Harvard University significantly increased its stake in the iShares Bitcoin Trust ETF (NASDAQ:IBIT), according to the latest 13F filing released on Friday.

Harvard’s IBIT A ‘Good Validation’ For ETFs

Harvard Management Company, a wholly-owned subsidiary of Harvard University that manages its endowment, pension assets, and other financial assets, reported holding 6,813,612 shares of IBIT as of Sept. 30, a 257% jump from the previous quarter.

IBIT holdings made up 21% of Harvard’s investment portfolio, making it the fifth-biggest investment after Microsoft Corp. (NASDAQ:MSFT) and Amazon.com Inc. (NASDAQ:AMZN).

The stake was worth $442.88 million based on IBIT’s price of $65 on Sept. 30.

Bloomberg analyst Eric Balchunas noted that it’s “rare” for an endowment, especially from universities like Harvard and Yale, to invest in exchange-traded funds.

“It’s as good a validation as an ETF can get,” Balchunas stated.

IBIT Among Premier ETFs?

The iShares Bitcoin Trust, which debuted in January 2024, has emerged as a significant player in the ETF industry.

The fund has attracted nearly $27 billion this year, placing it among the top six ETFs by inflows, according to TradingView. It had $75 billion in assets under management as of this writing

Price Action: Shares of IBIT closed 3.80% lower at $53.48 during Friday’s regular trading session, according to data from Benzinga Pro.

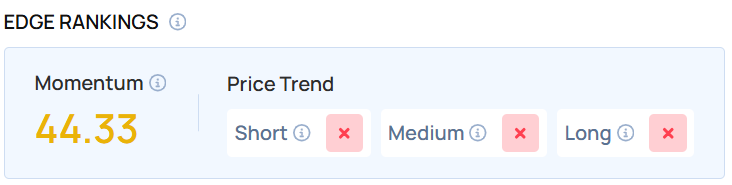

Benzinga’s proprietary Edge Rankings show Momentum as the strongest category for IBIT at 44.33/100. To see how the stock ranks for Value, Growth and other indicators, click here.

Read Next:

Photo Courtesy: f11photo on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.