Healthcare may be evolving at lightning speed, but affordability remains the toughest pill to swallow. From breakthrough drugs to digital care, innovation keeps rewriting medical possibilities. Yet for millions, the true challenge isn’t access to technology but access to treatment. The real victory ultimately lies in making every dose within reach.

GoodRx (GDRX) has long been the quiet hero in the messy maze of U.S. prescription prices — a digital platform helping millions find cheaper meds through easy comparisons and coupons. Recently, though, this calm player has gotten swept into the political spotlight.

After reports surfaced that GoodRx might partner with President Donald Trump's administration on its new “TrumpRx” initiative — a government-backed website promising lower drug prices — GDRX stock jumped this month. The idea is that the direct-to-consumer (D2C) prescription drug portal, TrumpRx, could become a one-stop site connecting Americans directly to pharma discounts. Already a household name in that game, GoodRx mat just power part of it.

Will this partnership be the catalyst that redefines GoodRx’s role in digital healthcare? Let's take a closer look.

About GoodRx Stock

Founded in 2011 out of a mission to fix America’s sky-high prescription drug prices, GoodRx turned comparison shopping into a prescription revolution. The Santa Monica, California-based company built a digital bridge between patients and affordable medicine, arming users with price tools and discounts that cut through pharmacy markups. It also provides telehealth through GoodRx Care and healthcare solutions for pets.

Valued at a market capitalization of about $1.4 billion, GoodRx stands as the nation’s go-to platform for medication savings, serving nearly 30 million users and some 1 million healthcare professionals each year. Sitting at the crossroads of pharma, payers, and patients, it has quietly rewritten how Americans pay for care — saving over $85 billion while challenging the industry’s long-held opacity.

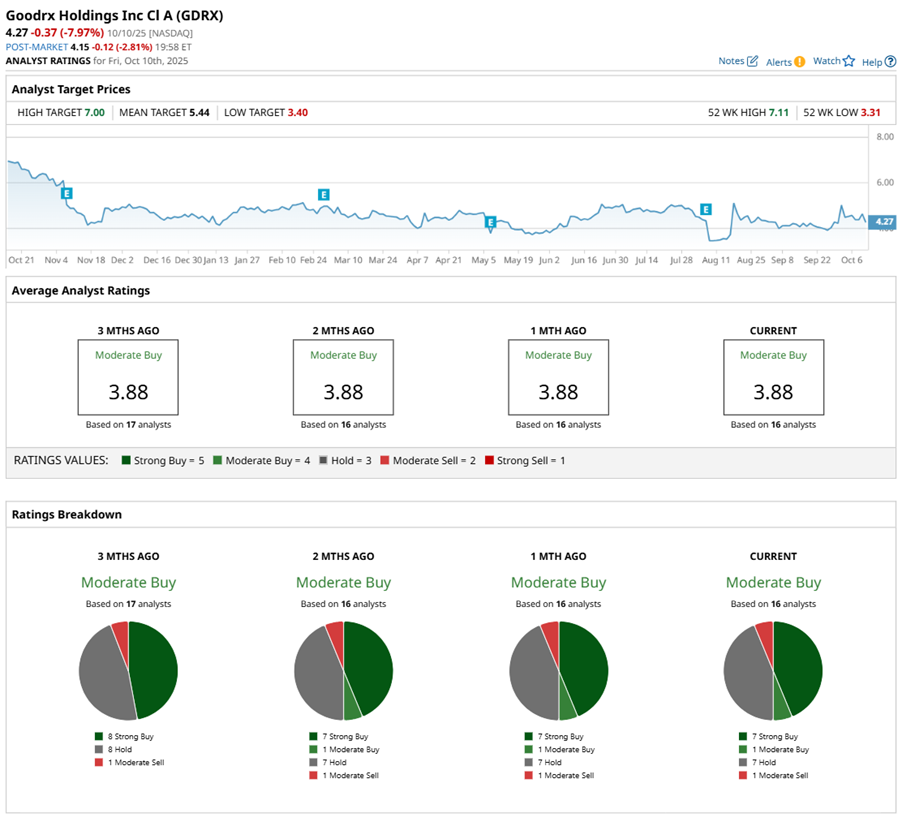

Shares of the pharmacies and prescription drug discounter have been on a bit of a rollercoaster. After touching a 52-week high of $7.11 last year, GDRX hasn’t quite revisited that peak. Still, the ride hasn’t been all downhill — GDRX stock has climbed 18% from its YTD low of $3.31, although it remains about 49% below its YTD high of $5.81. Over the past 52 weeks, the stock is down 41%.

In early October, GDRX stock climbed after the company expanded its partnership with Kroger (KR), rolling out its RxSmartSaver program across 2,200 pharmacies, boosting investor confidence in its growth potential. The move even included discounts on popular weight-loss drugs.

The real spark came on Oct. 9, when GDRX surged over 5% after news broke that the firm is in talks with the Trump administration to join the upcoming TrumpRx website. Trading volume exploded past 33 million, proving that investors are watching this story closely.

