The grip of the "Magnificent 7" tech giants on the market is loosening as small caps gain traction. On Aug. 13, the Russell 2000 (QRU25) jumped 2%, its strongest one-day move in three months, while the CNBC Magnificent 7 Index slipped 0.3% after touching a 52-week-high. In that same session, Chemours (CC) rallied more than 17.95%, Hillenbrand (HI) rose 12%, and Arrowhead (ARWR) climbed over 12%, gains that coincided with analysts issuing fresh buy ratings as momentum rotated into small caps.

Rising confidence that the Federal Reserve will begin cutting rates in September, with calls for reductions of 150 to 175 basis points, is fueling this shift. Cheaper capital tends to favor smaller companies that rely more on financing, making small caps natural beneficiaries of easing policy.

That macro tailwind, combined with improving stock-specific catalysts, is pulling investor focus away from the Magnificent 7 and toward more attractively small-cap names with clearer operating leverage to lower rates.

But here's the million-dollar question: Is this rotation from the Magnificent 7 to small-cap winners a temporary blip, or are we witnessing the dawn of a new market leadership cycle? Let's dive into these three stocks.

Chemours (CC)

Chemours is a specialist in advanced materials and chemistry for global industries. Its market capitalization is approximately $2.2 billion, and the company delivers a robust annual dividend yield of 5.71%, equating to $0.84 per share.

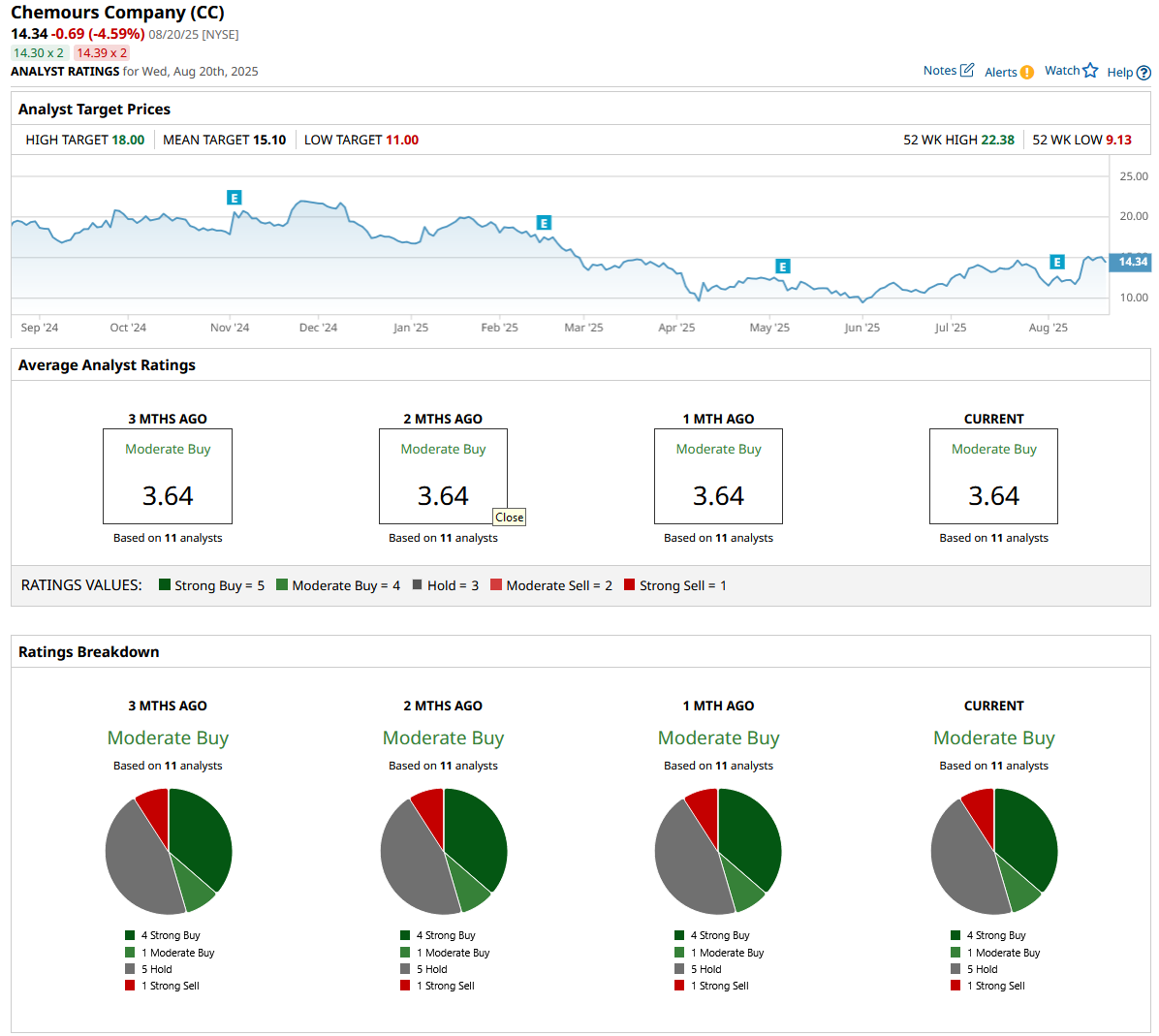

The stock trades at $14.34 as of Aug. 20, reflecting a year-to-date change of -14.82% and a 52-week move of -20.95%.

