European markets fall back

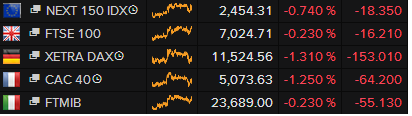

The continuing uncertainty over Greece as talks to resolve its financial crisis continue over the weekend has pushed shares sharply lower once more. The usual conflicting comments from various parties unsettled investors, with an increasing number of insiders now talking about a possible Greek exit from the eurozone. Added to the downbeat mood were US figures showing GDP contracted by 0.7% in the first quarter. The final scores showed:

- The FTSE 100 fell 56.49 points or 0.8% at 6984.43

- Germany’s Dax dropped 2.26% to 11,413.82

- France’s Cac closed 2.53% lower at 5007.89

- The Athens market lost 1.44% to 825.38

On Wall Street, the Dow Jones Industrial Average is currently down 54 points or 0.3%.

On that note it’s time to close up for the evening. Thanks for all your comments, and we’ll be back next week.

More optimism from Greece:

*GREECE WILL MAKE JUNE 5 PAYMENT DUE TO IMF, GREEK ECONOMY MINISTER STATHAKIS: REAL

— lemasabachthani (@lemasabachthani) May 29, 2015

Back to Greece, and the country could still stay in the euro even if it defaults (remember it has €1.6bn to pay to the IMF next month.)

That’s the view of Moody’s ratings agency in a note seen by the Financial Times. It quotes Moody’s saying: “A Greek exit from the euro is not an inevitable consequence of default. The decision to split would be a political act.”

The FT report is here (£):

Odds of a Fed rate hike in December down to 55% after negative GDP print and Chicago PMI miss. pic.twitter.com/r5E1ykVQcM

— Charlie Bilello, CMT (@MktOutperform) May 29, 2015

Here’s our story on the US GDP figures:

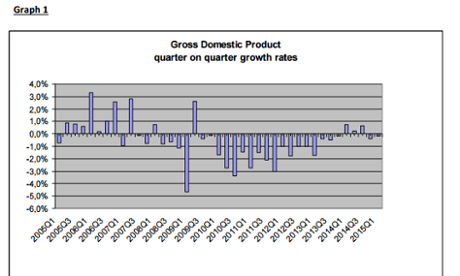

A harsh winter, a strong dollar and falling oil prices took their toll on the US economy in the first quarter, the Commerce Department revealed on Friday.

US gross domestic product (GDP) – the broadest measure of economic growth – shrank at an annualized rate of 0.7%. The Commerce Department had previously estimated output grew 0.2% from January through March.

The quarterly economic decline is the first since the economy shrank by an even sharper 2.1% annual rate in the first quarter of 2014. A bleak winter also contributed to that decline as consumers stayed home and some businesses closed.

Business investment fell at a 2.8% pace and exports declined 7.6%, hurt by the strength of the dollar. Consumer spending, which accounts for more than two-thirds of economic output, grew by 1.8% on an annual basis. In the fourth quarter – traditionally the best quarter for consumer spending – it grew 4.4%.

The full report is here:

And to make a trio of disappointing US numbers, consumer confidence fell to a six month low in May.

The University of Michigan consumer sentiment index fell to 90.7 from a revised 95.9 in April, the biggest decline since the end of 2012.

But it was an improvement on the preliminary May figure of 88.6 and economist expectations of a 89.9 reading.

Chicago PMI plunges to 46.2 in May. That's two sub-50 readings this year. Recession signal? pic.twitter.com/Yvp4bwaTOk

— Jamie McGeever (@ReutersJamie) May 29, 2015

More downbeat numbers from the US.

The Chicago Purchasing Managers Index came in at 46.2 in May, compared to 52.3 the previous month and forecasts of a figure of 53. This is the lowest level since February.

Updated

Wall Street has opened lower after the revision of the US GDP figures to show a contraction in the first quarter.

The Dow Jones Industrial Average is curently down around 50 points or 0.28%. But analysts are not getting too concerned about the US numbers. Dr Harm Bandholz at Unicredit said:

Now we have it in writing: The US economy had another dismal start into the year, with real GDP shrinking an annualized 0.7%. This marks the third time in the past five years that first-quarter GDP growth in the US was negative. As there has been no other quarter with negative GDP growth during that time, the debate about potentially flawed seasonal adjustment procedures has been heated. The Federal Reserve, however, did not find any evidence of material residual seasonality, and blamed instead “statistical noise, unusually harsh weather, and other idiosyncratic factors” for this recurring pattern. We agree and think that transitory factors, such as the inclement weather and the port strikes, played the major role.

The fundamentals for a solid acceleration of the US economy all remain in place. This holds true in particular for consumer spending, the main growth engine. In addition to a continuation of solid payroll gains and an ongoing acceleration in wage increases, we expect the savings rate to reverse its latest increase. This gives another boost to consumer spending. Moreover, the Federal Reserve highlighted in its latest minutes that “business contacts in several parts of the country continued to be optimistic and expected sales, investment, and hiring to expand over the rest of the year.” To be sure, while the anticipated rebound in the data is beginning to materialize right now, it started some weeks later than we originally thought. This may affect the quarterly growth pattern (with slightly weaker growth in the second quarter of 2015, and stronger gains in the second half of 2015). But overall, we remain confident that real GDP growth between the second quarter of 2015 and fourth quarter of 2015 will average 2¾% to 3%.

Back with Greece, and could there really be hopeful signs that things could finally be resolved? Or is any optimism still on the Greek rather than the creditor side?

Multiple reports indicate real progress at Brussels Group talks on #Greece. The 'final stretch' may be really near this time.

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

And it’s not just the US and Canada:

Not the best of lunch time #GDP updates as Brazil also announces that its economy shrank too http://t.co/3BTHgMohyE #weatherreport

— Shaun Richards (@notayesmansecon) May 29, 2015

My call that there will be no rate rises in U.S. Or UK in 2015 seems on track deflation no wage growth and slowing in GDP growth a clincher

— Danny Blanchflower (@D_Blanchflower) May 29, 2015

U.S. GDP Growth 1948-Present (with Recession Shading): pic.twitter.com/iRZcPTzwxP

— Michael McDonough (@M_McDonough) May 29, 2015

Canadian GDP shrinks too

Canada’s economy also struggled in the last quarter.

New data shows its GDP shrank by an annualised rate of 0.6% in January-March, the biggest contraction since 2009.

The mining, quarrying, oil and gas extraction, construction, wholesale trade and manufacturing sectors all suffered a drop in output, according to Statistics Canada.

Higher debt, shrinking economy, huge trade deficit, poor tax policy. All indicators point to #Harper economic failure http://t.co/UksDz5bEpO

— Richard Lorello (@richardlorello) May 29, 2015

Updated

US consumers still drove the economy forward, as this breakdown shows:

Here's how we got to -0.7% #GDP in Q1: Consumption: 1.23 Biz investment: 0.12 Trade: -1.9 Government: -0.2

— Michelle Jamrisko (@mljamrisko) May 29, 2015

Bad weather, less investment in oil exploration, and a port strike all drove the US economy into contraction, says Nancy Curtin, chief investment officer at Close Brothers Asset Management.

She agrees that growth should now be picking up:

“Confidence has rebounded, the job market is buoyant and robust housing market data of late offers a much brighter outlook than the first quarter figures suggest. Equally, lower oil prices should contribute to an uplift in consumer spending, further boosting growth as the year progresses.

Thanks to the fundamental strength of the economy, the Fed seems resolved to hike rates this year, although this will be patient and incremental, rather than drastic.”

The US economy is expected to bounce back in the current quarter, avoiding a recession.

Chris Williamson, chief economist at Markit, says recent data has been encouraging:

“The decline has already been largely shrugged off as a temporary blip by policymakers, linked to extreme weather, port closures and what looks to be a regular pattern in the official data of the economy weakening at the start of the year. Survey evidence is already pointing to a second quarter pick-up.

