Halliburton Co. (NYSE:HAL) reported stronger-than-expected third-quarter 2025 results on Tuesday.

The Houston-based company reported revenue of $5.6 billion, beating analyst estimates of $5.39 billion, and adjusted earnings of 58 cents per diluted share, topping the 50-cent estimate. GAAP earnings were 2 cents per share.

“I am pleased with Halliburton’s third-quarter performance. We delivered total company revenue of $5.6 billion dollars and adjusted operating margin of 13%. We also took steps that will deliver estimated savings of $100 million dollars per quarter, reset our 2026 capital budget and idled equipment that no longer meets our return expectations,” said Jeff Miller, chairman, president, and CEO.

Halliburton shares rose 3.1% to trade at $26.01 on Wednesday.

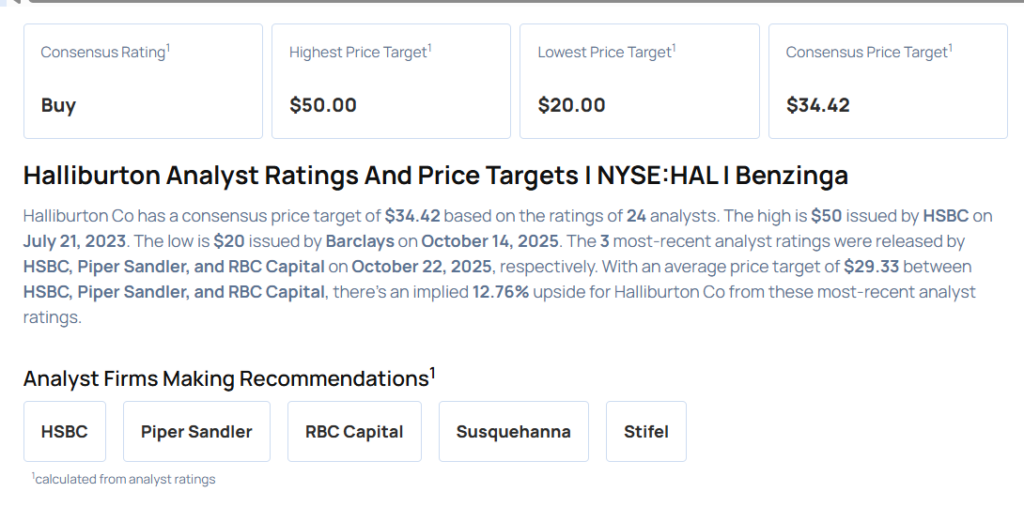

These analysts made changes to their price targets on Halliburton following earnings announcement.

- Stifel analyst Stephen Gengaro maintained Halliburton with a Buy and raised the price target from $27 to $32.

- Susquehanna analyst Charles Minervino maintained the stock with a Positive and raised the price target from $27 to $29.

- RBC Capital analyst Keith Mackey upgraded Halliburton from Sector Perform to Outperform and raised the price target from $26 to $31.

- Piper Sandler analyst Derek Podhaizer maintained the stock with a Neutral and boosted the price target from $25 to $27.

- HSBC analyst Samantha Hoh upgraded Halliburton from Hold to Buy and raised the price target from $23 to $30.

Considering buying HAL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock