UK grocery prices have surged at their fastest rate in 18 months, sparking fresh concerns among consumers grappling with the escalating cost of living.

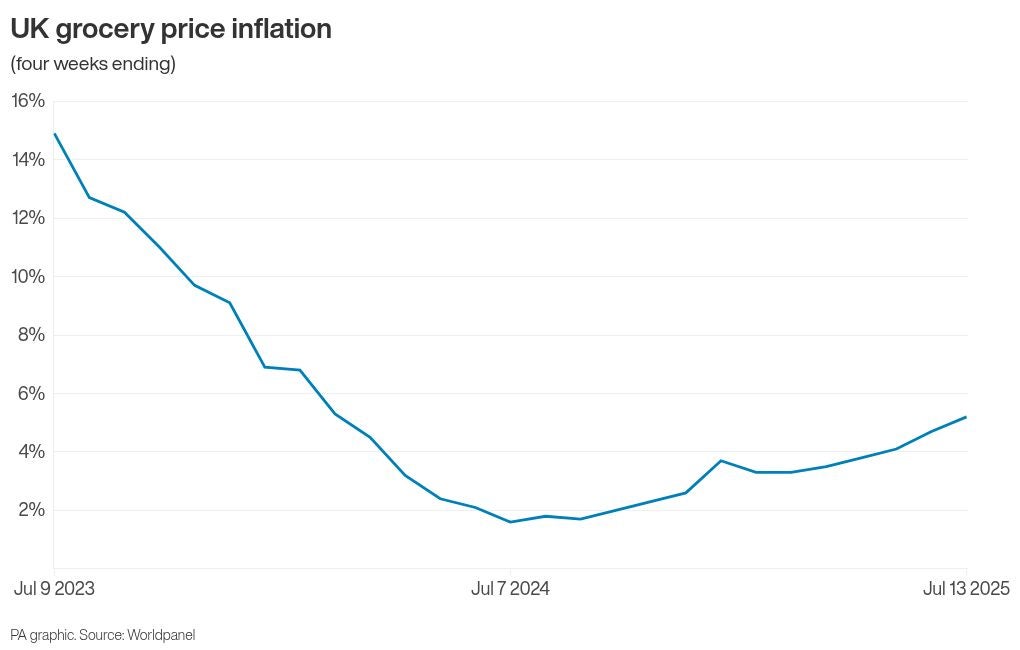

New data from market research firm Worldpanel by Numerator, formerly Kantar, reveals that grocery price inflation accelerated to 5.2 per cent in the four weeks leading up to 13 July.

This marks a notable jump from 4.7 per cent just a month prior and represents the highest level recorded since January 2024. Projections indicate that these rising costs are set to add an average of £275 to shoppers’ annual grocery spending.

Fraser McKevitt, head of retail and consumer insight at Worldpanel, highlighted the widespread concern among households.

He stated: "Just under two-thirds of households say they are very concerned about the cost of their grocery shopping, and people are adapting their habits to avoid the full impact of price rises.

"Own label products, which are often cheaper, continue to be some of the big winners and, in fact, sales of these ranges are again outpacing brands, growing by 5.6 per cent versus 4.9 per cent.”

He added that shopping data also showed that consumers have been cooking simpler meals in recent months as part of efforts to stick to budgets.

The price increases come amid a backdrop of commodity price pressures and higher costs for retailers, after recent increases in National Insurance contributions and the national minimum wage.

Worldpanel data also showed that overall consumer spending across UK grocers rose by 4.6 per cent over the 12 weeks to July 13.

Online retail specialist Ocado saw the fastest rise in sales over the period, with 11.7 per cent.

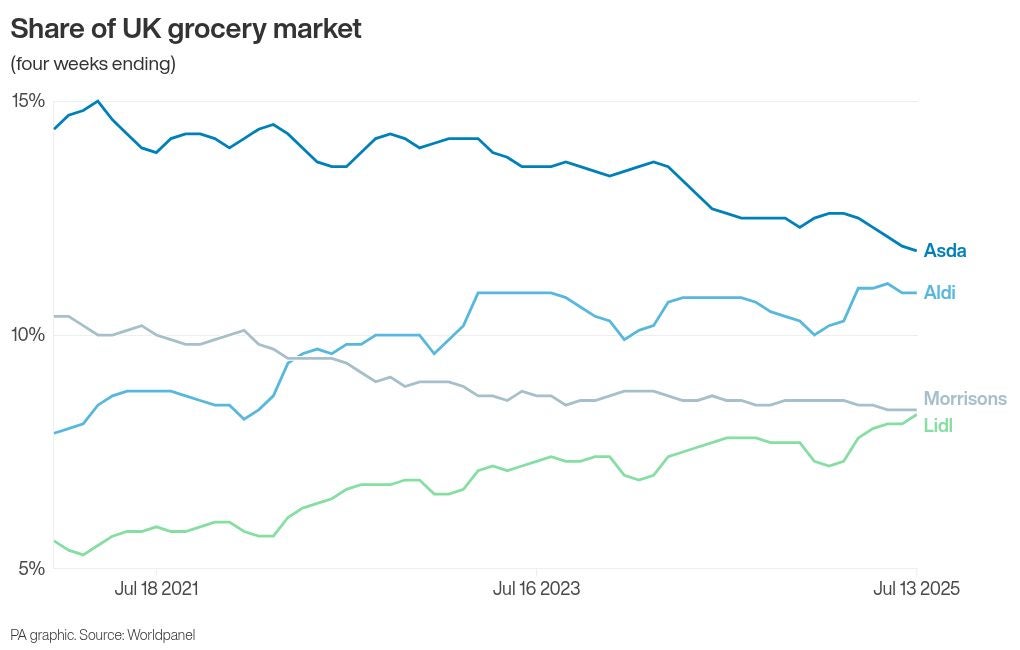

It was closely followed by German discount chain Lidl, which saw sales rise 11.1 per cent, to take its share of the UK grocery market to 8.3 per cent, moving it close to the size of rival Morrisons.

Elsewhere, the UK’s largest supermarket chain Tesco increased its share of the market further after growing sales by 7.1 per cent.

Asda and the Co-op were among the weaker performers, with sales declines of 3 per cent and 3.7 per cent respectively over the quarter.

August Bank Holiday benefits and pension payments dates plus cost of living support

Major supermarket super-sizes packs of one summer fruit as heatwaves boost crops

NHS facing £27bn bill for maternity failings in England

Police issue warning after dog treats laced with fishhooks found in walking spot