Markit’s flash PMI data, for example, have signalled robust growth, especially in the service sector. The monthly data are running at levels broadly consistent with 2-3% annualised GDP growth in the second quarter. Job creation has also held up surprisingly well.”

Should we panic that economic activity across America fell last quarter?

Dennis de Jong, managing director at UFX.com, says no.

He blames some one-off factors for the poor performance, plus the wintery weather, and reckons the broader outlook is still bright

“Fed Chair Janet Yellen will know that particularly poor winter weather, a strong dollar and an unstable energy sector weighed heavily on the data and all signs point to an immediate and strong turnaround.

Once consumers start to spend the extra cash generated by cheaper gas prices as expected by many, Yellen and Co. will start to think seriously about raising interest rates.

As I was saying...

Trade was the biggest spoiler for US growth in Q1, with the gap at its biggest in 30 years: http://t.co/clnOOZcBFX pic.twitter.com/aGWUAFXQSp

— Michelle Jamrisko (@mljamrisko) May 29, 2015

Strong dollar eats into US growth

The US economy is suffering from the strength of the dollar.

This new data shows that exports shrank by 7.6% during the quarter, while imports rose by 5.6%. The resulting trade gap is a drag on GDP.

And corporate profits also took a hit -- down by 8.7% after tax.

The fall in US GDP isn’t quite as sharp as feared, but it still shows the world’s largest economy hit a soft watch over the winter.

US Q1 #GDP (second estimate): -0.7% vs. -0.8% consensus.

— Brenda Kelly (@Brenda_Kelly) May 29, 2015

US economy contracts

BREAKING: The US economy contracted in the first three months of the year.

Revised data shows that US GDP actually shrank by 0.7% on an annualised basis (or around -0.17% in true quarter-on-quarter terms).

That’s down from an initial estimate of 0.2% annualised growth (0.05% q/q), which was already quite meagre.

Updated

Lunchtime summary: Greece in recession as bank deposits bleed away

Time for a very brief recap, before we get the US growth (or non-growth?) figures at 1.30pm BST.

Greek bank deposit levels have fallen to their lowest level in over a decade, as fears intensify that it could face capital controls or a default without a deal with creditors soon.

The country is also officially back in recession, after GDP shrank by 0.2% in the first three months of 2015.

German finance minister Wolfgang Schäuble has warned that the optimistic news from Greece does not match what he hears from its creditors.

Speaking at the G7 meeting in Dresden, Schäuble also said that Greece must get a deal by 30 June.

US Treasury secretary Jack Lew has urged both sides to crack on and get a deal soon.

Jean-Claude Juncker, EC president, is still confident of a deal “in the days or weeks ahead”.

But Greece’s deputy PM has criticised the lack of ‘political will’ to get a deal.

And the uncertainty is weighing on Europe’s stock markets, which are mainly in the red or flat today.

Here’s our latest news story, wrapping up all the main developments

Greece needs to step up and produce a credible set of reforms, to pave the way to a deal, says Treasury secretary Lew.

Strong stuff from Jack Lew telling Greeks to put forth a credible plan.

— HansNichols (@HansNichols) May 29, 2015

US Treasury secretary blasts lack of Greek progress

Jack Lew sounds exasperated with the lack of progress over Greece this year.

Too much time has been wasted this year, the US treasury secretary tells reporters at the G7. Both sides need to get serious, fast.

Jack Lew on Greece at #g7finance: too much time spent unproductively since January, serious talks from both sides needed, sooner the better

— Niels H. Buenemann (@nielsbuene) May 29, 2015

US Tsy Sec Lew says it's possible that June 5 is not the real deadline for #Greece

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

Jack Lew is also warning that the consequences of Greece leaving the eurozone can’t be fully predicted.

That’s a message he also hammered home in London on Wednesday.

US Treasury secretary Jack Lew is now giving a press conference in Dresden - and begins by subtly chiding Germany over its trade and budget surpluses.

#g7 #Lew indirectly telling German hosts to spend more. Just led off on surplus nations doing more. pic.twitter.com/Gbb5ZM6dtS

— Steve Sedgwick (@steve_sedgwick) May 29, 2015

Wolfgang Schäuble is fielding more questions on Greece.

He tells reporters at the G7 meeting in Dresden that although other European leaders may have “different views with the Greek leaders”, we all share a common responsibility for Europe.

We will do everything possible to live up to our responsibilities, he pledges.

And he also points out that Greece’s leaders have a democratic mandate.

As Schäuble puts it:

The Greek government are the representatives of the Greek people, and that is why they deserve respect.....

And he concludes by insisting that while it’s not a marriage of love:

I have no personal problem with my colleague [Greece’s Yanis Varoufakis].

Schaeuble describes his relationship with Yanis as: "not a marriage of love"

— Mehreen (@MehreenKhn) May 29, 2015

And that’s the end of the press conference.

Updated

Here’s confirmation that EC president Jean-Claude Juncker has predicted a Greek deal soon...

.@JunckerEU at #EUJapan summit presser: "On #Greece, we will find a solution in the coming days or weeks." pic.twitter.com/cqMZWFKel5

— Mina Andreeva (@Mina_Andreeva) May 29, 2015

Schaeuble and Yanis finally singing from the same hymn sheet. Say actual deadline for deal is June 30.

— Mehreen (@MehreenKhn) May 29, 2015

Schäuble: The Greek programm ends at the end of June. And then added "as things are now". They could change /via @telloglou #Greece

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

Schäuble: Greece has until 30 June

Onto questions...

How much time is left to get a deal with Greece?

Wolfgang Schäuble replies that we have until the end of June, when the existing programme runs out.

As things stand, that programme will expire if there is no agreement.

Updated

Weidmann says that the G7 policymakers see “considerable merit” in establishing a bankers code of conduct, to address the string of recent scandals.

These scandals relate to the mindset in the financial industry, and the misconduct individuals. And individual integrity and good conduct is beyond the reach of regulation.

The task of reshaping the global financial system after the crisis is not finished, says Weidmann.

Policymakers at the G7 meeting agreed to press on and complete the job, including removing the problem of “Too big to fail” banks.

Bundesbank president Jens Weidmann now gives a statement.

We can’t blame bad luck for the disappointing economic growth seen across the world economy in recent years, Weidmann says. He cites demographic factors, weakening productivity growth as factors that have hurt potential growth in recent years.

(reminder, the press conference is live here)

Schäuble: G7 only discussed Greece briefly

We had a brief discussion on Greece, Schäuble says, only for a few minutes.

And then he takes a pop at Athens, saying that the positive noises out of Greece do not match what the G7 was told by the institutions

LOL Schaeuble "Greece talks at G-7 only took a few minutes"

— Jonathan Ferro (@FerroTV) May 29, 2015

Schaeuble: "positive news from Greece does not correlate with what we hear from the institutions". Adds G7 only spent "few mins" on t topic

— Mehreen (@MehreenKhn) May 29, 2015

We stand ready to help Nepal after the tragic earthquake this month, which may include debt relief, says Schäuble.

We had a very intensive debate on terrorist financing, Schäuble continues. He cites virtual currencies as an area of concern.

Schäuble: We all agreed on need for structural reforms for higher growth. "Public investments also needed" #G7finance pic.twitter.com/Itkjf89ALY

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

On tax issues, we agreed that we must co-operate to boost tax fairness, and to improve cooperation between national tax bodies, Schäuble tells the G7 press conference.

It is feasible to make progress here, and to improve everyday tax administration. We need to work more with developing countries too.

Schäuble speaks first, saying the G7 meeting was “most successful”.

Of course, the ministers, central bank governors and economists didn’t agree on everything....they never do. But we had a fruitful discussion on how to boost economic growth and make the global economy more resilient.

There was full agreement on the need for structural reforms -- ambitious structural reforms to stimulate private sector investment and boost productivity.

Updated

The G7 closing press conference with Wolfgang Schäuble and Jens Weidmann is starting now.

