Graphjet Technology Inc. (NASDAQ:GTI) experienced a 36.61% after-hours surge on Monday, with shares climbing to $0.13 from a closing price of $0.092. According to Benzinga Pro data, before soaring in extended trading session, GTI dipped 0.76% during regular session.

Check out the current price of GTI stock here.

1-for-60 Reverse Split Targets Nasdaq Compliance

The Malaysia-based graphene producer announced that its shareholders approved a share consolidation plan, selecting a 1-for-60 ratio for both issued and unissued ordinary shares. This move, approved by shareholders at an extraordinary general meeting on August 7, aims to elevate the stock price to meet NASDAQ’s $1.00 minimum bid requirement.

The consolidated shares will maintain trading symbol “GTI” on Nasdaq Global Market, with the new CUSIP number G30449139. Continental Stock Transfer & Trust Company will serve as exchange agent, with fractional shares rounded up to the nearest whole share.

Graphjet Technology also agreed to partner with the Centre for Materials Engineering and Smart Manufacturing (MERCU) at Universiti Kebangsaan Malaysia to explore using graphite and graphene in additive manufacturing for advanced heat sink development under the Ministry of Higher Education's 2025 Consortium of Research Excellence program.

Graphjet Technology said on Monday that it has also agreed to partner with the Centre for Materials Engineering and Smart Manufacturing (MERCU) at Universiti Kebangsaan Malaysia to explore using graphite and graphene in additive manufacturing for advanced heat sink development under the Ministry of Higher Education's 2025 Consortium of Research Excellence program.

The share consolidation will take effect at 12:01 a.m. Eastern Time on August 25

Financial Performance Shows Significant Improvement

The company’s first-quarter financial results reveal substantial operational improvements compared to the prior year. Net loss decreased 96.0% to $577,023 for the three months ended on March 31, from $14.3 million in first quarter 2024. This dramatic improvement stems primarily from reduced general administrative expenses, which fell from $14.1 million to $553,000.

For the six-month period, net losses declined 91.4% to $1.27 million from $14.7 million year-over-year. The company maintains $227,828 in cash as of March 31, down from $348,655 in September 2024.

Technology and Market Positioning

Graphjet Technology operates as a pre-revenue company with patented technology for manufacturing graphene and graphite from palm kernel shells. The proprietary process achieves an 83% reduction in carbon footprint and 80% reduction in production costs compared to traditional methods.

Graphjet’s products target high-growth sectors including electric vehicle batteries, semiconductors, biomedical applications, and energy storage systems. With approximately 5 million tons of palm kernel shells available annually in Malaysia, Graphjet utilizes only a small fraction for sustainable graphene production.

The carbon recycler has a market capitalization of $13.88 million and with and an average volume of 40.07 million shares, it trades between $0.057 and $4.15 over the past year.

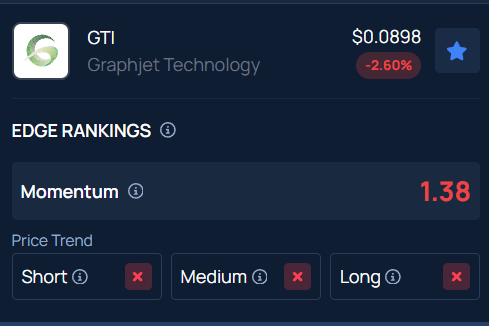

According to Benzinga Edge Stock Rankings, GTI stock has a negative price trend across all time frames. Additional performance details are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: REDPIXEL.PL from Shutterstock