Graphcore, a U.K.-based artificial intelligence (AI) processor developer, is considering its strategic options. The company is facing difficulties raising money from investors and may be seeking a buyer for a deal worth around $500m (£400m), reports The Telegraph. Among the potential purchasers the newspaper names Arm, OpenAI, and Softbank, though none of these entities confirmed any talks with Graphcore.

Despite raising over $700 million from investors like Microsoft and Sequoia (with a massive valuation at $2.8 billion as of late 2020), Graphcore has struggled to become a viable player on the market of AI processors with its intelligence processing units (IPUs), partly due to closure of its China business due to U.S. AI technology restrictions last year.

The company reported an 11% increase in losses ($204.6 million in 2022), with revenue dropping from $5 million to $2.7 million, according to The Telegraph. The company has taken measures to cut costs in response to its financial challenges, which included staff layoffs and closing international offices. To continue operations and compete in the AI chip market, Graphcore needs to raise more funds by May 2024. These funds may come from existing investors, or a buyer.

Rumored interested parties include Arm, SoftBank, and OpenAI, but no official statements have been made. The sale might face scrutiny from national security officials due to the strategic importance of AI technology.

Meanwhile, Chrysalis, a London-listed fund with a Graphcore stake, revealed in December that one of its a portfolio companies was in process of being sold. Soon after, it sharply raised its Graphcore stake's value, hinting at a sale, according to Zeus Capital analysts. This adjustment implied Graphcore's valuation at $528 million, based on an investor's estimate. Baillie Gifford, another Graphcore investor, also upped its valuation of Graphcore.

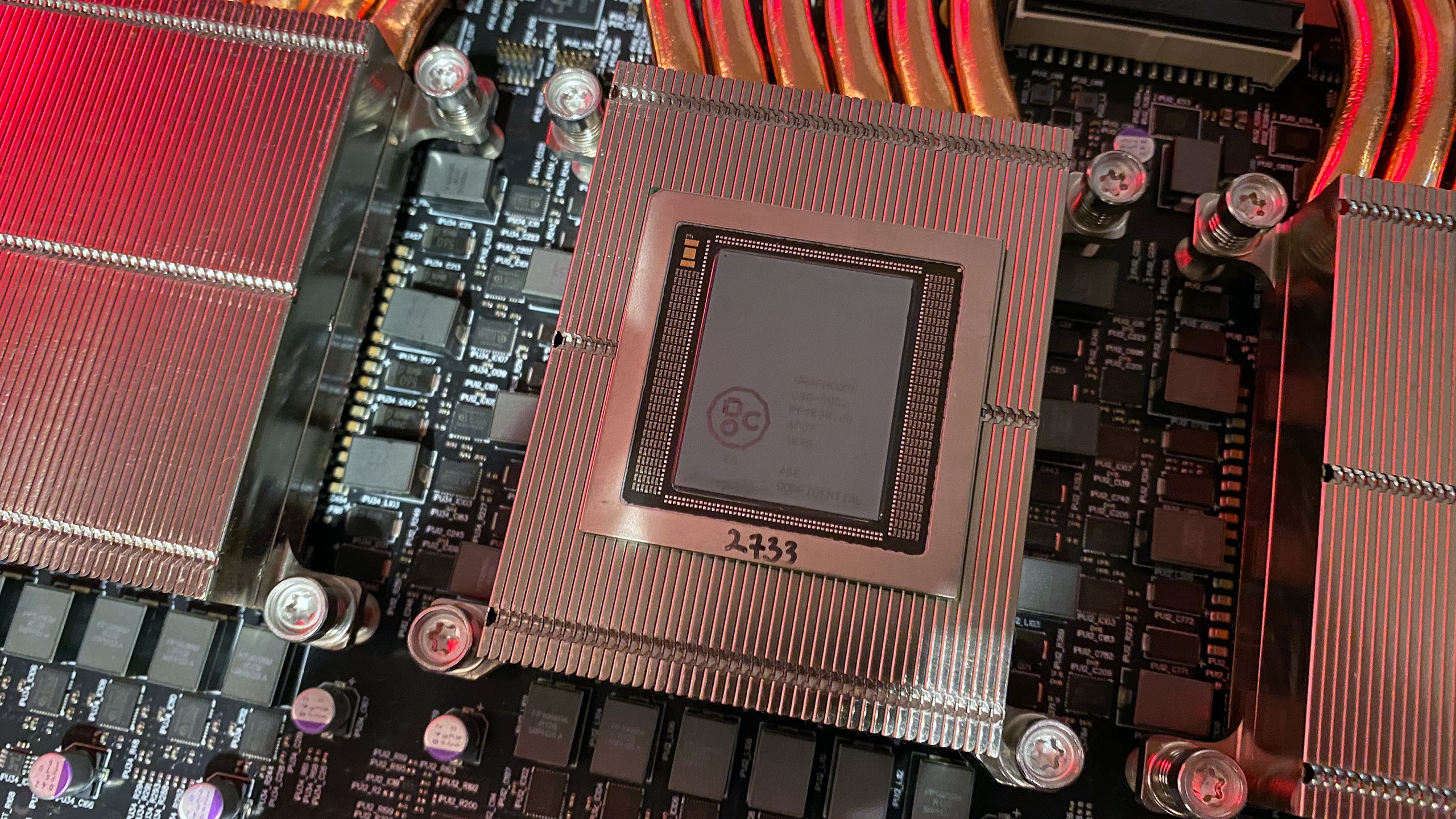

Graphcore got into headlines in 2020, when it released its Colossus MK2 GC200 intelligence processing unit (IPU) that featured 59.4 billion transistors and was the industry's most complex chip at the time. Each GC200 IPU packs 1,472 independent IPU cores with SMT that can handle 8,832 separate parallel threads and carries 900 MB of SRAM with an aggregated bandwidth of 47.5 TB/s per chip (eliminating need for external memory) as well as 10 IPU links to scale-out with other GC200 chips. From performance point of view, each GC200 offers up to 250 FP16 TFLOPS, which is comparable to Nvidia's A100's 312 FP16 TFLOPS (yet lower than 624 FP16 TFLOPS with sparsity), but the market did not bite.