A flurry of quotes from EC president Jean-Claude Juncker just hit the wires; none of them suggest a breakthrough is imminent (he’s in Toyko for a Japan-EU summit)

Juncker Says Greece Aid Negotiations Are `very Difficult' Cos ones speaking in Greek and one in German !

— Steve Collins (@TradeDesk_Steve) May 29, 2015

*JUNCKER: GREECE ISSUE TO BE SOLVED IN `COMING DAYS AND WEEKS' - keeping options open then?

— Michael Hewson (@mhewson_CMC) May 29, 2015

The selloff in Europe’s stock markets is accelerating, as investors fret about Greece.

The German DAX is the worst performer, down over 1%.

Daniel Sugarman of ETX Capital says traders are worrying about next month’s IMF repayments (despite Yanis Varoufakis insisting he has it under control):

European markets continued to feel the ongoing effects of the situation in Greece, with fresh fears that the country will be unable to make yet another repayment due to the IMF. The Greek government has still not made it clear how it intends to make the €1.6 billion repayment, the first tranche of which falls due next Friday.

Updated

Heads-up: Germany’s finance minister and central bank chief will be giving a press conference at the G7 meeting in Dresden, in around 40 minutes time.

Live at 12:45 press conference on #g7finance in Dresden with Wolfgang Schäuble and Jens Weidmann http://t.co/QJSroxaDYc

— Deutsche Bundesbank (@bundesbank) May 29, 2015

Greece’s long slump is even worse than the Great Depression of the 1930s....

ELSTAT confirms another recession in Greece. And it was already doing worse than the US Great Depression. pic.twitter.com/cx6jLuARoc

— RBS Economics (@RBS_Economics) May 29, 2015

The Great Depression ended after president Roosevelt took a range of drastic measures, including suspending the gold standard in 1933. Greece, though, wasn’t able to weaken its own currency so had to undergo such a painful ‘internal devaluation’.

Updated

Greek recession confirmed

More gloom for Greece -- statistics body ELSAT has just confirmed that the country is back in recession.

Updated GDP data showed that the Greek economy shrank by 0.2% in the first three months of 2015, in line with the initial estimate earlier this month.

The detail of ELSTAT’s report (online here) paints a pretty weak picture.

Investment by companies and the government, or “gross fixed capital formation” tumbled by 7.5% compared with the 4th quarter of 2014.

That suggests firms basically stopped spending amid the political uncertainty, as the government tightened its own belt too.

Exports fell by 0.6% quarter-on-quarter, while imports decreased by 0.7%.

Greece’s economy had returned to growth last year, after plunging into a deep slump after accepting harsh austerity measures in return for two bailouts.

But the “recovery” quickly stumbled. Greek GDP shrank by 0.4% in the final three months of last year; two consecutive quarters of contraction equals a recession.

Updated

Last month’s hefty withdrawals are part of a wider pattern.

Greek banks have been suffering deposit outflows since December 2014, when the previous government called a general election after failing to elect a new president.

This chart from Credit Suisse’s Neville Hill shows how it slowed down after Greece won a four-month bailout extension in late February:

Greek bank deposits fell another 4% in April. The problem is the euro leaving Greece, not Greece leaving the euro. pic.twitter.com/ynZz4UdzHT

— Neville Hill (@CSEUEconomics) May 29, 2015

In a sign of the times, Greek bank deposits have fallen to an 11 year low as the IMF repayment looms next Friday #Greece #bank #Grexit

— Spreadex (@spreadexfins) May 29, 2015

Greek bank deposits fall to lowest since 2004

Worried Greeks pulled €5.6bn out of their accounts last month, as the country’s banks continue to bleed.

Official data just released shows that Greek bank deposits fell to €139.4bn in April, down from €145bn in March.

That’s the lowest level since 2004, as fears of a default, capital controls or even a full-blown Grexit continue to alarm depositors.

