MUMBAI: Google Pay and PhonePe will have to pull back on customer incentives to bring their market share gradually toward the 30% cap imposed by the National Payments Corporation of India (NPCI), a report by Bernstein Research has said.

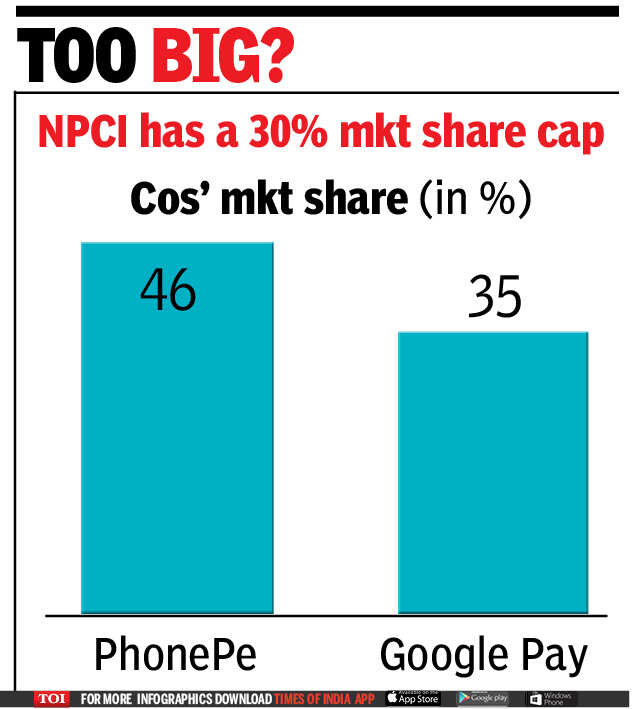

PhonePe currently has a market share of 46% of UPI transactions by volume, followed by Google Pay, which accounts for 35% of all UPI transactions. In March, NPCI came out with its framework for implementing the cap. The corporation had said that it was authorised to penalize third-party app providers if they violate the cap.

“Within the UPI super-apps, PhonePe leads the pack on overall UPI market share and has grown market share relative to Google Pay and Paytm. PhonePe and Google Pay continue investing in providing customer incentives and spend on marketing at 2.5-3.0x revenue,” said Gautam Chhugani of Bernstein in the report.

The report points out that UPI, which gained popularity with users sending money to each other, is now increasingly being used for merchant payments. In volume terms, more people use UPI than cards (both credit and debit) to make payments in stores. Overall, cards still do better because of online payments and standing instructions. With recurring mandates coming up for UPI, the online segment could also grow.

If the big two pull back on incentives, it is likely to result in the share of payment to merchants going up further. According to the report, Paytm has cut its marketing spending from 1.2 times of revenue in FY17 to 0.4 times in FY20. It now spends 0.2 times of its revenue on marketing.

Besides having a market share of only 14%, Paytm is not subject to the caps as it is a payments bank and not a third-party app provider. However, Paytm is not chasing peer-to-peer transactions and is focusing on building a full-stack payments suite beyond UPI — point-of-sale, online payments gateway — the report said. It is also building a financial services platform focusing on pay-later lending and wealth management and insurance.