Hasbro, Inc. (NASDAQ:HAS) will release earnings results for the third quarter, before the opening bell on Thursday, Oct. 23.

Analysts expect the Pawtucket, Rhode Island-based company to report quarterly earnings at $1.63 per share, down from $1.73 per share in the year-ago period. The consensus estimate for Hasbro's quarterly revenue is $1.35 billion, compared to $1.28 billion a year earlier, according to data from Benzinga Pro.

On Sept. 8, Hasbro and Disney Consumer Products, Inc., the retailing and licensing subsidiary of the Disney Experiences segment of The Walt Disney Company (NYSE:DIS), announced an expanded collaboration that will bring Disney characters into Hasbro's iconic PLAY-DOH brand.

Shares of Hasbro rose 0.4% to close at $75.16 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

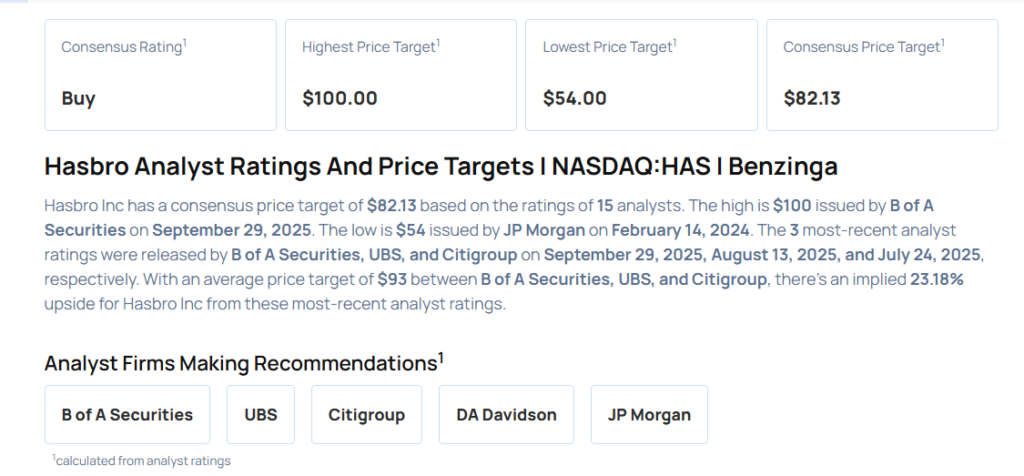

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst James Hardiman maintained a Buy rating and boosted the price target from $79 to $91 on July 24, 2025. This analyst has an accuracy rate of 63%.

- JP Morgan analyst Christopher Horvers maintained an Overweight rating and increased the price target from $75 to $94 on July 24, 2025. This analyst has an accuracy rate of 74%.

- Roth Capital analyst Eric Handler maintained a Buy rating and raised the price target from $86 to $92 on July 24, 2025. This analyst has an accuracy rate of 74%.

- Morgan Stanley analyst Megan Alexander maintained an Overweight rating and raised the price target from $83 to $85 on July 24, 2025. This analyst has an accuracy rate of 66%.

- Citigroup analyst James Hardiman maintained a Buy rating and raised the price target from $72 to $79 on June 16, 2025. This analyst has an accuracy rate of 63%

Considering buying HAS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock