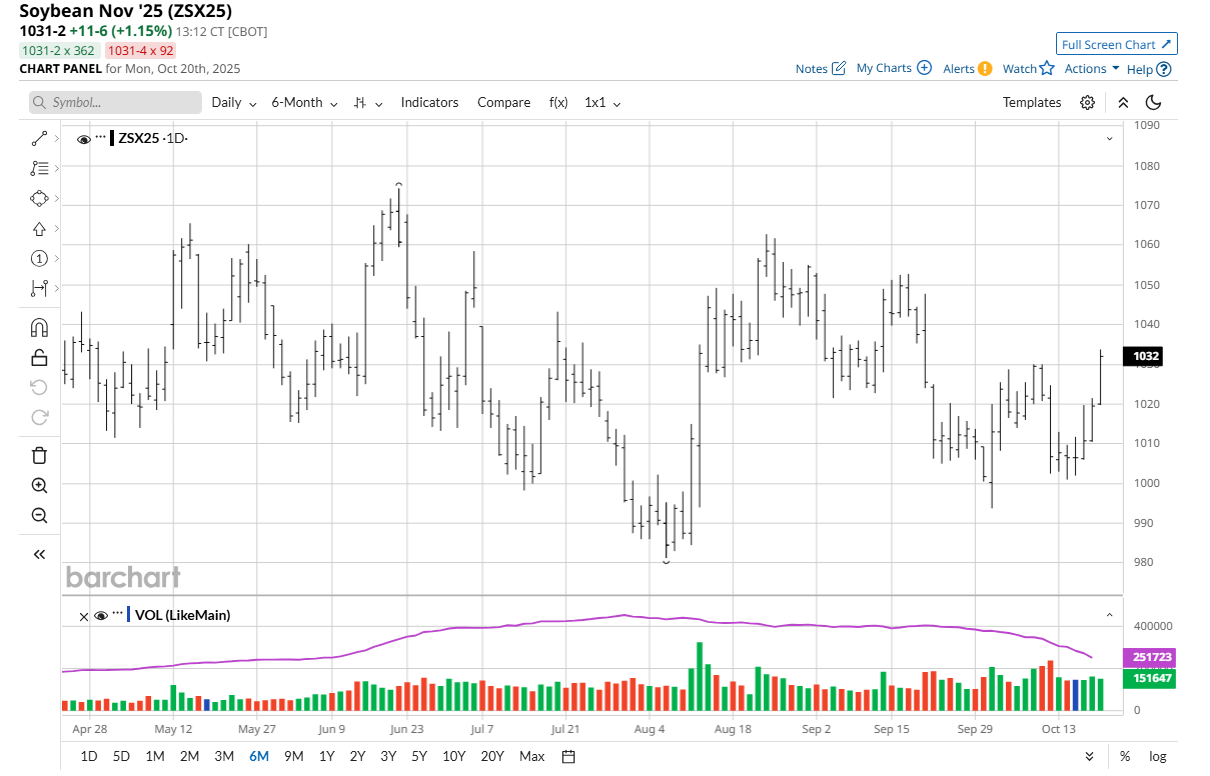

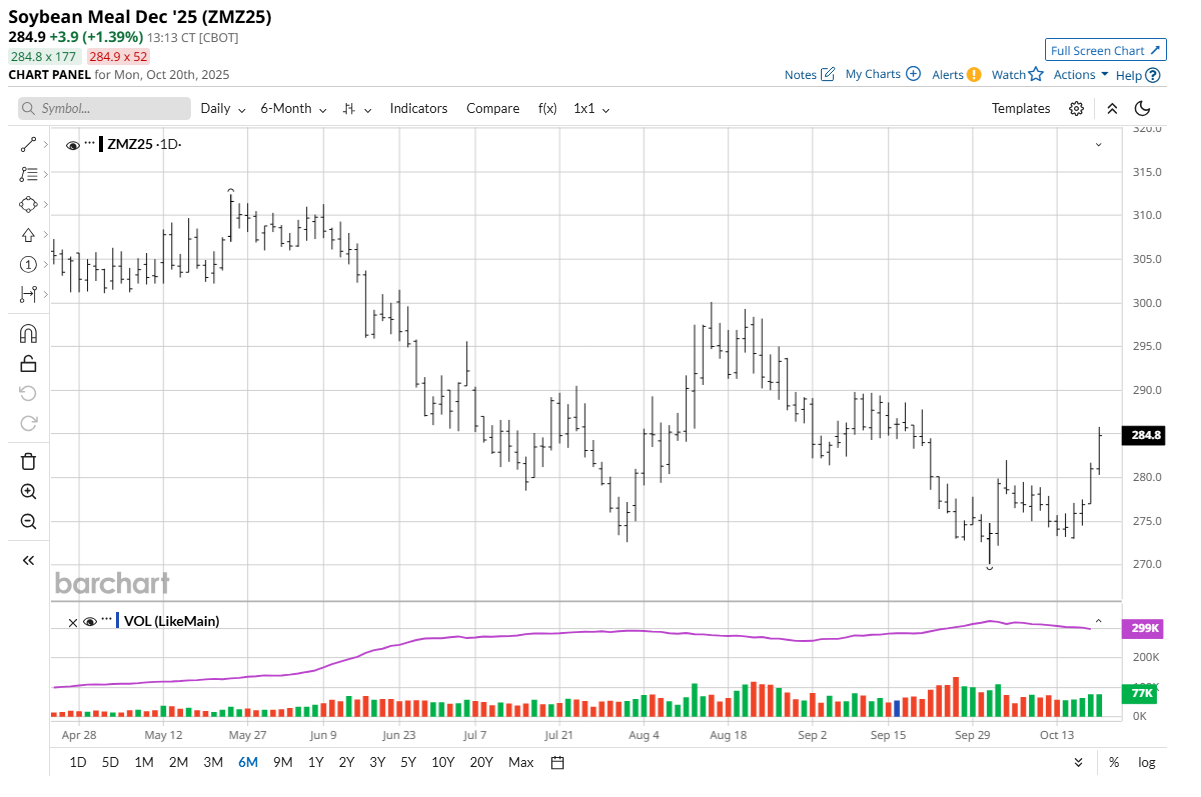

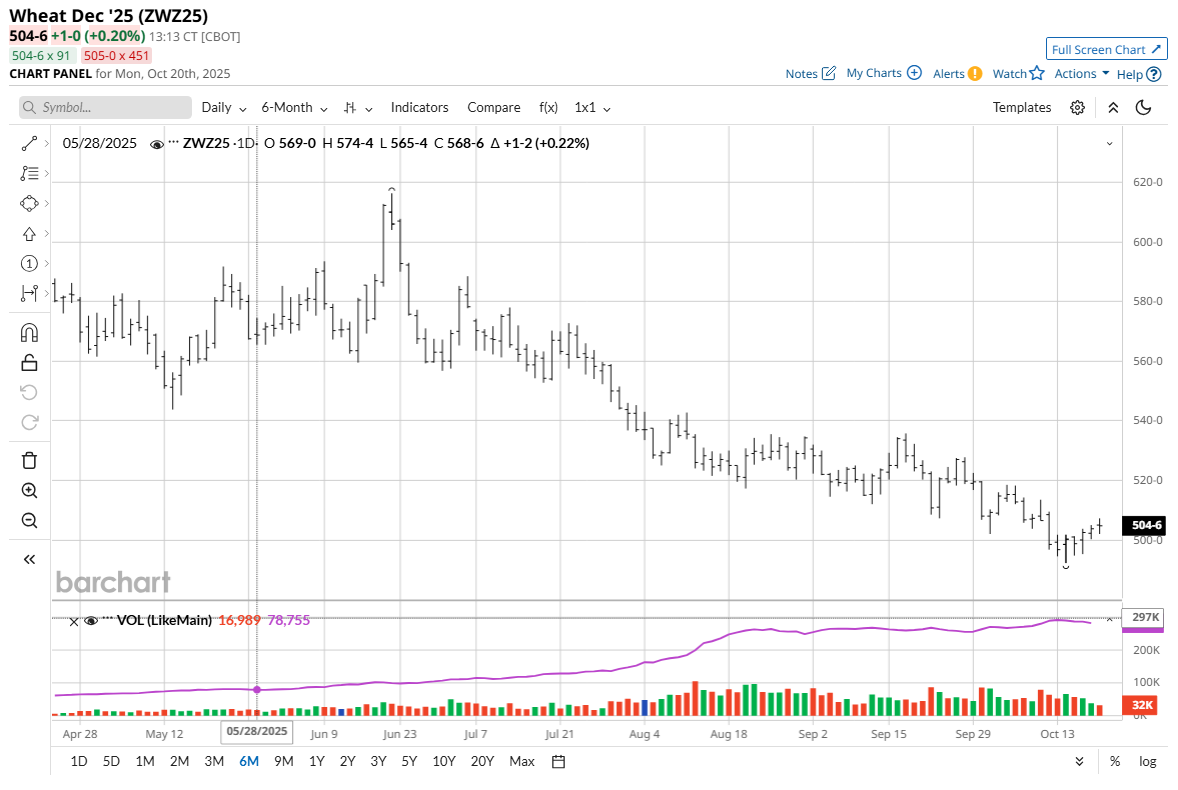

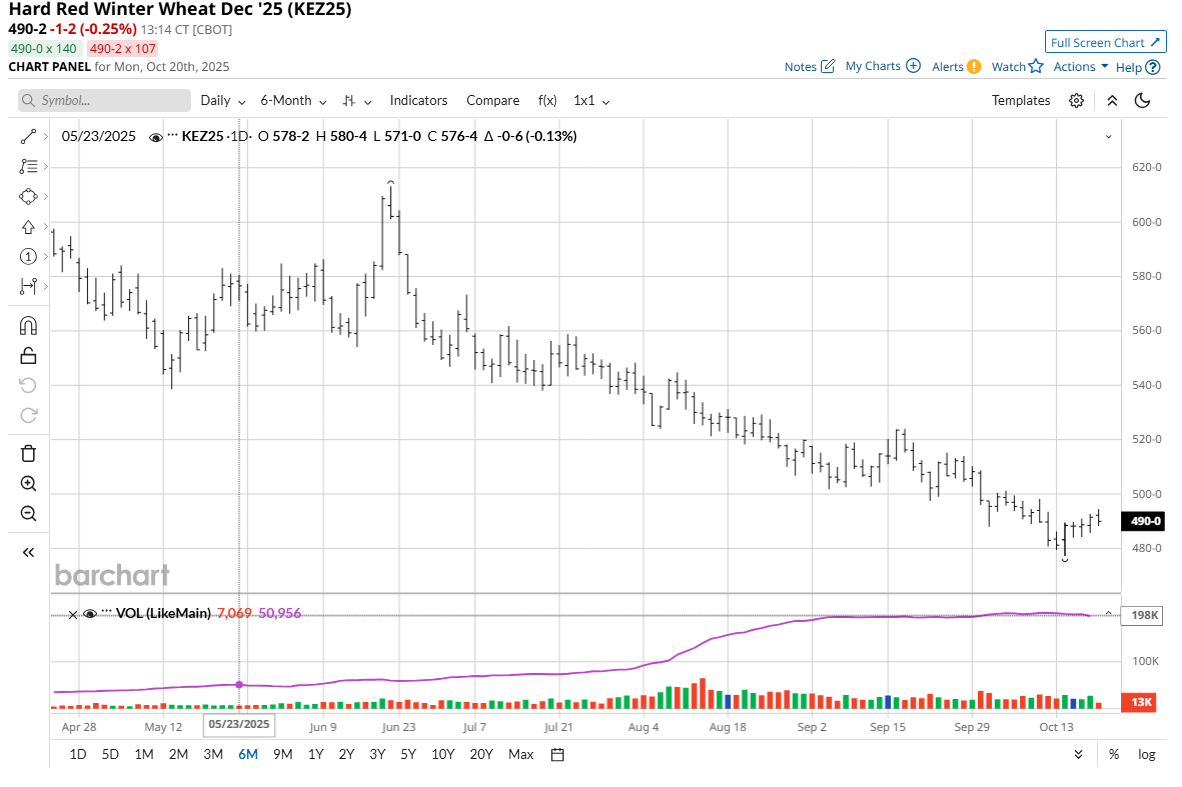

The grain futures markets showed impressive price gains late last week. December corn (ZCZ25) futures Friday hit a three-week high and for the week gained 9 1/2 cents. November soybeans (ZSX25) last week were up 12 3/4 cents. December soybean meal (ZMZ25) closed on Friday at a four-week high and for the week rose $6.00. December soft red winter wheat (ZWZ25) for the week was up 5 1/4 cents. December hard red winter wheat (KEZ25) futures last week gained 8 1/2 cents.

Friday’s technically bullish weekly high closes in December corn, November soybeans, December meal, and December winter wheat suggest more buying interest from the chart-based speculative traders early this week. However, global stock markets wobbled early Friday on some regional U.S. bank worries.

Grain bulls do not want to see shaky markets that would quickly sap speculative buying interest in the grain futures.

Some upbeat comments from President Donald Trump on Friday regarding U.S.-China relations also supported buying interest in the grain markets to end the trading week. The scheduled late-October summit meeting between Trump and Chinese President Xi Jinping in Asia may be one of the most important events of the year for the grain futures markets. Trump has said more Chinese purchases of U.S. soybeans is near the top of his list of objectives for that meeting.

U.S. corn and soybean harvesting will be winding down in the next few weeks, which will also see commercial hedge selling pressure dying down. That’s price-friendly for corn and beans. However, the extended U.S. government shutdown creates a big data void that’s not bullish for the grains. Keener uncertainty in markets generally always favors the bears.

As the calendar turns to November, grain trader focus will turn more to global demand and the corn and soybean growing seasons in Brazil and Argentina. It’s not surprising to see weather markets develop for Brazil and Argentina crops from November to March.

While the corn market has been devoid of fresh U.S. export reports for the past couple weeks, recent export demand for U.S. corn has been good, which will likely keep a floor under corn futures prices in the coming months.

Wheat traders this week will continue to look to the corn and soybean futures markets for their own daily price direction.

