Government borrowing last month jumped to the highest level for May outside the pandemic era despite a boost to the tax take after the Chancellor’s national insurance hike.

The Office for National Statistics (ONS) said so-called compulsory social contributions, largely made up of national insurance contributions (NICs), jumped by £3.9 billion or 14.7% to a record £30.2 billion in April and May combined.

It followed the move by Rachel Reeves in April to increase NICs for employers, which has seen wage costs soar for firms across the UK as they also faced a rise in the minimum wage in the same month.

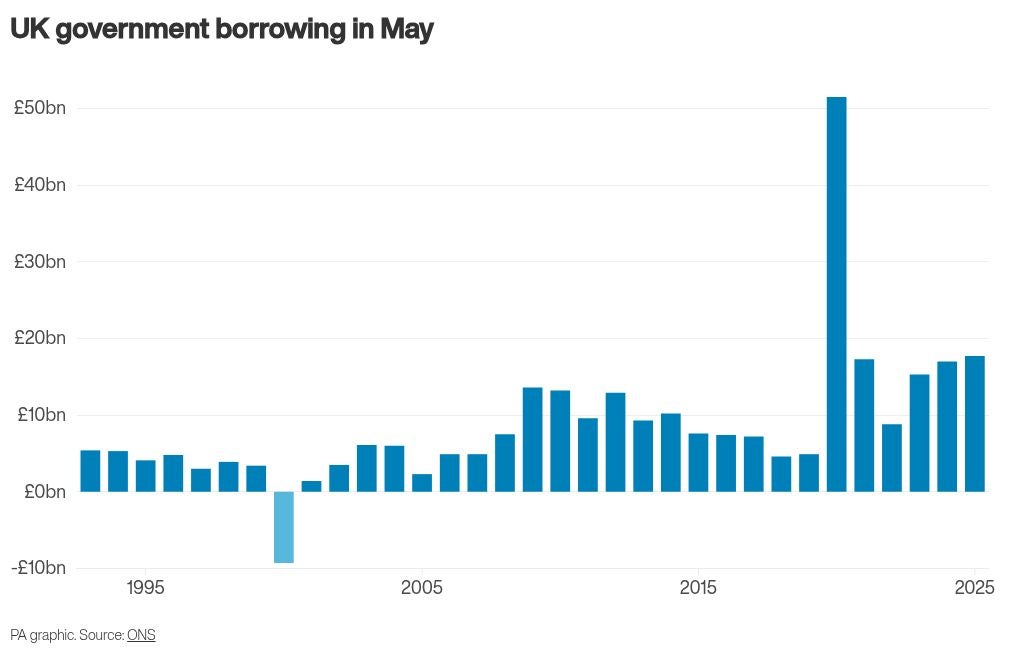

In spite of this, borrowing still surged to £17.7 billion last month, the second highest figure on record for May, surpassed only at the height of Covid.

The ONS said May borrowing was £700 million higher than a year earlier, though it was slightly less than the £18 billion most economists had been expecting.