Its valuation sits at 10.18 times trailing earnings, well below the sector median of 16.84x, while annual sales reach $5.78 billion, suggesting a company with deeper value potential if its performance continues to improve.

On Aug. 5, Chemours announced second-quarter earnings with net sales up 4% year-over-year to $1.6 billion, driven largely by 65% growth in Opteon refrigerant sales within its TSS segment. Despite registering a net loss of $381 million, mainly due to noncash charges and a transitional tax impact, adjusted EBITDA increased to $253 million, and adjusted net income rose to $87 million ($0.58 per share), marking solid operational progress over last year. CEO Mark Vergnano characterized the quarter as one of “differentiated growth with improved capital discipline.”

Chemours also secured a major technology achievement as Samsung Electronics qualified its Opteon fluid for SSD cooling, cutting data center cooling energy use by 90% and ownership costs by 40% after rigorous OCP-driven testing, a first for Samsung and a major advancement for the data infrastructure industry.

Looking forward, earnings estimates project Q3 EPS at $0.37, down 7.50% from $0.40 and 2025 full-year at $1.37, up 13.22% from the prior year’s $1.21. Analysts remain fairly confident, with CC holding a consensus “Moderate Buy,” though the average price target of $15.10 is only 5% above current levels and almost half of the analysts are saying “Hold.”

Hillenbrand (HI)

Hillenbrand (HI) operates as a diversified industrial manufacturer and holds a market cap of around $1.86 billion. The company has continued to reward shareholders with an annual dividend of $0.90 per share, translating to a yield of 3.40%.