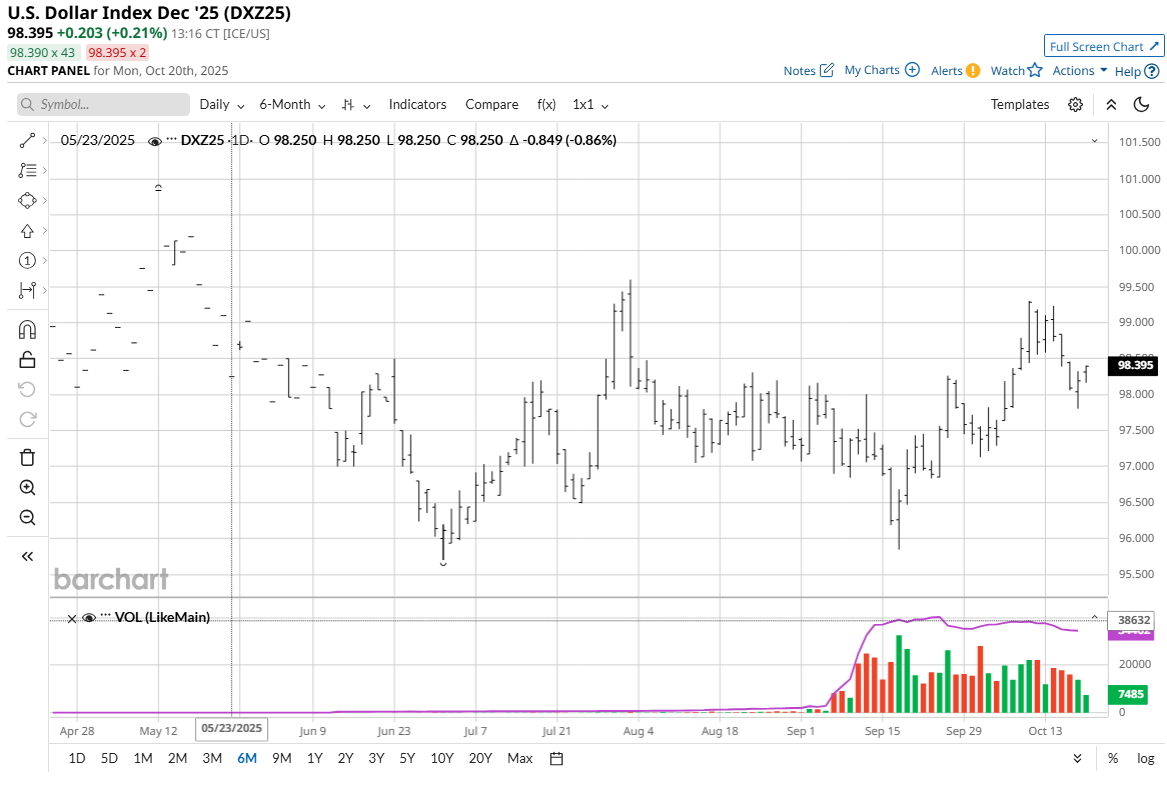

Grain Traders Monitoring Weakening U.S. Dollar Index

The U.S. dollar index ($DXY) last week showed significant price weakness, which worked to support buying interest in the grain futures markets. The USDX will be an important outside-market element for the grain futures markets in the weeks and months ahead. Continued weakness in the USDX would make U.S. grain export prices more competitive on the global trade markets.

