTM put with an expiration on Sept. 26. The $8 strike fits the bill with a Vol/OI ratio of 28.11.

As you can see from above, you’re selling the Sept. 26 $11.50 call for $175 premium income and buying the Sept. $8 put for $81, resulting in a net credit of $94. OPEN stock closed Sept. 10 at $5.86, so you’re preserving some of those gains, while generating some income.

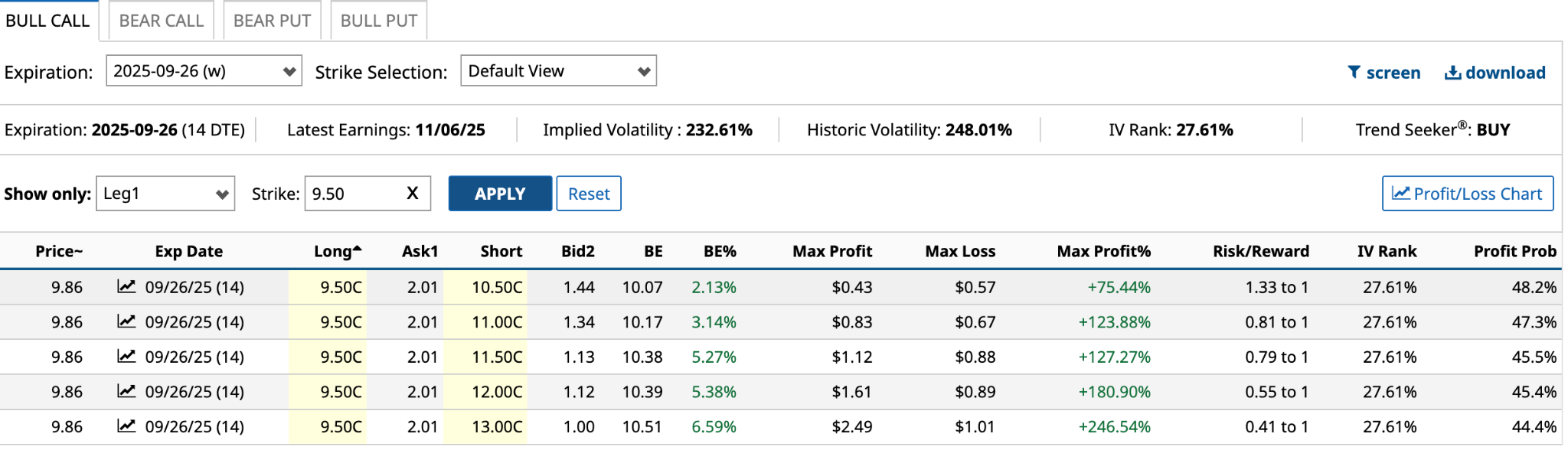

If you don’t own the stock, the bull call spread would be the way to go here. The strategy involves buying a call at a specific strike price and also selling the same number of calls at a higher strike price. This play is less expensive than simply buying calls.

I’m looking to buy a call near-the-money or ITM (in the money) and sell a call with the same expiration and higher strike price.

Based on prices as I write this on Friday morning, I’m looking at buying the Sept. 26 $9.50 call, which is slightly ITM, and selling a put higher than the current share price.

In this instance, I’d go with selling the $13 call. It would produce the highest maximum profit of the five choices at $2.49 with the lowest risk/reward ratio.

In this instance, I’d go with selling the $13 call. It would produce the highest maximum profit of the five choices at $2.49 with the lowest risk/reward ratio.

The Bearish Options Strategy

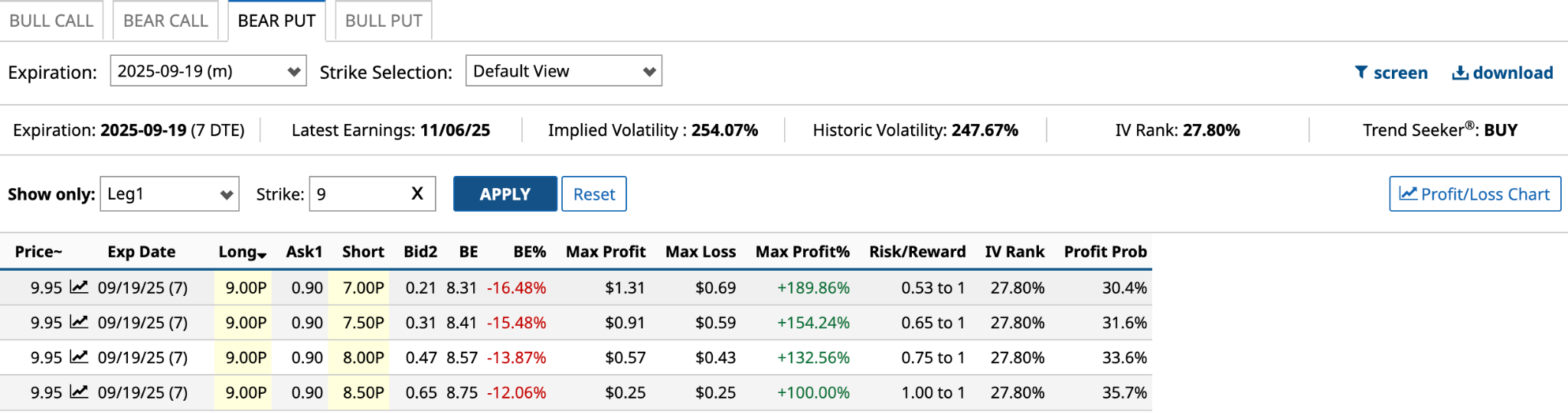

Given the seven highest Vol/OI ratios for OPEN stock yesterday were puts, I’d recommend a bear put spread over a bear call spread for this situation. The former is when you’re very bearish, while the latter is if you’re moderately so. It involves buying a put option at one strike price and selling another at a lower strike price.

The top Vol/OI ratio for puts yesterday was the Sept. 19 $9 strike at 122.97. Anything above 100 is significant. I’d buy this put and sell one that’s lower.

Based on the share price of $9.95, I’d recommend selling the $7 put. Although the profit probability is over five percentage points lower, the risk/reward ratio is half that of the $8.50 put strike, making the $7 bet a more acceptable risk with a maximum loss of just $69 per contract.