Like a zombie, the story of another trade deal between the United States and China rose from the dead over the weekend.

-

Watson was triggered, again, raising the question of the actual intelligence of algorithm trade. Again. Pit traders wouldn't fall for this time, after time, after time, after time…

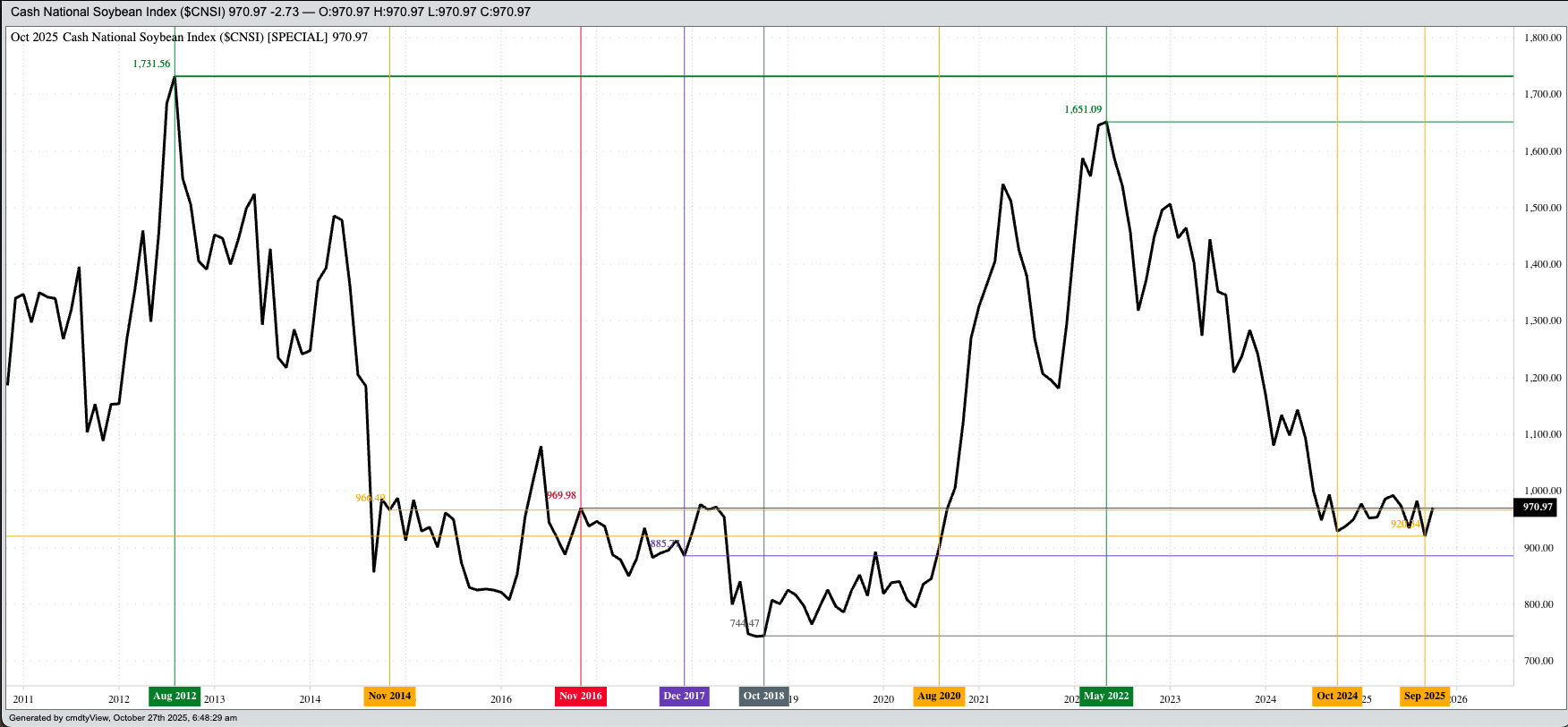

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. Has the US soybean market seen a fundamental change? Not based on its intrinsic value: The National Soybean Index.