Shares are not just catching eyes for a comeback, but also looking like a bargain. Trading at 18.9 times forward earnings and 1.68 times sales, GDRX sits below both its sector averages and historical median, suggesting the market has not fully priced in its potential comeback story.

GoodRx’s Q2 Earnings Snapshot

When GoodRx unveiled its second-quarter earnings report on Aug. 6, it wasn’t one of flashy numbers, but it was a story of steady resilience in a fast-changing pharmacy world. Revenue inched up just 1% year-over-year (YOY) to $203.1 million — a modest rise that reflected both headwinds and hidden strength.

Prescription transactions, the company’s core business, slipped 3% annually to $143.1 million as fewer monthly active consumers logged on — a 14% drop blamed on widespread pharmacy closures and volume declines in an integrated savings program. Still, smarter contracts and a better sales mix helped cushion the fall.

Subscription revenue also dipped 7% to $20.5 million, as fewer users signed up for GoodRx’s paid plans. But in contrast, pharma manufacturer solutions revenue surged 32% to $35 million, a bright spot fueled by expanding partnerships with drugmakers and growth in direct pricing initiatives. That pivot shows GoodRx is steadily evolving beyond a simple coupon app into a broader healthcare tech partner.

Adjusted EPS came in at $0.09, up slightly from last year’s $0.08, while adjusted EBITDA rose to $69.4 million with a healthy 34.2% margin. Though both revenue and EPS of $0.04 missed Wall Street’s projections, cash flow told a stronger story — $49.6 million generated from operations in Q2 versus just $9.7 million in last year's quarter, a sign of tightening financial discipline and improved cash management. The balance sheet stood steady with $281.3 million in cash and $497.5 million in debt, underscoring the company’s measured approach to growth.

GoodRx’s capital playbook remains grounded — invest in profitable growth, trim debt, repurchase shares, and pursue M&A that fits its mission. Management emphasized a disciplined capital strategy designed to weather short-term bumps while positioning for long-term expansion.

Looking ahead, GoodRx expects full-year 2025 revenue to climb from 2024 levels, even as near-term results take a hit from the Rite Aid bankruptcy and weaker volumes in one of its savings programs, together trimming an estimated $35 million to $40 million off the top line. Despite this drag, management still projects adjusted EBITDA between $265 million and $275 million, signaling 2% to 6% growth annually.

Analysts tracking GoodRx project fiscal 2025 earnings to climb 54% YOY to $0.20 per share, then surge another 35% in 2026 to $0.27 per share.

GoodRx's Potential Involvement With TrumpRx

In the U.S., healthcare often feels like a luxury purchase, especially when it comes to prescription drugs. Nearly half of American adults say it is tough to afford their medical bills, and about one in five admit they have skipped filling a prescription simply because of the cost, according to July 2025 data. June's GoodRx Research echoes that pain — 67% of Americans call medication costs a burden, and a shocking 30% say they have cut back on groceries or clothing just to pay for their meds.

That’s the reality driving the rise of D2C pharma sales, as people hunt for ways to bypass the middlemen and get fairer prices. TrumpRx is the newest initiative from the Trump administration — a website set to launch next year that aims to connect consumers directly with pharmaceutical manufacturers’ discount programs.

CEO Wendy Barnes believes GoodRx can power and perhaps partner with the government site — a move that might not only expand access, but also reinforce the company’s role as the digital backbone of affordable healthcare.

So, for GoodRx, this could be more opportunity than competition. With millions of users and a trusted presence in the prescription savings space, GoodRx already serves as a go-to platform for price comparisons and pharmacy discounts nationwide. By joining forces with TrumpRx, it could amplify its reach, integrate its data-driven tools into a larger national framework, and potentially influence how Americans navigate drug costs.

What Do Analysts Expect for GoodRx Stock?

When the TrumpRx news sent GDRX stock climbing, Bank of America chose to stay cautious. The investment bank recently reaffirmed its “Underperform” rating and $3.40 price target, even as the stock crossed $4.

BofA sees the proposed TrumpRx program as a mixed bag — on one hand, GoodRx’s trusted brand could gain a powerful boost if the government taps its platform to deliver D2C drug discounts. On the other hand, Trump’s aggressive push toward “net pricing” could disrupt GoodRx’s traditional savings model, cutting into its core business. For now, analysts are keeping their stance steady, watching how these political developments unfold before deciding if GoodRx’s story is heading for revival or more turbulence ahead.

GDRX stock has a "Moderate Buy” rating overall that reflects solid confidence from the analyst community. Among the 16 analysts tracking the stock, seven issue a “Strong Buy,” one backs a “Moderate Buy,” seven advise a “Hold,” and the remaining one analyst gives a “Moderate Sell” rating.

The stock’s average analyst price target of $5.46 implies potential upside of 40% from here. Meanwhile, the Street-high target of $7 suggests that GDRX can still rally as much as 80% from current levels.