Growth stocks have fallen out of favor over the last few months amid expectations for tighter Federal Reserve policy. With some stocks having fallen 70% or 80% from their highs, Ritholtz Wealth Management's Josh Brown expects to see more acquisitions in the near term.

"We just witnessed a massive deal with Microsoft Corporation (NASDAQ:MSFT) buying Activision Blizzard, Inc. (NASDAQ:ATVI)," Brown said Friday on CNBC's "Fast Money Halftime Report." "If you think that's the last one we're going to see in Q1 with the Nasdaq down 19%, I think you'd be wrong there."

He highlighted Robinhood Markets Inc (NASDAQ:HOOD) as a potential buyout target.

Although Brown reiterated that he's been negative on Robinhood's stock since it was trading around $70 per share, he thinks it offers "super low risk" as an acquisition target.

Robinhood's market cap has fallen to $9 billion and the company's net capital is close to $3 billion, Brown emphasized, suggesting that Goldman Sachs Group Inc (NYSE:GS) could acquire Robinhood for around $6 billion. "I think there are a lot of situations like that," he added.

"There's a certain point where maybe not all the air has come out," Brown said. "But too much has come to still want to press those bets. Not in all cases, but I think in some very big well-known names."

HOOD Price Action: Robinhood has traded as high as $85 since its IPO last year. It made new lows during Friday's session, before rebounding and trading higher.

The stock was up 7.54% at $12.49 at the time of publication Friday afternoon.

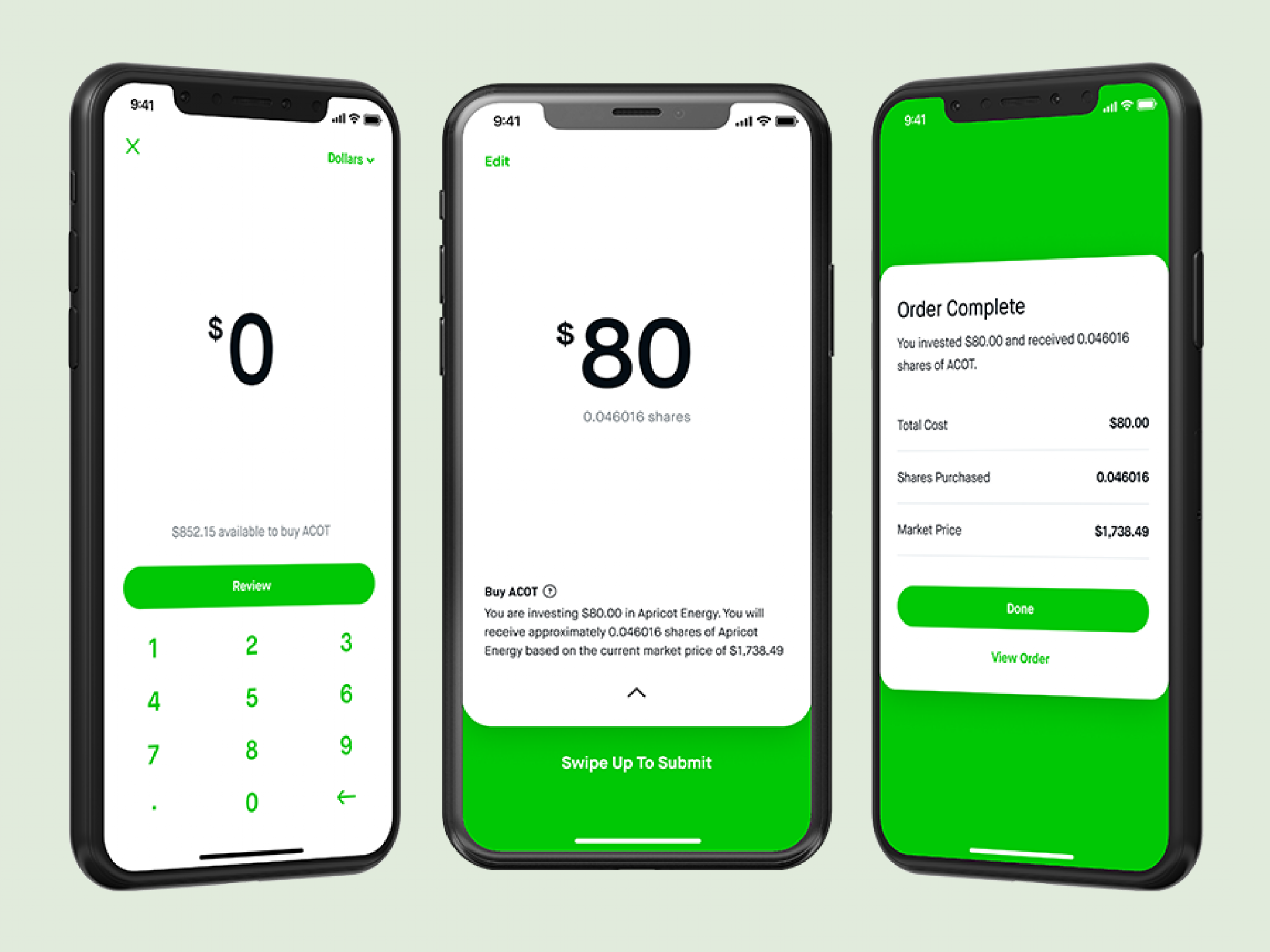

Photo: Courtesy of Robinhood.