CHART: #Greece bleeding continues. New OFFICIAL data show bank deposits down (again!) by 6 bn€ in April. 11-year low. pic.twitter.com/zmqoiQpKV5

— Maxime Sbaihi (@MxSba) May 29, 2015

This could just send a shiver through the G7 meeting in Dresden and the negotiations in Brussels. Not to mention households across Greece.

Bank deposits had been fairly stable last year, but have been steadily falling since the start of 2015, forcing the ECB to provide more and more help (€80.2bn of emergency liquidity at the last count)

Won't be much left in #Greece's banks by the time #ECB gets the keys. Deposits down another €5.6 billion in April. pic.twitter.com/bN0qk0Pesm

— Geoffrey Smith (@Geoffreytsmith) May 29, 2015

Updated

The picture is brighter in Italy this morning. The Italian stats office has just confirmed that the economy grew by 0.3% in the last quarter.

That’s in line with the initial estimate two weeks ago, and means Italy’s economy expanded for the first time since autumn 2013.

#Italy GDP grows for 1st time in 6 quarters by 0.3% - been in/out of recession/negative quarters since 2009/10 crisis http://t.co/fko7vCezC2

— Linda Yueh (@lindayueh) May 29, 2015

Greek finance minister: We want a comprehensive deal with debt relief

Yanis Varoufakis made some interesting points in his interview with Vima FM radio station, and a couple of perplexing ones.

He said:

- Greece is aiming for a single, comprehensive agreement with the creditors that will involve debt relief.

- Greek negotiators are resisting pressure to accept “permanent recessionary measures”, including raising VAT rates.

- Greece will not implement a transaction tax on bank withdraws, as has been rumoured (he claims the idea came from the creditors too)

#Greece MinFin Varoufakis: "Our side on BrusselsGroup opposed with vigor the proposal re: a transaction tax." @vimafm

— The Greek Analyst (@GreekAnalyst) May 29, 2015

- He also claimed that Greece could raise taxes without hurting economic demand, if they also promoted the redistribution of wealth in the economy.....

Varoufakis claims that if new taxes introduced, they are not recessionary if they involve redistribution. Oh well...

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

- And no-one should panic about Greece’s ability to repay the International Monetary Fund next month. Yanis has it in hand.

#Greece MinFin Varoufakis, when asked whether we got the money to pay the IMF, he says "let ME the MinFin worry about this, not the people!"

— The Greek Analyst (@GreekAnalyst) May 29, 2015

Updated

You can hear Yanis Varoufakis’s radio interview here (it’s in Greek.....)

Thanks, Greek Analyst!

Link on #Varoufakis's live interview at @vimafm here: http://t.co/jiNaoOOMz2 cc @graemewearden HT @YanniKouts

— The Greek Analyst (@GreekAnalyst) May 29, 2015

Greek finance minister Yanis Varoufakis is speaking on Greek radio now.

I’m afraid I’ve not got the link, but the key points are being tweeted:

#Greece FinMin says very close to completing Greek program review; Greek talks have new developments every day ~@vimafm

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

#Greece FinMin Varoufakis says there is agreement with the 'Institutions' on VAT model; no agreement yet on rates ~@vimafm

— Yannis Koutsomitis (@YanniKouts) May 29, 2015

Swiss economy contracts

As if the Fifa scandal wasn’t bad enough, Switzerland has been hit with the news that its economy is shrinking.

Swiss GDP fell by 0.2% in the first three months of the year, worse than the stagnation which economists expected.

The strong Swiss franc is being blamed. It soared in January after its central bank gave up trying to keep it artificially weak; that made Swiss exports less competitive.

As the State Secretariat for Economic Affairs put it:

“The trade balance in goods and services in particular delivered negative growth contributions.”

More news from the G7 meeting in Dresden, from French finance minister Michael Sapin.

*SAPIN SAYS EUROPE NEEDS GREECE DEAL WITHIN 'DAYS OR WEEKS'

— Dealingroom (@Dealingroom1) May 29, 2015

I think we knew that already.....