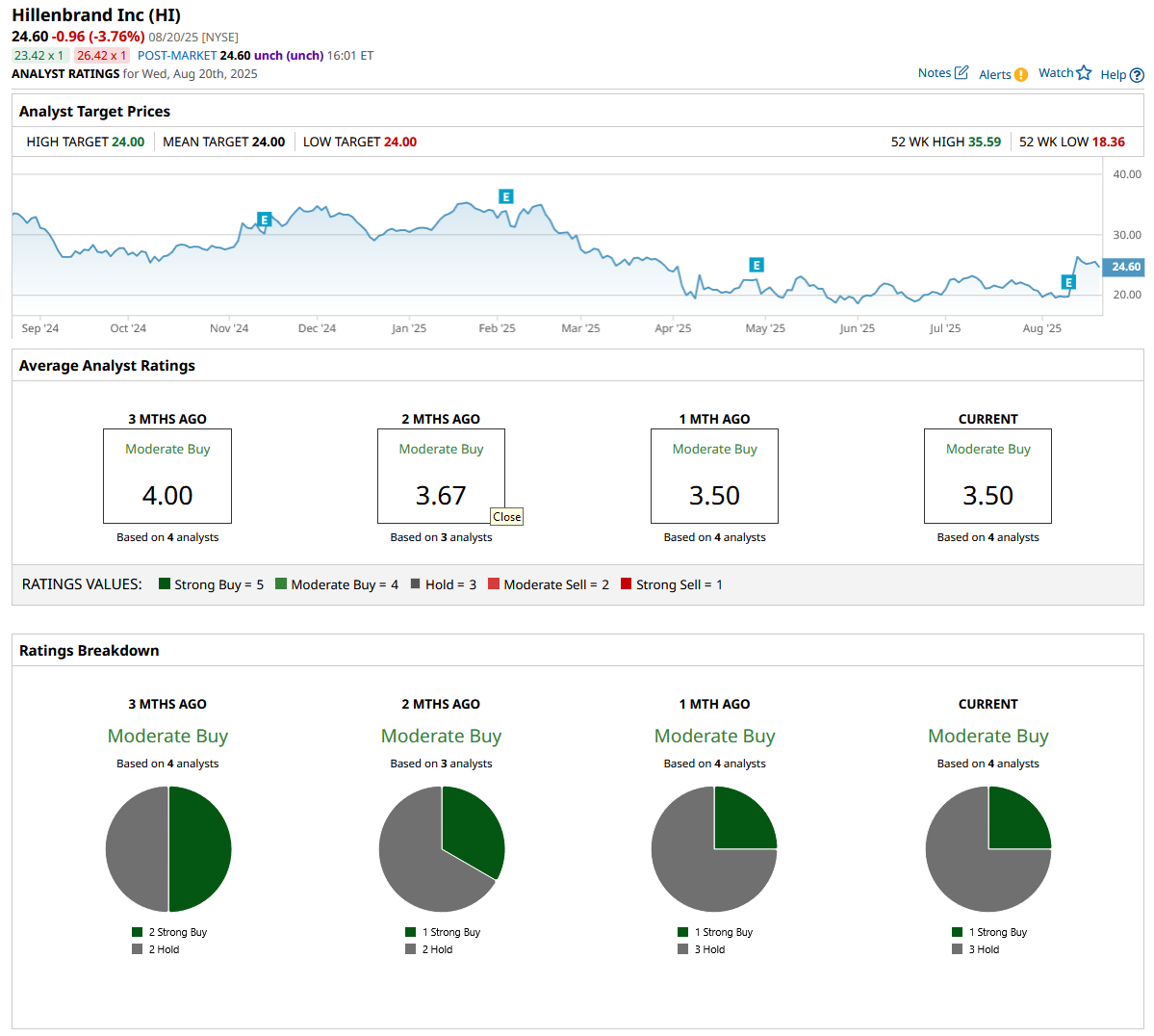

At $24.60 on August 20, HI’s shares reflect a difficult market stretch, showing a decline of 19.79% year-to-date and down 24.77% over the last 52 weeks.

These numbers land alongside a forward PE multiple of just 10.41x, which is less than half the sector median of 21.36x. The company’s $3.55 billion enterprise value adds weight to its ongoing operational reboot and streamlined capital deployment.

Earnings for the third quarter of fiscal 2025, reported on Aug. 11, illustrated just how much transition the business is undergoing. Net revenue came in at $599 million, down 24% from last year, primarily reflecting the sale of the MIME business and weaker capital equipment orders. Nevertheless, the company managed to swing back to a small GAAP profit of $2 million, or $0.03 per share, compared to a significant loss in the prior year.

On an adjusted basis, earnings per share stood at $0.51, although this was 40% lower than the previous period, with pro forma adjusted EBITDA also falling by 28%, largely due to lower volumes, a less favorable product mix, and persistent inflation, some of which was cushioned by productivity advances and solid pricing discipline.

Looking forward, consensus expectations for the September quarter and full fiscal year call for EPS of $0.49 and $2.25, representing declines of 51.49% and 32.23% versus last year, respectively.

In recent months, Hillenbrand has taken deliberate steps to reshape its portfolio and strengthen its financial footing. The July divestiture of its TerraSource stake, in partnership with Astec Industries (ASTE), delivered a $115 million cash inflow, part of a $245 million transaction, further supporting its strategy to concentrate on higher-return opportunities. Shortly after, Hillenbrand paid off its $375 million debt due September 2026 and extended its primary credit agreements, moves that enhanced liquidity.

Even in this environment, analyst sentiment remains constructive, with all three surveyed maintaining a “Moderate Buy” view. The consensus target of $24 per share reflects a projected downside of roughly 6.2%.

Arrowhead Pharmaceuticals (ARWR)

