GoodRx Holdings Inc. (NASDAQ:GDRX) shares jumped 5.08% in after-hours trading on Monday, following the announcement of a collaboration with Novo Nordisk A/S (NYSE:NVO) to offer discounted GLP-1 medications at fixed pricing nationwide.

Check out the current price of GDRX stock here.

Partnership Details Drive Market Response

GoodRx announced that eligible self-paying patients can now access all strengths of Ozempic and Wegovy pens for $499 per month through its platform, effective immediately. The collaboration marks the first time Ozempic has been available at this self-pay price point.

See Also: Berkshire’s UnitedHealth Bet Highlights Long-Term Confidence Despite Depressed Earnings

The discount program operates across over 70,000 retail pharmacies nationwide, targeting patients without adequate insurance coverage for these high-demand diabetes and weight-loss medications.

Growing Market Demand Fuels Investor Interest

Market data reveals significant consumer demand for GLP-1 access. Nearly 17 million people visited California-based pharmacytech, seeking GLP-1 medication savings in the past year, representing a 22% increase from the previous period.

GoodRx research indicates 19 million Americans lack insurance coverage for GLP-1s prescribed for weight loss, creating a substantial addressable market for the partnership.

Competitive Landscape Developments

The announcement follows similar pricing strategies from competitors. Eli Lilly and Co. (NYSE:LLY) launched $499 monthly pricing for Zepbound’s highest doses through LillyDirect in July. Novo Nordisk previously introduced NovoCare Pharmacy in March, offering direct-to-patient Wegovy delivery at the same price point.

The FDA approved an additional Wegovy indication for liver condition treatment on Saturday, potentially expanding the addressable patient population further.

Technical Analysis and Market Position

According to Benzinga Pro data, GDRX closed regular trading at $5.12, up 37.27% for the session on Monday. The stock’s 52-week range spans $3.31-$8.80, with a current market capitalization of $1.78 billion and price-to-earnings ratio of 55.27. Average daily volume of the healthtech stands at 1.56 million shares.

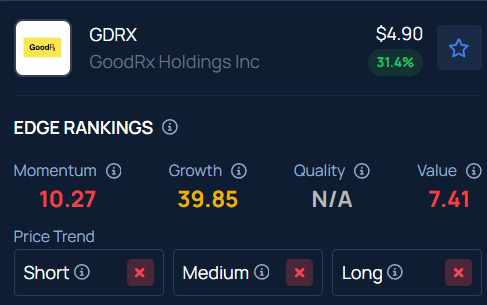

Benzinga’s Edge Stock Rankings indicate, GDRX stocks have negative trends across all time frames. Find out how rivals in the industry rank.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Shutterstock.com