In a world where live experiences have gone digital, ticketing has quietly become one of the most valuable frontiers of entertainment. Buying a seat to your favorite concert or game is not just a transaction anymore, but an extension of lifestyle and fandom.

The online event ticketing market, worth $85.4 billion in 2025, is marching toward $102.8 billion by 2030 — expanding at a 3.8% compound annual growth rate (CAGR) and powered by mobile-first shopping, premium add-ons, and AI-driven pricing. Yet even as regulators tighten the screws on transparency and fees, the demand for seamless access to live moments keeps soaring.

Amid this evolution stands New York-based StubHub Holdings (STUB). Once known purely for reselling tickets, the company is now ready to take center stage. Its next act is bold –— shifting into direct ticket issuance, a $153 billion opportunity that could redefine how fans secure their first access to major events. The company’s initial public offering (IPO) on Sept. 17 drew feverish demand, with the offering oversubscribed multiple times.

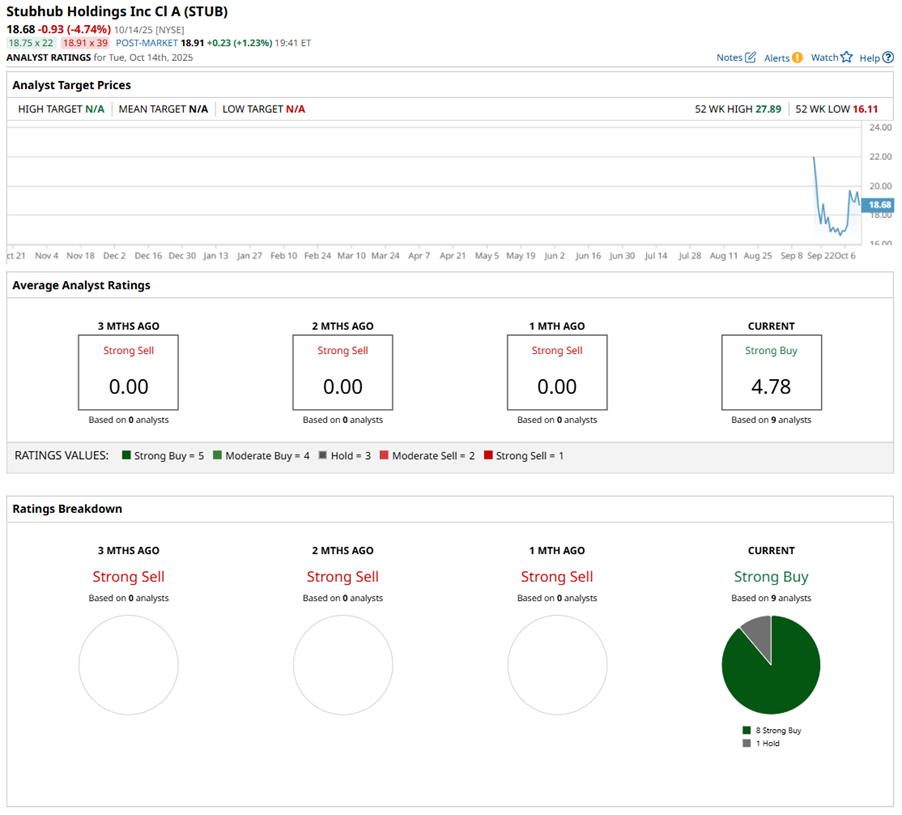

Despite a choppy debut, Wall Street did not stay on the sidelines for long, with several analysts initiating coverage on STUB stock. But it was Goldman Sachs’ confident “Buy” rating and Street-high target of $46 that stole the spotlight. The target points to potential upside of more than 100% — an ambitious bet that StubHub’s next act might just steal the show.

Let's pull back the curtain and see what’s really unfolding with StubHub.

About StubHub Stock

Co-founded in 2000 by CEO Eric Baker, StubHub has evolved into a global ticketing powerhouse. After eBay (EBAY) bought StubHub for $310 million in 2007 and later sold it to Viagogo for about $4 billion in 2020, the two merged into StubHub Holdings, reuniting Baker with his original creation. Today, StubHub Holdings is a global hub for live experiences, connecting fans to sports, concerts, theater, and events under the StubHub and Viagogo brands. As the world’s leading second-hand ticket marketplace, it operates across more than 200 countries and territories, supporting 33 languages and 48 currencies — a true cross-border ecosystem for live entertainment.

Now, the company is venturing beyond resales into direct ticket issuance, a bold expansion launched last month to sell new tickets for major events. Backed by AI-driven insights and seamless end-to-end event management, StubHub is positioning itself to reshape how fans around the world discover and buy tickets.

Since its Sept. 17 IPO, STUB stock has had a bumpy ride, opening the door to public markets with a splash but closing its first day down by 6.8%. The ticketing platform raised roughly $800 million, yet early trading painted a choppier picture than fans snapping up concert or game tickets.

The stumble continued, with shares down about 20% from their IPO level over the following weeks. STUB stock hit a low of $16.11 earlier this month, on Oct. 3. However, the last five days have shown a glimmer of recovery, climbing roughly 21% as investors digest StubHub's growth story and its push into direct ticket issuance.