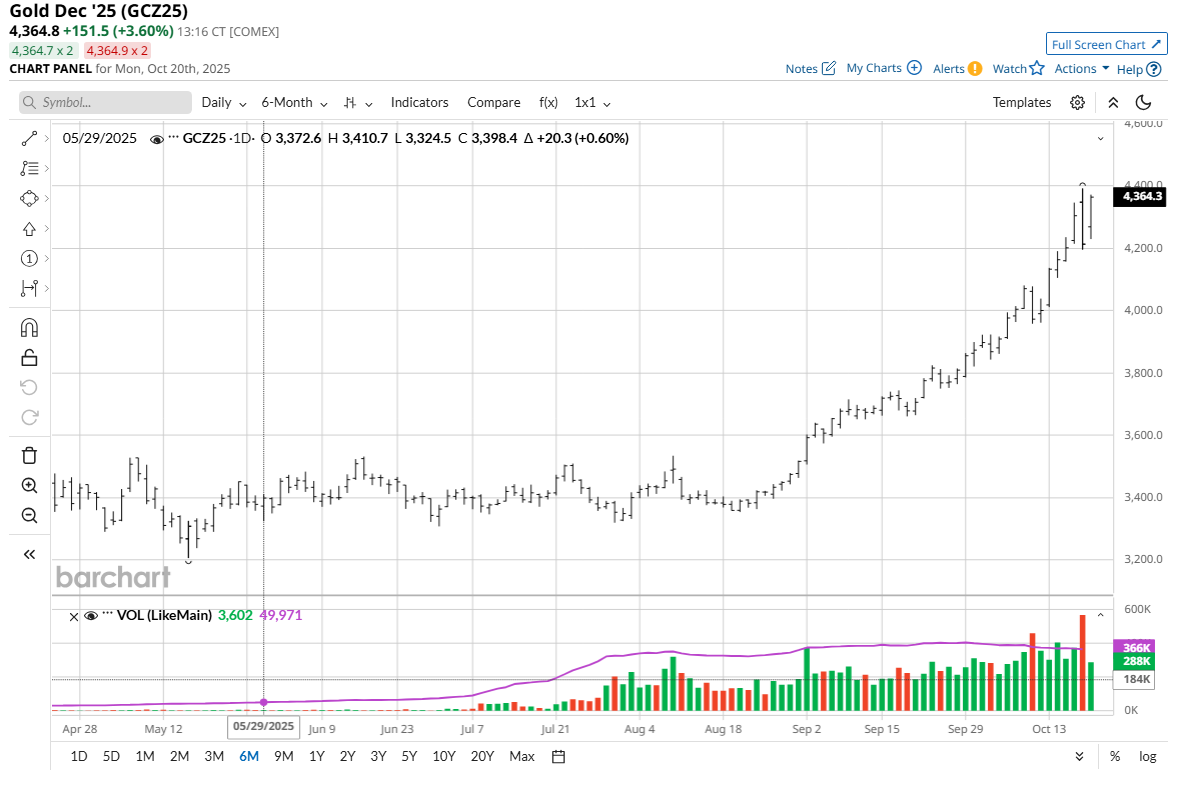

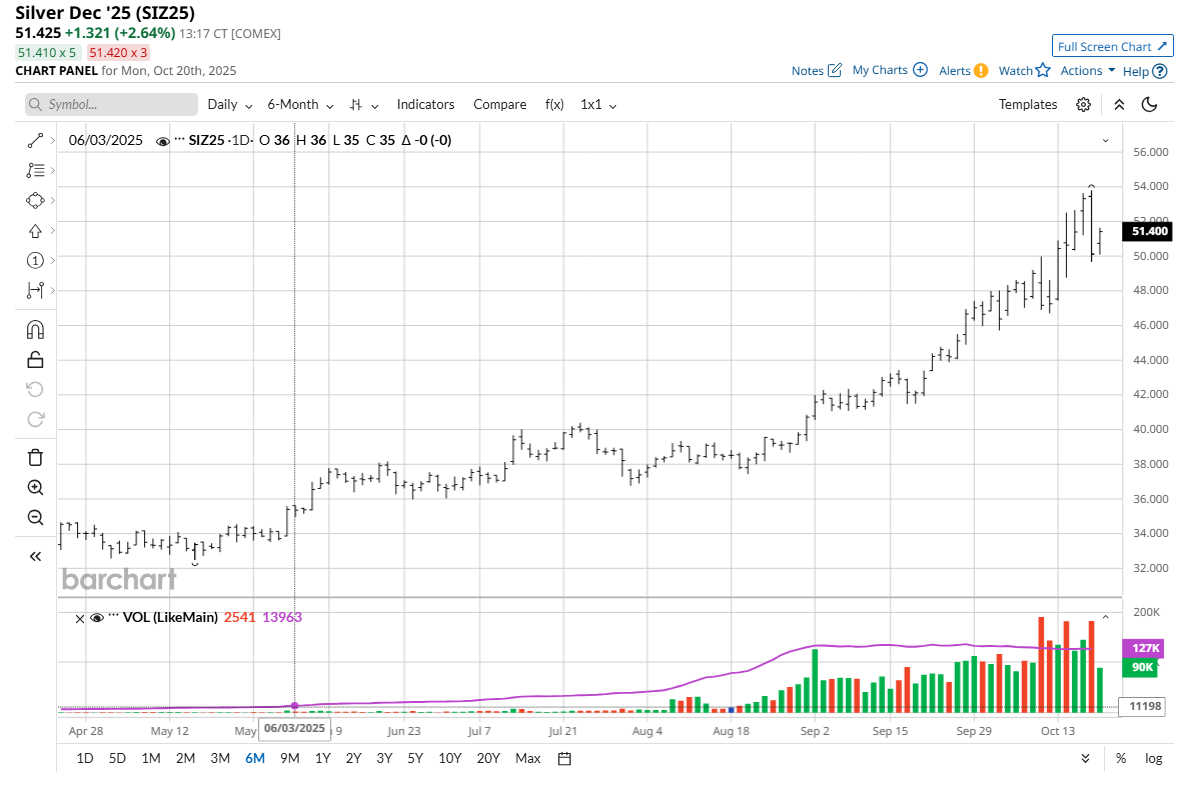

Grain Traders Also Eyeing Gold, Silver Markets

The gold (GCZ25) and silver (SIZ25) markets last week hit record highs but then on Friday saw sharp losses that produced high daily volatility and by the close had produced technically bearish “key reversals” down on the daily bar charts. Those are early warning clues that market tops may be in place. It’s likely that gold and silver futures trading will remain highly volatile this week. Extreme price moves, either up or down, may well have an impact on grain futures trading — especially major selloffs in gold and silver that would likely produce spillover selling pressure in other raw commodity futures markets, including the grains.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.