Grain futures market bulls got a solid gut-punch on Friday when President Donald Trump abruptly canceled a planned meeting with Chinese President Xi Jinping and threatened to implement “a massive increase” in tariffs on Chinese products. The White House decision followed a tense week of tariff maneuvers and export restrictions that have sent ripples through global markets.

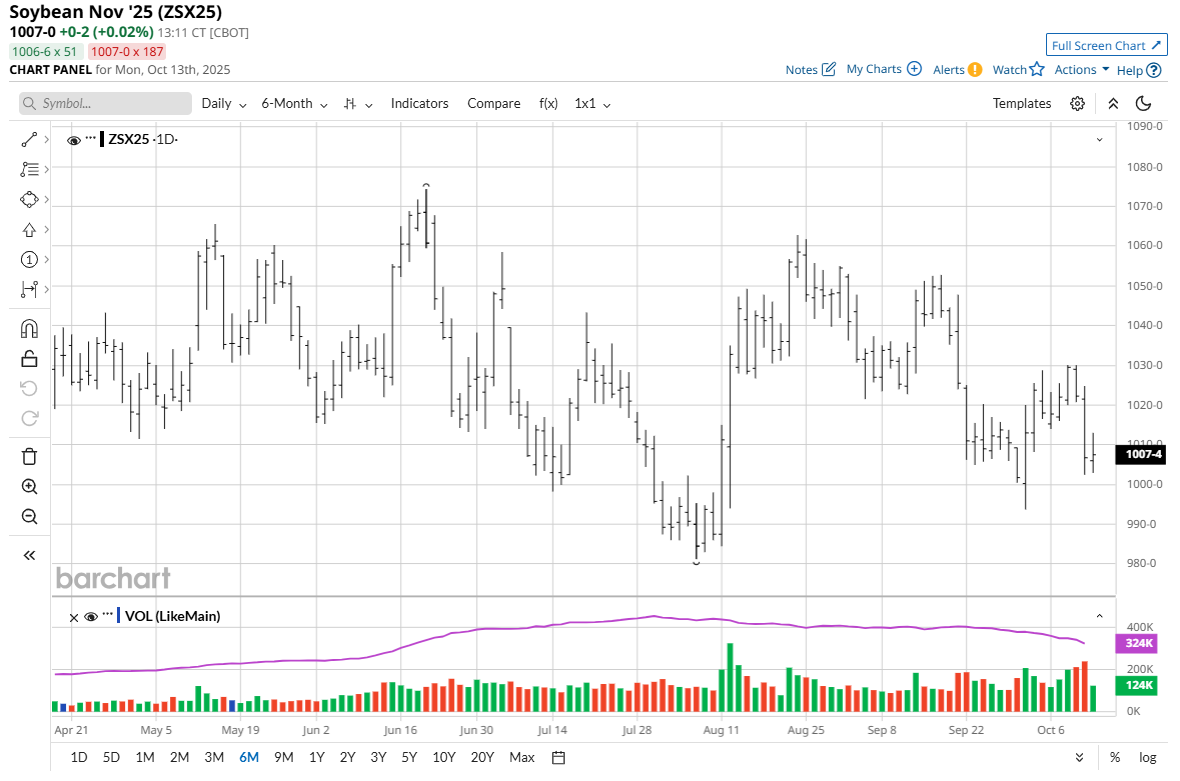

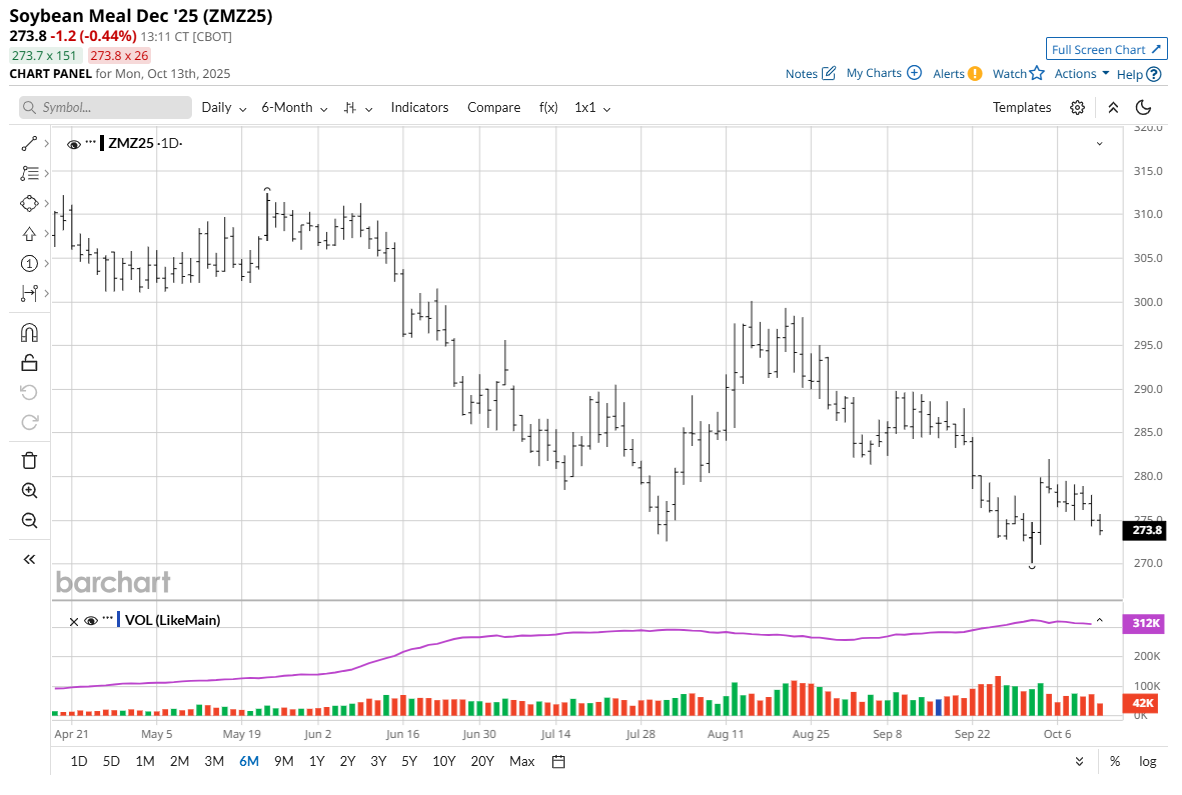

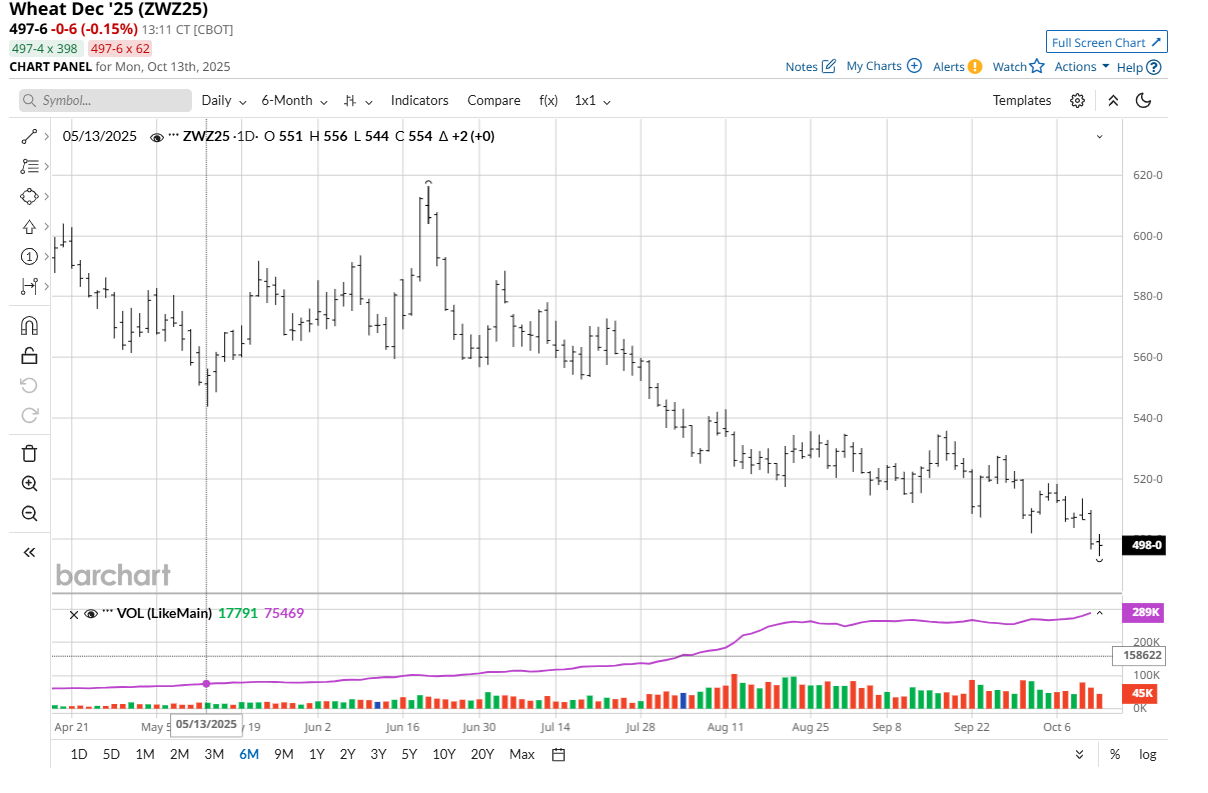

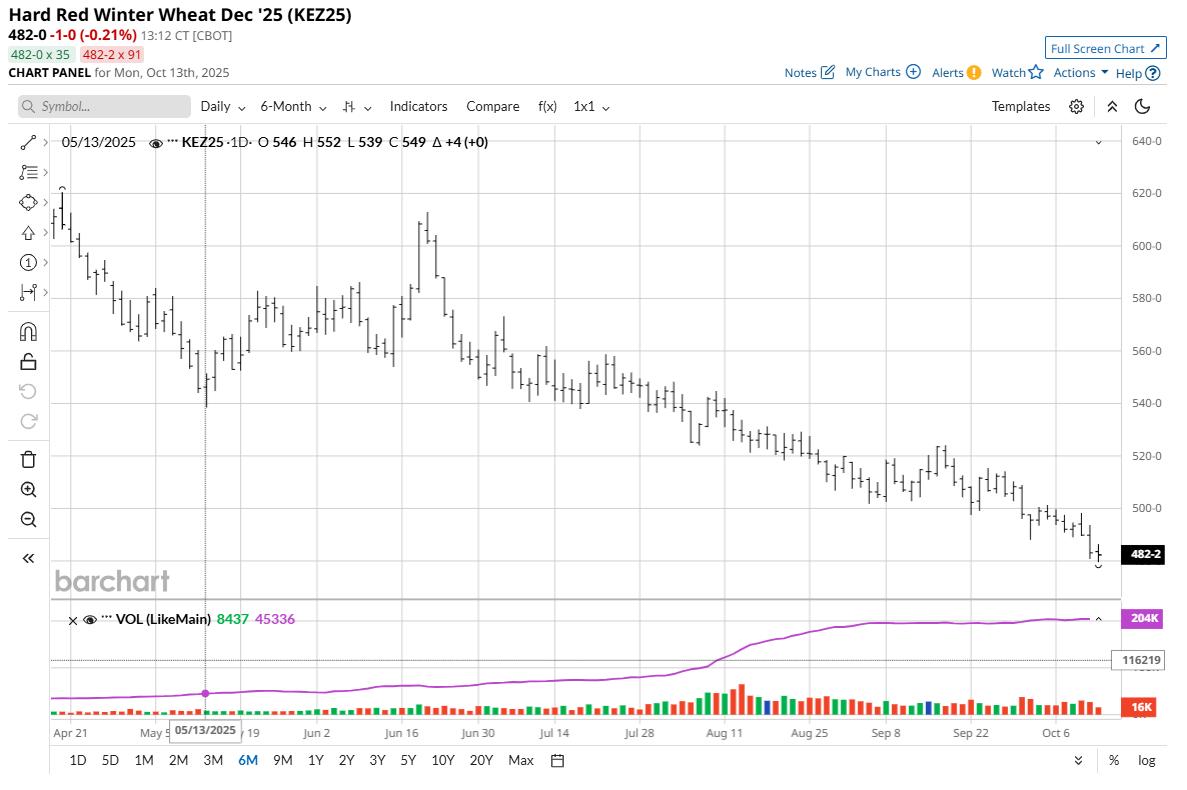

December corn (ZCZ25) futures fell 5 1/4 cents on Friday to $4.13 and for the week were down 6 cents. November soybeans (ZSX25) fell 15 1/2 cents to $10.06 3/4, on the week down 11 1/4 cents. December soft red winter wheat (ZWZ25) fell 8 cents to $4.98 1/2 and hit a contract low on Friday. For the week, December SRW was down 17 1/4 cents. December hard red winter wheat (KEZ25) lost 6 3/4 cents to $4.83 and set a contract low. December HRW was down 14 cents for the week.

Trump wrote in a social media post on Friday: “Some very strange things are happening in China! They are becoming very hostile, and sending letters to countries throughout the world, that they want to impose export controls on each and every element of production having to do with rare earths, and virtually anything else they can think of, even if it’s not manufactured in China. Nobody has ever seen anything like this but, essentially, it would ‘clog’ the markets, and make life difficult for virtually every country in the world, especially for China.”

