/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

Technology titan Alphabet's (GOOG) (GOOGL) Google is one of the foremost players looking to gain supremacy in the hotly contested artificial intelligence (AI) race. To that end, the California-based search giant has made an investment that can see it owning more than 5% stake in a data center company. Industrial-scale data centers, in particular in the domain of AI, are crucial as they provide the massive compute power needed to train and run large AI models, with high-speed networking and storage to handle enormous datasets efficiently.

Thus, Google's investment in Cipher Mining (CIFR) can become a vital cog in the former's ambitions to become a winner in the AI race.

About Cipher Mining

Founded fairly recently in 2021, Cipher Mining is a company that develops and operates industrial-scale data centers with a focus on Bitcoin (BTCUSD) mining and, more recently, AI-centric high-performance computing (HPC) and hosting. Cipher Mining was formed via a business combination with Good Works Acquisition Corp. (GWAC), a SPAC, in 2021, in which the combined company took the name Cipher Mining Inc.

Currently valued at a market cap of $4.5 billion, the CIFR stock has been on a tear this year, rising by a mammoth 165% on a year-to-date (YTD) basis.

Notably, Google’s 5.4% proforma equity stake in Cipher Mining stems from a 10-year HPC hosting agreement between Cipher and AI cloud platform Fluidstack. Under this deal, Google will backstop $1.4 billion of Fluidstack’s lease obligations to support project-related debt financing. In return, Google will receive warrants to acquire about 24 million shares of Cipher common stock, representing roughly a 5.4% pro-forma ownership stake.

However, after a searing rally and a potential minority ownership stake by Google, should CIFR stock become a part of an investor's portfolio? Let's find out.

Modest Revenues, Unprofitable

Although Cipher now brands itself as a data center developer, its revenues in the current juncture are actually generated by Bitcoin mining. And there also, the performance is nothing to write home about.

Yet to be profitable, Cipher reported revenues of $43.6 million in Q2 2025, the most recent quarter for which results are available. Even though this represented an annual growth of 18.4%, losses widened to $0.12 per share from $0.05 per share in the year-ago period. This was also wider than the consensus estimate of a loss of $0.07 per share. In fact, over the past nine quarters, Cipher's bottom line has missed Street expectations on six occasions.

Worrying, net cash outflow from operating activities for the first six months ended June 30, 2025, doubled to $103.45 million from about $52 million in the previous year. However, the cash balance grew multiple-fold from $5.6 million at the start of the year to $62.7 million. This was much higher than its short-term debt levels of $7.45 million.

Bitcoin mining is a capital-intensive process, making profitability in the initial years a tall task. However, now that the company is shifting towards another new line of business altogether, the path to reach profitability may have become longer.

Can Cipher Effectively Juggle Two Balls?

Notwithstanding the strong shift towards building high-performance computing, Cipher Mining will not stop mining Bitcoin. Cipher has recently acquired a substantial 300 megawatt (MW) data center property at Barber Lake, Texas, which is strategically suitable for both Bitcoin mining activities and accommodating major HPC clientele. Furthermore, the company is actively engaged in the process of redeveloping and enlarging its current Bitcoin mining data centers, such as the facility in Colorado City, Texas, to better support AI services and demanding HPC tasks.

However, despite a significant, nearly twofold increase in its mining capacity during the second quarter of 2025 compared to the second quarter of 2024, the actual volume of raw BTC mined by Cipher in the most recent quarter remained virtually identical to the production levels achieved during the two months following the halving event in the second quarter of 2024. Specifically, the second quarter of 2025 saw the firm mine approximately 500 Bitcoins.

Meanwhile, a new data center construction project in Texas, named Black Pearl, is underway and is designed for the dual purpose of boosting Bitcoin mining capabilities while simultaneously strengthening Cipher’s HPC operations. The initial phase, which has commenced with 150 MW of power, is anticipated to increase the company’s hash rate significantly and is expected to become the primary source of revenue. By successfully expanding its capacity, Cipher is positioned to distribute its fixed expenses across a broader hash rate base. This structural improvement enhances the company's potential for profitability, even in a scenario where BTC prices remain stable.

Further, Cipher's existing expertise in the field of Bitcoin mining is expected to provide considerable advantages as it builds out its AI infrastructure. For example, the data centers were initially constructed to handle the high-energy demands of Bitcoin mining, making the same infrastructure readily suitable for running AI workloads. Moreover, the company’s proven track record in managing energy-intensive mining operations enables it to reliably provide guaranteed power efficiency, a crucial obstacle often faced by emerging AI startups and cloud platforms.

Overall, by leveraging its current infrastructure for a rapidly expanding, high-demand market, Cipher can grow its revenue streams without the need to construct entirely new facilities. Its sites are already located in areas, such as West Texas, where power is readily available and inexpensive, granting the company a distinct cost advantage over new market entrants.