It’s Halloween Week, and what better way to get things started than with a familiar story rising from the dead once again. Like a zombie. As the clock struck 19:00 Sunday, my friend in the brokerage industry sent me a message, “What a headline for the ambulance chasers…”. The news was “US-China trade talks yielded a framework ahead of the (US president’s) meeting with China’s President Xi next Thursday. Beijing said the two sides had reached an initial consensus on issues including fentanyl and ship levies, while (US Treasury Secretary) Bessent said China had agreed to make substantial soybean purchases.” Okay. Fine. But here’s the thing: WE HAVE HEARD ALL THIS BEFORE. There is no deal, just a framework for the meeting. An underling then says China is going to buy all the US soybeans farmers can grow. IT IS THE SAME GAME AS ALWAYS. Nothing will happen. Yet we saw markets react again, with gold (GCZ25) falling as much as $103.60 (2.5%) and US stock index futures adding about 1% overnight through Monday’s early morning hours. As we look at Watson’s reaction, we can again question the “I” in AI by asking, “What’s in your head? In your head? Zombie, zombie, zombie…”[i]

I’ve moved the soybean market up to the leadoff position because it is here we saw the biggest reaction to the same old news. While November (ZSX25) moves into delivery at the end of the week, the spot contract opened 8.75 cents higher before rallying as much as 19.0 cents overnight on trade volume of 44,000 contracts. Not to be outdone, the more heavily traded January contract (ZSF26) jumped 13.5 cents on the open and added as much as 18.5 cents while registering 66,000 contracts changing hands and was sitting 16.25 cents higher at this writing. Did China buy soybeans overnight? Let’s talk about this for a moment. Since the US president shut down the government, there have been a number of mornings when it looked like the world’s largest buyer was locking in some secondary supplies from the US. Still, the president should be aware if purchases are being made under cover of darkness, so statements like what came out late last week through the weekend will be made. Then when (or if) the US government reopens and sales announcements are made, the US president will stand in front of every camera possible and say, “I did that.” Meanwhile, the National Soybean Index ($CNSI) remains below its 10-year average end of October price near $9.99.

The corn market was also in the green pre-dawn Monday, likely pulled higher on spillover buying from soybeans. Something I forgot to mention in the Commentary above is both corn and soybeans show a seasonal tendency to rally during October, so the fact both markets have eventually moved higher this month isn’t a big surprise. Is it due to the US government insurance harvest price being calculated during October, with daily closes running well below what was seen as the base price was set this past February? Possibly. What about the intrinsic value of the corn market? The National Corn Index ($CNCI) was calculated last Friday at $3.84, just above its previous 5-year low end of October settlement of $3.78 from 2020 and not that much different than October 2024’s October price of $3.82. Based on the economic law of Supply and Demand we can say US corn market fundamentals are about the same as last year and nearly the most bearish it has been in five years. But I understand few want to look at that reality when the US president continues to tell them how well they are doing, all because of how great he is. A lesson those in the feeder cattle industry are now learning.