Thanks to a wave of recent analyst optimism, STUB has seen a modest lift. With bullish ratings coming in, investors are starting to price in the company’s long-term potential. Its global expansion, AI-driven insights, and push into direct ticket sales are shaping the narrative, suggesting that while short-term volatility remains, StubHub could still emerge as a stock worth keeping an eye on.

StubHub’s Latest Q2 Earnings Report

StubHub’s first-half 2025 report, released ahead of its IPO, tells a story of growth intertwined with mounting pains. On the surface, the company’s revenue momentum looks promising. Gross merchandise sales — the total value of tickets sold — rose to $4.38 billion in H1 2025, up from $3.94 billion last year. Meanwhile, total revenue for the first half of the year climbed 3% year-over-year (YOY) to $827.9 million.

But beneath the top-line gains in the first half of the year, profitability remains a challenge, with net losses widening sharply as the company invests in scaling operations and expanding its footprint. For H1, total costs rose 3.5% YOY to $776 million, with StubHub posting a net loss of $111.8 million, or $1.84 per share, more than doubling last year’s loss of $50.2 million or $0.82 per share.

In Q2 alone, StubHub posted a net loss of $75.9 million, more than triple the $20.5 million loss a year earlier. Loss per share widened 267% annually to $1.25, reflecting higher operational costs, which increased 4.1% YOY to $405.2 million for the quarter. Revenue dipped slightly in Q2, sliding 3% YOY to $430.3 million, signaling a short-term headwind amid rising expenses.

Cash flow tells a mixed story. Net cash from operating activities fell 55% YOY to $177.6 million, yet total cash, cash equivalents, and restricted cash ended June 30, 2025, at $1.26 billion. Long-term debt ticked slightly higher to $2.36 billion.

In short, StubHub is still navigating the balance between growth and profitability, with losses reflecting early investments in expansion and direct ticket sales. While the numbers show short-term pressure, the company is laying the groundwork for long-term scale, making its next chapters — and STUB stock — a story worth watching.

What Do Analysts Expect for StubHub Stock?

When the IPO quiet period ended, STUB stock suddenly came alive, surging higher as a chorus of bullish voices echoed across Wall Street. Analysts seemed to agree on one thing — the ticketing giant’s story might just be getting started.

Goldman Sachs initiated coverage with a “Buy” rating and a $46 price target, implying STUB could more than double. Analyst Eric Sheridan described StubHub as “positively levered” to the long-term trend of consumers spending more on experiences than on things. The analyst believes StubHub’s global dominance in secondary ticketing gives it a springboard to expand into the direct issuance market, while also boosting ad revenues and global market share.

Bank of America analyst Justin Post gave a “Buy” rating and a $25 target, pointing to StubHub’s near-50% U.S. resale market share and rising opportunities in primary ticket sales. Evercore ISI analyst Mark Mahaney struck a similar tone, highlighting StubHub’s revenue growth, gross margins, and asset-light business model. Mahaney initiated coverage on STUB with an “Outperform" rating and a $29 target.

Wedbush’s Scott Devitt was equally optimistic, rating STUB as “Outperform” with a price target of $25. He projected a multi-year growth runway powered by StubHub’s expansion into direct issuance, pegging the opportunity at a staggering $127 billion. He anticipates that the segment could be the company’s next big growth engine, driving momentum well beyond its core resale business.

Still, Devitt cautioned that “execution risk” looms large. StubHub’s move into direct ticketing means stepping onto the same turf as Ticketmaster’s parent, Live Nation (LYV), where competition is fierce and relationships with event organizers are key.

The real test will be whether StubHub can scale its new model while securing greater inventory from leagues, venues, and promoters. Yet, if it sticks the landing, StubHub could reshape how fans access live entertainment. That’s a story that Wall Street seems eager to bet on.

Overall, STUB stock has a consensus “Strong Buy” rating out of 12 analysts covering the stock. Out of that group, a majority of 10 analysts have a “Strong Buy” rating while two have a “Hold" rating.

The consensus price target of $27.80 suggests 34% potential upside from current levels. Meanwhile, the Street-high target of $46 suggests STUB stock can rally as much as 122% from here. It’s early days, but that kind of upside shows why investors and analysts are keeping a close eye on StubHub as it begins to stake its claim in the direct ticketing market.

Final Note on STUB Stock

StubHub’s entry into the public markets has been a bit of a mixed bag. The IPO grabbed headlines, but the stock has struggled to find consistent momentum, reflecting early investor caution and the fact that this story is still unfolding. Analysts remain upbeat, pointing to StubHub’s global reach and growth potential, yet the market is clearly taking a measured view.

At the center of the buzz is direct ticket issuance, a space larger than StubHub's traditional resale business and more insulated from regulatory and competitive pressures. StubHub is only scratching the surface here, and execution will be critical as it expands relationships with leagues, venues, and promoters.

Not everyone is convinced. For instance, ‘Mad Money’ host Jim Cramer called the IPO a “flop,” noting delayed timing, lackluster early results, and regulatory hurdles. Still, if StubHub can navigate the challenges and scale its direct sales, it has a shot at turning potential into performance — and possibly reaching Goldman Sachs’ $46 target.