Updated

Worries about Greece are weighing on Europe’s stock markets again. They’re mostly down in early trading:

Stan Shamu of IG believes markets will remain edgy until a deal is reached:

I suspect there will be plenty of headlines about Greece driving volatility in coming weeks as €1.6 billion is due over four tranches.

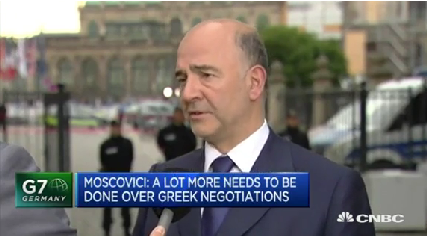

Moscovici: We are dedicated to keeping Greece in the euro

What about Christine Lagarde’s comment that Greece could leave the euro, Commissioner Moscovici?

He replies that this is “not the scenario of the Commission”.

We are dedicated to have Greece staying in the eurozone, a solid Greece, a reformed Greece.

And there is “true solidarity” between the Institutions (Greece’s lenders) Moscovici tells CNBC’s Steve Sedgwick.

But being prepared and responsible, have you worked on a plan B for Grexit, in case a deal isn’t reached?

No, I don’t consider that, Moscovici insists. We have one plan, one action, one will, to keep Greece in the eurozone.

Updated

European commissioner Pierre Moscovici is the first policymaker to break cover from the G7 this morning.

He told CNBC thatthere’s been “good progress” between Greece and lenders.....

....but more work needs to be done, including on Greece’s pensions.

*MOSCOVICI SAYS IT'S CLEAR TIME IS RUNNING SHORT ON GREECE

— Dealingroom (@Dealingroom1) May 29, 2015

*MOSCOVICI SAYS 'WE'RE NOT YET THERE' ON GREEK PENSION REFORMS

— Dealingroom (@Dealingroom_EN) May 29, 2015

Updated

Greece’s deputy prime minister, Yannis Dragasakis, has claimed that ‘political will’ is the missing ingredient needed for a deal (explaining why his boss phoned the leaders of Germany and France last night)

Greek Dep PM Dragasakis: Political will is missing on Greece deal --Corriere della Sera via BBG

— Live Squawk (@livesquawk) May 29, 2015

Dragasakis: Greece is willing to pay its debts, but is against new austerity

— Live Squawk (@livesquawk) May 29, 2015

Updated

Introduction: Greek talks, and US growth figures

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

We’re coming to the end of another week that started with hopes of a breakthrough between Greece and its creditors, but has seen little evidence of progress since.

Talks between the two sides will continue in Brussels today, and over the weekend, to close the gap on labour market reform, pensions, VAT rates and Greece’s budget targets. The same issues they’ve been split over for weeks.

Greece hopes for a deal by Sunday, but its lenders remain quite sceptical. Last night’s warning from Christine Lagarde that Greece could potentially leave the euro shows that policymakers still believe the crisis could spiral.

As Lagarde argues, Grexit wouldn’t be “a walk in the park”, but would “probably not” mean the end of the euro.

Greek PM Alexis Tsipras spoke with German Chancellor Angela Merkel and French President Francois Hollande in a teleconference call last night, in an attempt to drum up a ‘political’ deal to break the deadlock.

The Kathimerini newspaper explains:

The three leaders spoke for about an hour and government sources referred to “a positive climate.”

The exact content of the conversation remained unclear but it is thought Tsipras asked Merkel and Hollande to make good on a pledge they made at an EU leaders’ summit in Riga last week to help overcome potential obstacles in the negotiations.

As we covered yesterday, the Greek crisis was occupying the minds of the G7 finance ministers and central bankers yesterday. Not officially on the agenda, but ‘on the sidelines. For example:

Those G7 ministers will continue to discuss the global economy in Dresden today, so let’s hope they didn’t overdo the champagne.

Also coming up today....

We get the second estimate of US growth in the first quarter of this year, at 1.30pm BST.

The first estimate, of annualised growth of just 0.2%, could actually be revised even lower.

We’ll be tracking all the main events through the day:

.jpg?w=600)