However, the endeavor is not without inherent risks. Beyond the projects that have already been announced and capitalized, the company is unlikely to execute any further major expansions to its mining operations. Not only is initiating a new operation prohibitively expensive, but the ongoing maintenance costs for all existing and newly constructed mining centers will also be substantial.

Also, increased regulatory oversight or rising energy costs within Texas could negatively impact Cipher’s operational expenditures and its growth initiatives. The company's reliance on strategies involving power curtailment, while helpful for avoiding financial penalties, could also signal potential difficulties in consistently achieving production targets if grid stability or the cost of energy becomes less predictable.

Analyst Opinion

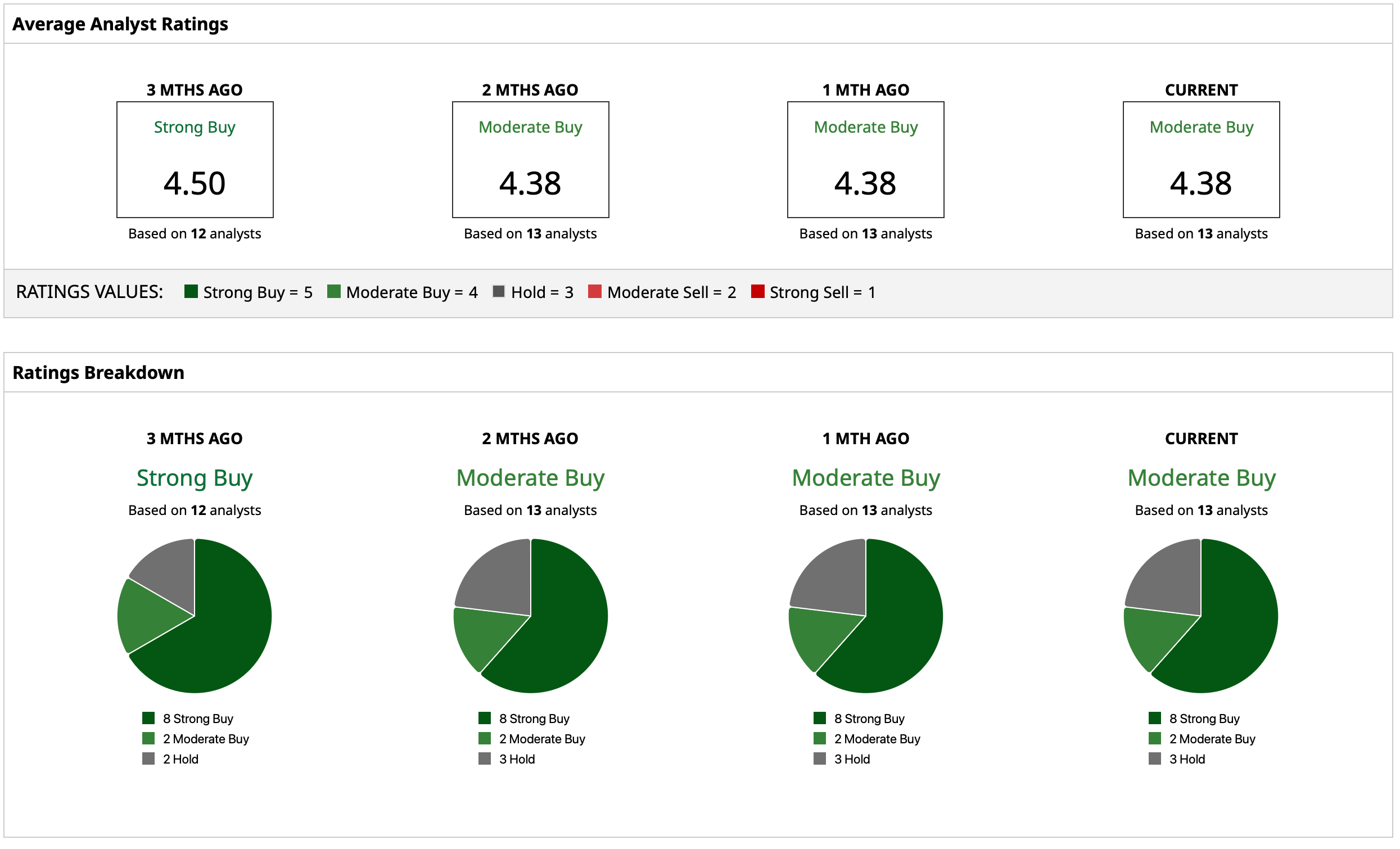

Overall, analysts are cautiously optimistic about the CIFR stock, attributing to it a rating of “Moderate Buy,” with a mean target price and high target price of $7.82. The high target price of $12 indicates limited upside potential from current levels. Out of 13 analysts covering the stock, eight have a “Strong Buy” rating, two have a “Moderate Buy” rating, and three have a “Hold” rating.