Alphabet (GOOG) stock, which was out of favor with markets for the last couple of years due to both macroeconomic and company-specific risks, has bounced back in style. The Google-parent recently rose to a record high and became a $3 trillion behemoth, joining ranks with Magnificent 7 peers Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA).

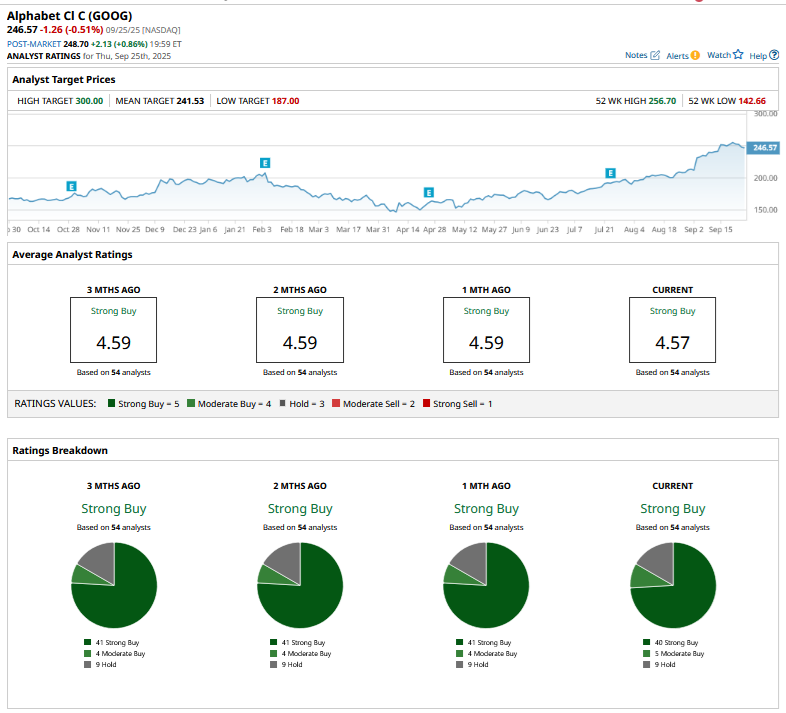

GOOG Stock Forecast

It’s been nothing short of a turnaround in sentiment for GOOG, and Wall Street is catching up with substantial target price hikes. Looking at some of the notable revisions this month, Baird raised GOOG’s target price from $215 to $275 while Truist increased its from $225 to $285. Citigroup and Tigress Financial raised their estimates to $280, while JMP Securities raised its target from $250 to $290.

The latest addition to the upgrade crew is Moffett Nathanson analyst Michael Nathanson, who not only raised his target price to $295, which is just shy of the Street-high estimate of $300, but also argued that Alphabet and not Nvidia should be the world’s most valuable company. While that might seem improbable in the short term, I won’t rule out the possibility, as no one really expected Nvidia to be in that position either.

Why Is GOOG Stock Going Up?

GOOG stock is up an impressive 42% over the last three months, and the rally has been aided by several factors. To begin with, it delivered what CEO Sundar Pichai rightly termed a “stand out” performance in Q2, in which the company defied all the noise over losing its dominance in search. Google’s Search revenues rose 11.7% in the quarter, and if anything, the growth rate accelerated from the previous quarter. Google’s cloud revenues rose 32% in the quarter as the company, along with Microsoft Azure, continued to gain market share at the cost of Amazon Web Services (AWS). While the market’s reaction to Alphabet’s Q2 earnings was quite somber, it laid the stage for re-rating, which we saw subsequently. Meanwhile, Alphabet continues to win mega cloud deals, and last month it scored a six-year deal worth $10 billion with Meta Platforms (META).

Earlier this month, Alphabet won a major reprieve in the Department of Justice antitrust case as District Judge Amit Mehta allowed it not only to retain Chrome and Android, but continue with its partnership with Apple that makes it the default choice on iPhones. It was the best-case scenario that the company could have reasonably hoped for, and the stock saw a sharp rally following the ruling.

Can Alphabet Stock Keep Going Up?

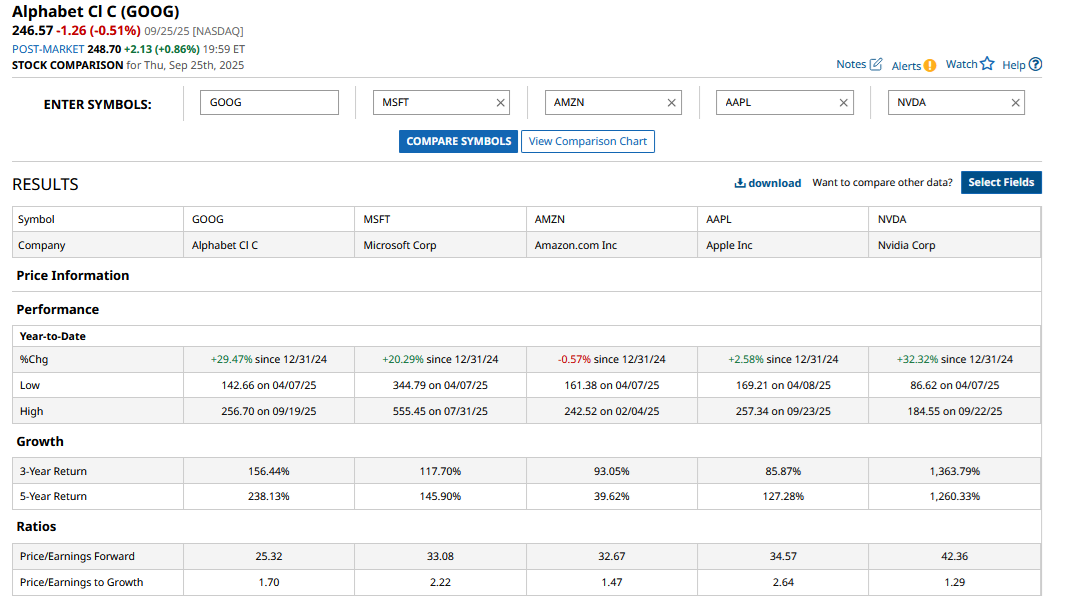

I have been bullish on GOOG stock for quite some time now, primarily due to its depressed valuations, as it was trading at a discount to the average S&P 500 Index ($SPX) constituent.

Alphabet has seen an expansion in valuation multiples amid the recent rally and trades at a forward price-earnings multiple of 24.9x, which, while being higher than the S&P 500 Index, is still the lowest among Magnificent 7 constituents. That said, the current multiples are the highest that they have been in three years.

However, I believe GOOG was always due for a re-rating, as the stock never really got “AI respect” like many of the other Big Tech companies. Alphabet’s recent financial performance has shown that it won't be easy for upstarts to challenge its lead in the search market, especially as the company has visibly raised its game in AI, something most Google users would agree with.

Also, I believe there are several underappreciated assets in Alphabet’s portfolio – YouTube, for instance. YouTube has been consistently the most watched streaming platform on U.S. TV screens, and the company still has a lot of legroom to monetize YouTube users, including by pushing paid subscriptions. Google’s Waymo self-driving unit is another long-term growth driver even as competition with Tesla’s (TSLA) robotaxi heats up.

Overall, even as I believe that the bulk of valuation re-rating in GOOG is now behind us, the stock is still reasonably priced and can rise further from these levels as it advances in AI and cloud while protecting its turf in the search and digital advertising business.