The Trump administration attempted to de-escalate the situation on Sunday. Trump signaled openness to a deal with China to quell fresh trade tensions while warning that export controls announced by Beijing last week were a major barrier to talks. He wrote on social media Sunday: “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” In the meantime, Vice President JD Vance called on Beijing to “choose the path of reason” in the latest spiraling trade fight between the world’s two leading economies, claiming the U.S. has more leverage if the fight drags on.

According to senior officials, the president cited Beijing’s “unacceptable escalation” in rare-earth export controls and lack of progress on agricultural commitments as reasons for withdrawing. The meeting — originally set to discuss trade realignment, currency policy, and agricultural imports — had been viewed by farm groups as a potential turning point toward restoring Chinese purchases of U.S. soybeans. However, China had never officially confirmed the Trump-Xi talk.

“This signals a deep-freeze in U.S./China agricultural diplomacy,” said one trade strategist. “For Midwest producers already facing credit stress, this is a gut punch.” U.S. equity markets also plunged on the development.

Beijing’s Commerce Ministry responded coolly, saying China “regrets the U.S. decision” and will “evaluate appropriate countermeasures.” The statement left open the possibility of future engagement but emphasized that “respect and equality must form the foundation of dialogue.”

Where Are the Grain Markets Headed from Here?

Fresh technical damage was inflicted on the corn, soybean complex, and winter wheat markets Friday, including technically bearish weekly low closes that will embolden the speculative, chart-based bears to play the short sides this week.

Rapid harvesting of U.S. corn and soybean crops has ramped up commercial hedge pressure as peak harvesting of the two crops is now occurring. The commercial selling in corn and beans will likely peak and then start to subside in the next couple weeks, which may give the corn and soybean futures markets bulls a reprieve.

Under normal circumstances, last week would have included USDA’s October production and WASDE reports. However, the extended U.S. government shutdown may see a USDA data void continue for some time to come. That’s not bullish for grains. Uncertainty generally always favors the grain market bears.

The bright spot for corn is that recent export demand for U.S. corn has been good, which may keep a floor under corn futures prices in the coming months.

The soybean market absorbed the brunt of the body blow to the grain markets as U.S-China trade relations suddenly turned south on Friday. Just last Thursday, Trump said that at his scheduled meeting with Xi later this month that U.S. soybean sales to China would be a top priority. That all seemed to evaporate on Friday.

One bright spot is the soybean meal (ZMZ25) futures market, which on Friday only suffered slight losses — suggesting there is good value-buying demand for meal at present prices.

Technical price charts for winter wheat futures markets remain firmly bearish overall, which will keep chart-based speculative bears confident. Wheat futures traders will be looking to the daily price action in corn and soybean futures markets for their own near-term price direction.

Surging Greenback Another Negative for U.S. Grain Markets

The U.S. dollar index ($DXY) last week hit a nine-week high and had the best weekly performance in a year. The USDX is now trending higher, suggesting a major bottom is in place for the index and that it can continue to trend up in the coming months. That will make U.S grains less price-competitive on the world trade markets, which conduct most of their business in U.S. dollars. The stronger dollar makes U.S. grains more expensive to purchase in non-U.S. currency.

What Will Rescue the Grain Futures Markets?

While the erosion in U.S.-China trade relations sent the grain futures markets into a tailspin last Friday, the grains were not in great shape even before that bearish news occurred. Following are a few bullet points that would likely help turn the tide from bearish to at least neutral, if not bullish.

- U.S. corn and soybean harvests winding down and commercial hedge selling pressure easing

- Lower U.S. interest rates are likely coming, as soon as the end of this month. Other major central banks are likely to follow. Lower interest rates mean better economic growth, including better demand from consumers and businesses, due to lower borrowing costs.

- Longer-term price charts show the corn, soybean and wheat futures markets’ prices are way down from just two or three years ago, suggesting the historical cycle of grain prices at some point in the not-too-distant future will turn from bust to boom.

- Weather is always a wild card in grain markets. The South American grain crops are seeing their growing seasons upcoming. Weather scares for the South American crops are not uncommon and occur in varying degrees. Don’t be surprised to see a weather scare for South American crops in the coming months.

- Better risk appetite in the general marketplace would boost better speculative buying in grain futures. The U.S. government shutdown and the lack of fresh USDA crops data is bearish. However, when the government reopens, so will the flow of economic data that grain traders need to better deliver price discovery and become more confident.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.