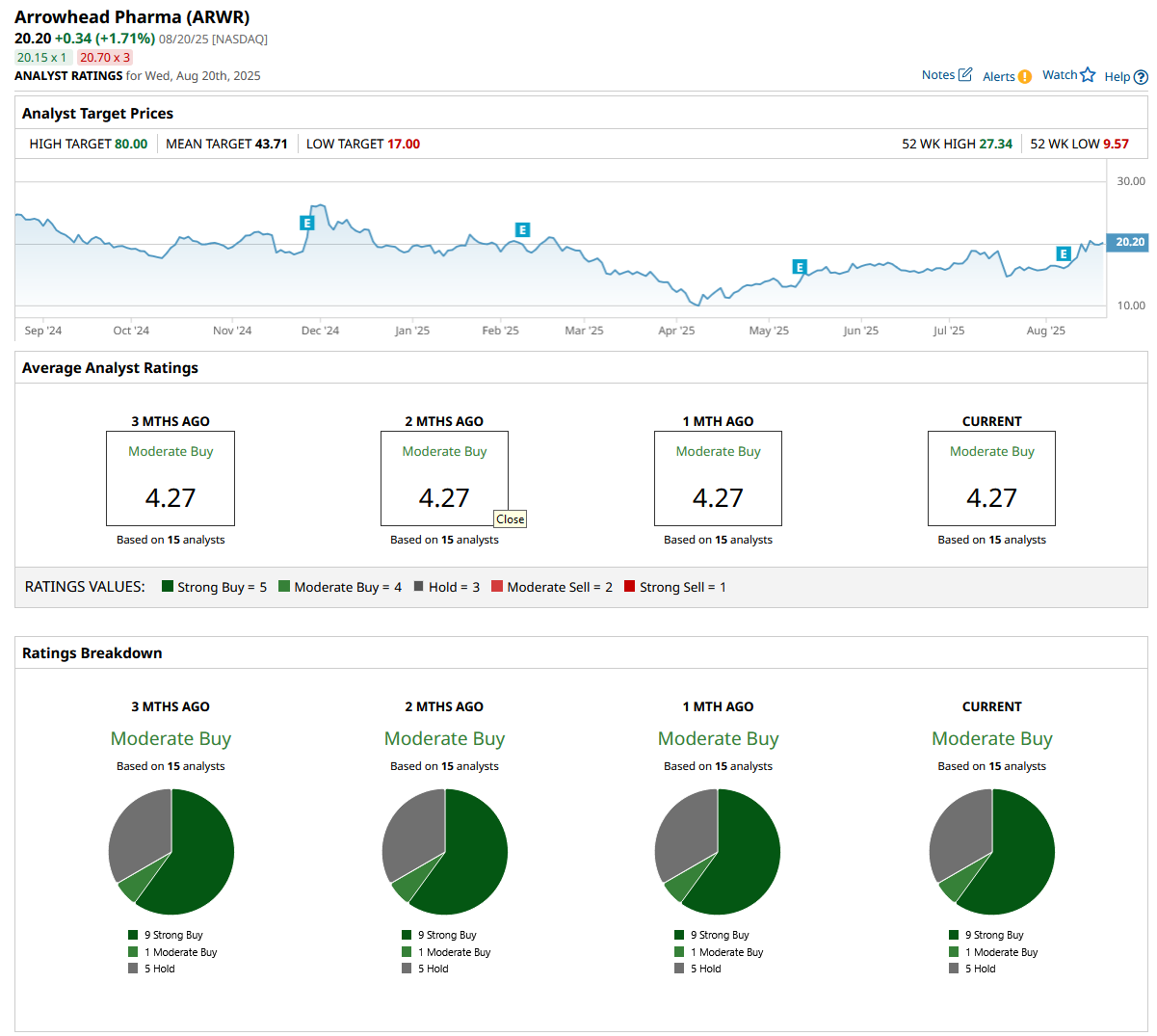

Arrowhead (ARWR) is a biotech innovator focused on developing RNA interference therapies for genetic diseases. Its shares are priced at $20.20 as of Aug. 20, reflecting a solid YTD gain of 7.45% and a 52-week move of -14.41%.

Arrowhead's market cap is about $2.76 billion, and shares trade around 4.73x book versus a sector median near 2.77x, reflecting a premium to peers for its platform and partnered pipeline.

This summer, Arrowhead reinforced its war chest and strategic flexibility with a string of deal-driven milestones. In July, the company unlocked a $100 million payment from Sarepta Therapeutics (SRPT), by progressing the ARO-DM1 clinical trial into its next phase, following a blockbuster global licensing agreement that included a $500 million upfront payment and a $325 million equity investment from Sarepta at a premium of $27.75 per share.

Such capital inflows not only extend Arrowhead’s R&D runway but also validate its platform with a partner renowned for neuromuscular disease expertise. On Aug. 13, Arrowhead bought back about $50 million of its own shares and is set to receive an equivalent amount as a milestone-related cash transfer from Sarepta, in a further effort to strengthen liquidity and limit dilution.

The Q3 earnings report, released Aug. 7, painted a picture of a company in heavy investment mode. Revenue hit $27.77 million, but EPS landed at -$1.26 with a net loss of $175.2 million, reflecting Arrowhead’s commitment to advancing its robust clinical pipeline despite coming in below consensus. However, milestone payments and licensing agreements help offset these upfront R&D expenses and maintain operational flexibility.

Looking ahead, the outlook is for substantial improvement, with street forecasts calling for EPS of -$0.12 for the current quarter and a positive $0.03 for the full fiscal year, representing significant growth compared to last year.

Analyst sentiment is firmly positive, with nine of the 15 rating the stock a “Strong Buy,” one giving it “Moderate Buy,” and the last five a “Hold.” The consensus price target stands at $43.71, a formidable implied upside of nearly 120% from current levels.

Conclusion

The shift away from the Magnificent 7 is real, and these small-cap names, CC, HI, and ARWR, are proving they deserve fresh attention. Each faces its own challenges, but their current momentum, smart strategic moves, and strong analyst backing suggest the tide could keep turning in their favor. Considering recent upgrades, renewed optimism, and partnerships, it seems far more likely these shares grind higher than slip back into the shadows. Small caps are finally having a moment, and this time, it just might last.