Tom Lee was right. No matter what the S&P 500 ($SPX) and Nasdaq-100 ($IUXX) indexes have faced over the past decade, they’ve continued to trend up. Dismissed as a perma-bull by some (including me at one point), his broad market views have been far more accurate than not.

Now, Lee has been unwavering in his positive stock market outlook for so long, you could argue that nothing would turn him bearish. In other words, just as some forecasters have not said a kind word about the stock market since 2007, the opposite can also be true. Especially when you consider that since hedging is not a mainstream approach, there’s a very strong positive bias toward the stock market.

After all, when your industry’s compensation is based in large part on asset-based fees, you have two ways to keep earning more: new assets or an increase in the value of existing assets.

None of this is an outright criticism. I worked under that exact system as an advisor for 27 years, and as a mutual fund manager three different times during that span. I get the “assets under management” thing. But it doesn’t ultimately matter what any market strategist says. It is what they do.

And for Tom Lee, who broke off years ago from the brokerage world to start his Fundstrat research firm, it is quite an accomplishment to bring his active portfolio to life through the Fundstrat Granny Shots US Large Cap ETF (GRNY). Plus, the 11-month old fund just crossed $3 billion in assets!

So, as self-directed investors, we need to instantly ask ourselves: What is reality and what is fantasy? That is, does $3 billion in AUM in year 1 mean Mr. Lee’s ETF is doing something truly unique? Or is it simply riding the tide when it is high? Let’s explore this in a handful of ways:

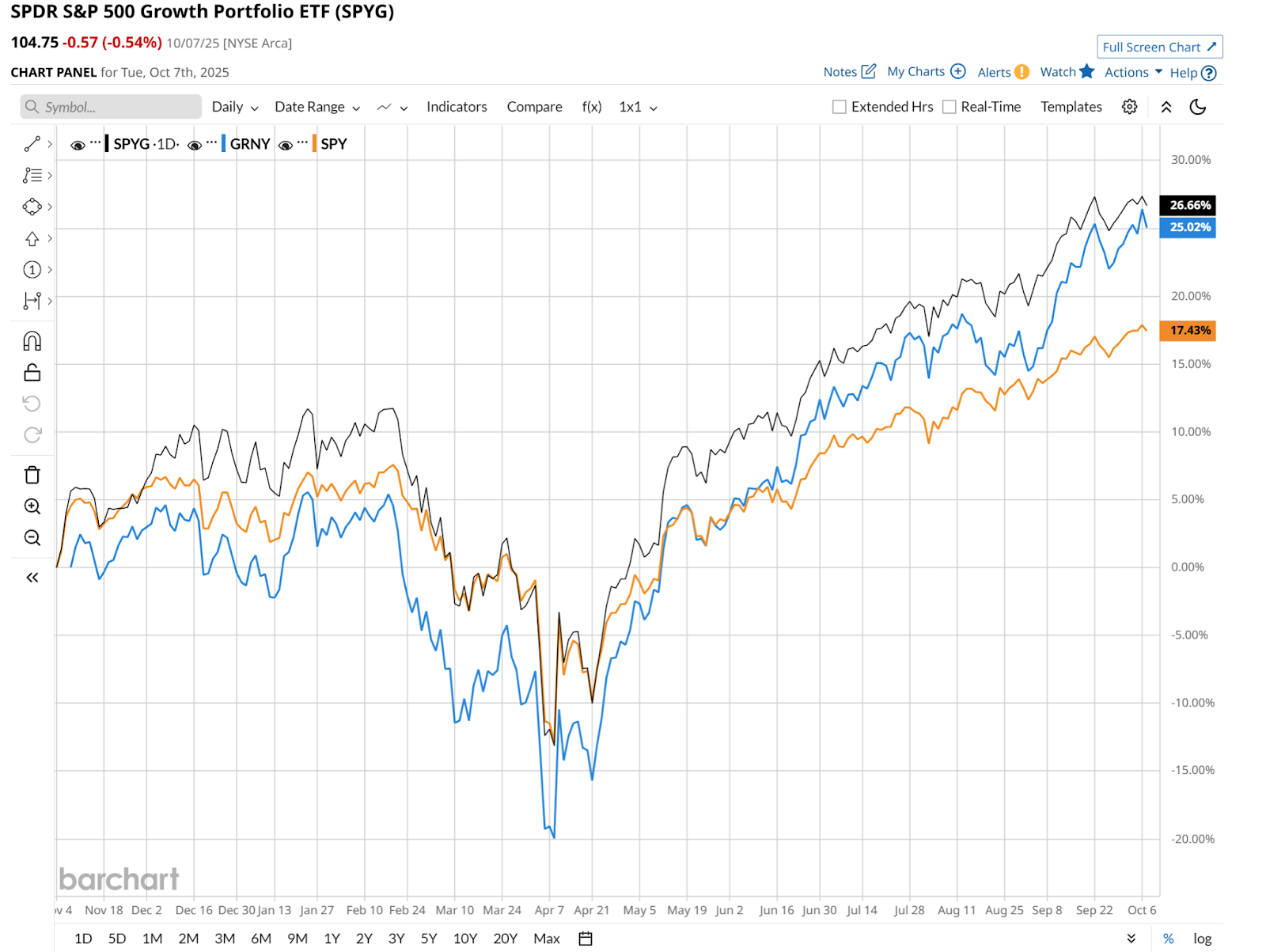

MYTH: GRNY has performed very well so far versus its peers, which explains its asset-gathering success. Shown here, the fund is up 25% since inception, well above the S&P 500 itself. But GRNY is more of a growth ETF than a “blend” of growth and value stocks. So there’s clearly an element of marketing muscle here. Tom Lee is a financial television regular, which may explain it. We live in an age of influencers.

REALITY: GRNY has benefitted from Tom Lee’s frequent media exposure, in addition to his tenure as a top Wall Street strategist and communicator.

MYTH: This ETF raised all of those assets because its shareholders piled in for the long haul.

REALITY: GRNY, according to its prospectus, “seeks long-term capital appreciation.” Tom Lee is far less a trader than an investor, and so assuming that all of that capital flooded in because they all plan to stay for many years, and be as patient as he is, is a stretch. Time will tell. For decades, investors in ETFs, and mutual funds before them, are notorious for chasing performance.

REALITY: GRNY’s portfolio is notably different from the S&P 500 Index.

This is the case, but because it is an equal-weighted ETF, not weighted by company size like the more common version of the S&P 500. However, the holdings list, about 40 names in all, are a very typical basket of growth stocks, with some additional blue-chips included. So while there’s research input into this actively managed ETF, the net result is a collection of stocks that are not substantially different in behavior from the broad market.

There is evidence of the fund’s stated “thematic” approach, but in a market so drunk on tech stocks and mega-caps, it is hard to blame any active manager for not straying too far from what’s working and popular.

REALITY: A “granny shot” is a technique for shooting basketball free throws, in an underhanded motion. Yup, that’s what a granny shot is. My grandmothers were not accomplished hoopsters as far as I know, but the term is not new. GRNY’s materials explain that it focuses on consistent high-quality stocks, and not flashy trends.

This ETF needs to be tested in a sustained rough market to see if what is actually “trendy” and not sustainable is the valuations currently applied to some of those high-quality stocks. But the same can be said for many popular ETFs today. Investors should approach any asset-gathering monster like this one with a healthy dose of caution.

That doesn’t mean GRNY and its collection of currently popular stocks won’t continue to work. But as my grandma used to remind us, “don’t eat too much sugar.” If and when the sugar high wears off, we’ll see which ETFs were alpha-drivers, and which were beneficiaries of a hefty tail wind.