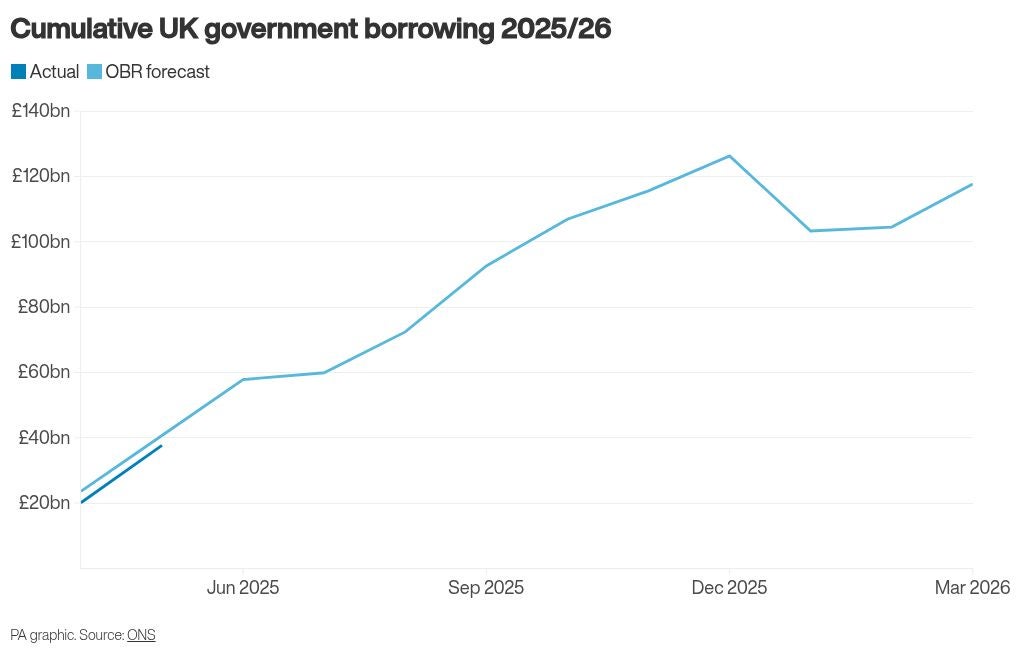

Borrowing for the first two months of the financial year to date was £37.7 billion, £1.6 billion more than the same two-month period in 2024.

Public sector net borrowing excluding public sector banks was £17.7 billion in May 2025. This was £0.7 billion more than in May 2024 and the second-highest May borrowing since monthly records began in 1993.

— Office for National Statistics (ONS) (@ONS) June 20, 2025

➡️ https://t.co/I4cI5aiUZ4 pic.twitter.com/LxKyTrmoh6

Rob Doody, deputy director for public sector finances, said: “Last month saw the public sector borrow £0.7 billion more than at the same time last year, with only 2020, affected as it was by Covid-19, seeing higher May borrowing in the time since monthly records began.

“While receipts were up, thanks partly to higher income tax revenue and national insurance contributions, spending was up more, affected by increased running costs and inflation-linked uplifts to many benefits.”

While May’s borrowing out-turn was lower than economists were expecting, it was more than the £17.1 billion pencilled in by the UK’s independent fiscal watchdog, the Office for Budget Responsibility (OBR) in March.

But the figures showed that central government tax receipts in May increased by £3.5 billion to £61.7 billion, while higher NICs saw social contributions rise by £1.8 billion to £15.1 billion last month alone.

Public sector net debt, excluding public sector banks, stood at £2.87 trillion at the end of May and was estimated at 96.4% of gross domestic product (GDP), which was 0.5 percentage points higher than a year earlier and remains at levels last seen in the early 1960s.

The ONS said the sale of NatWest, formerly Royal Bank of Scotland, cut net debt by £800 million last month, but did not have an impact on borrowing in the month.

Public sector net financial liabilities excluding public sector banks were provisionally estimated at 83.9% of GDP at the end of May 2025. This was 2.5 percentage points more than at the end of April 2024, but 12.5 percentage points less than for public sector net debt. pic.twitter.com/wcjZOnXOTx

— Office for National Statistics (ONS) (@ONS) June 20, 2025

Interest payments on debt, which is linked to inflation, fell £700 million to £7.6 million due to previous falls in the Retail Prices Index.

Interest payments depend on inflation from two months earlier.

But recent rises in RPI are expected to see debt interest payments race higher in June.

Thomas Pugh, economist at audit and consulting firm RSM UK, warned that despite the NICs increase, Ms Reeves is still likely to have to announce further tax increases in the autumn budget.

Commenting on today’s public sector finances figures for May 2025, ONS Deputy Director for Public Sector Finances Rob Doody said: (quote 1 of 2) pic.twitter.com/A6p9MsvZcF

— Office for National Statistics (ONS) (@ONS) June 20, 2025

He said: “The under-performance of the economy and higher borrowing costs mean the Chancellor may already have lost the £9.9 billion of fiscal headroom that she clawed back in March.

“Throw in the tough outlook for many Government departments announced in the spending review and U-turns on welfare spending and the Chancellor will probably have to announce some top-up tax increases after the summer.

“We are pencilling in tax increases of £10 billion to £20 billion.”

Darren Jones, chief secretary to the Treasury, insisted the Government had “stabilised the economy and the public finances”.

“Since taking office, we have taken the right decisions to protect working people, begin repairing the NHS, and fix the foundations to rebuild Britain.”