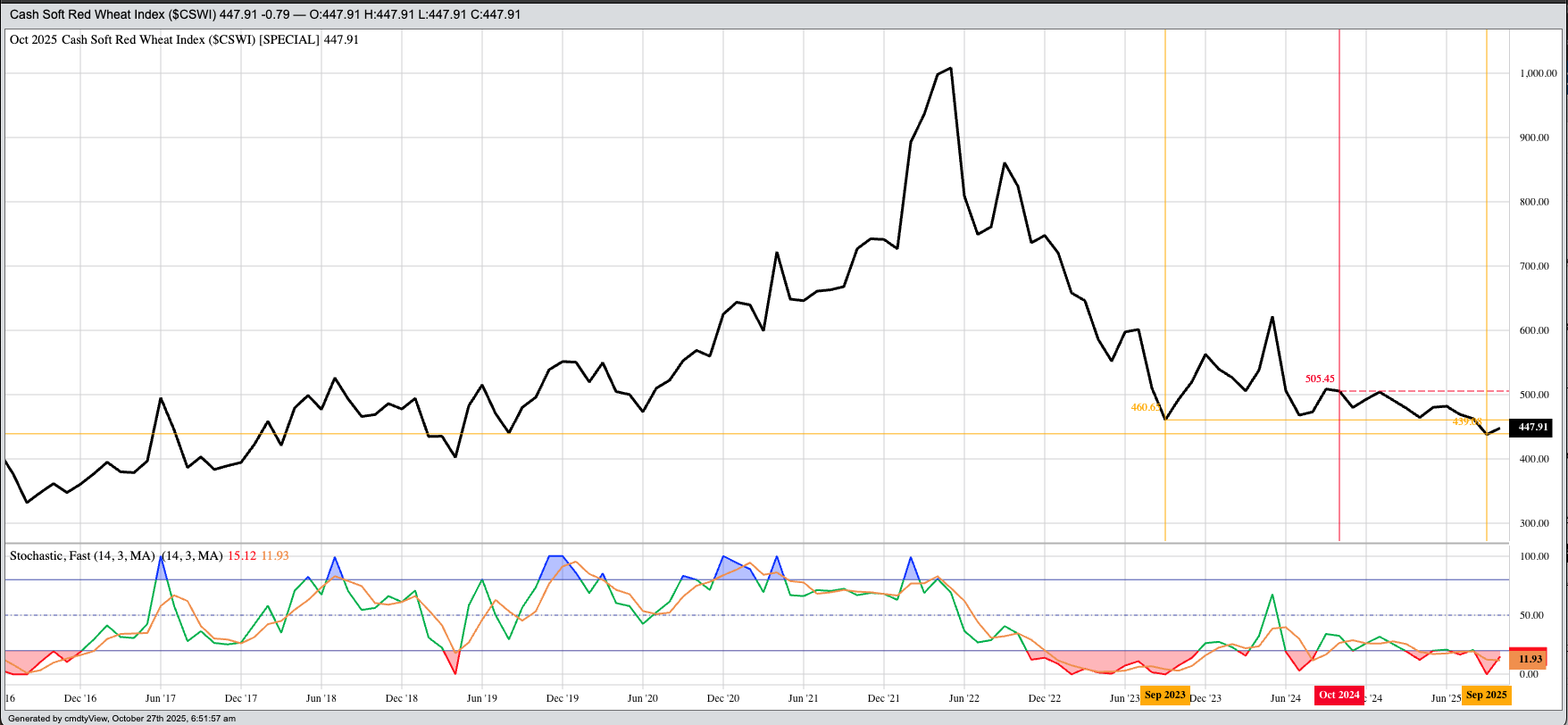

Boats heading to China are obviously lined up stem to stern at US port facilities waiting to load wheat. Right? I’m sure that will be the narrative from the BRACE Industry early Monday morning, at least those few who actually look at the US wheat sub-sector. After all, December SRW is up 9.25 cents at this writing after rallying as much as 12.0 cents overnight on trade volume of 20,000 contracts while Dec HRW gained as much as 12.25 cents and December HRS gained as much as 9.0 cents through pre-dawn Monday. Again, I’ll waste time by pointing out the reality that all three National Cash Indexes are at or well below previous 5-year low end of October price levels confirming US supplies far outweigh demand for those bushels. But that doesn’t matter, right? Not when we are told how great everything is? Just like the fine folks in North Korea. On another note, driving through the US Southern Plains this past weekend I can confirm Texas, Oklahoma, and Kansas received a good deal of rain. Just what the newly planted 2026 HRW crop needed heading into winter dormancy. But who cares about the weather these days?

[i] From the 1994 Cranberries song Zombie, sung by the late Dolores O’Riorden.