Goldman Sachs just upgraded Estée Lauder (EL) to “Buy” from “Neutral,” raising its price target to $115 from $76. Analyst Bonnie Herzog believes the cosmetics giant has reached a "fundamental inflection point" after years of struggling with pandemic-related travel retail declines and nimble competitors.

The company's "Beauty Reimagined" strategy is gaining traction. Management launched brands on Amazon (AMZN) across 11 divisions and TikTok, adopting a consumer-first approach to drive faster innovation. These moves are already paying off as Estée Lauder regains U.S. market share.

China presents the biggest catalyst as sales returned to mid-single-digit growth in the second half of fiscal 2025 after prolonged weakness. Travel retail is also rebounding, with Hainan returning to growth and inventory levels improving. Travel retail once accounted for nearly a third of sales but dwindled to just 15% in fiscal 2025.

Goldman forecasts 500 basis points of EBIT margin expansion by fiscal 2028, driven by cost efficiencies and productivity gains. The bank expects double-digit EBIT margins by fiscal 2027 and believes topline growth could return as soon as the first quarter.

EL stock has already rallied over 80% over the past six months as sentiment improves. Recent upgrades from HSBC, Deutsche Bank, and BofA Securities confirm growing Wall Street confidence that the worst is behind Estée Lauder.

Is Estee Lauder Stock a Good Buy Right Now?

Estée Lauder is emerging from three consecutive years of sales declines with a turnaround strategy that seems to be working. The cosmetics giant guided fiscal 2026 revenue growth of flat to 3%, marking an inflection point after an 8% decline in fiscal 2025 (ended in June). More importantly, it expects operating margin expansion of 165 basis points despite absorbing over $100 million in tariff headwinds.

CEO Stéphane de la Faverie's "Beauty Reimagined" strategy centers on five pillars, with consumer coverage and innovation showing the fastest progress. The company now operates 11 brand stores on Amazon's U.S. Premium Beauty platform, with expansion into Canada, Mexico, and the U.K. This aggressive digital push helped Estée Lauder gain prestige beauty market share in the U.S. for the first time in years during the second half of fiscal 2025.

After prolonged weakness in China, the region posted mid-single-digit retail sales growth in both the third and fourth quarters, with all 10 major brands growing and market share gains across every category and channel. Management expects mid-single-digit growth in China for fiscal 2026, a notable improvement that provides confidence in the turnaround trajectory.

Estee Lauder slashed travel retail exposure from 19% of sales at its fiscal 2021 peak to just 15% today, bringing it more in line with industry norms and reducing volatility. While conversion remains weak, healthier inventory positions the business for modest growth this year. Innovation is accelerating, and Estée Lauder is committed to having 25% of sales come from new products in fiscal 2026, up from historically low levels.

The company is tripling the percentage of innovation launched in under a year from 10% to 30%, enabled by AI that reduced critical packaging failures by 94% and compressed stability testing from six months to 72 hours.

Gross margin expanded 230 basis points in fiscal 2025 despite massive volume deleverage, demonstrating the power of the profit recovery and growth plan. The company exceeded its PRGP savings targets and expects continued benefits, though a significant portion is being reinvested in consumer-facing activities rather than being directly applied to the bottom line.

Is EL Stock Undervalued?

Estee Lauder reported an adjusted earnings per share of $1.52 in fiscal 2025, down from $2.59 in fiscal 2024. Wall Street estimates earnings to expand to $4.82 per share in fiscal 2030.

Today, EL stock trades at a forward price-to-earnings (P/E) multiple of 45x, which is higher than the 10-year average of 35x. If EL stock is priced at 30x earnings, it should trade around $145 in four years, indicating an upside potential of 50% from current levels.

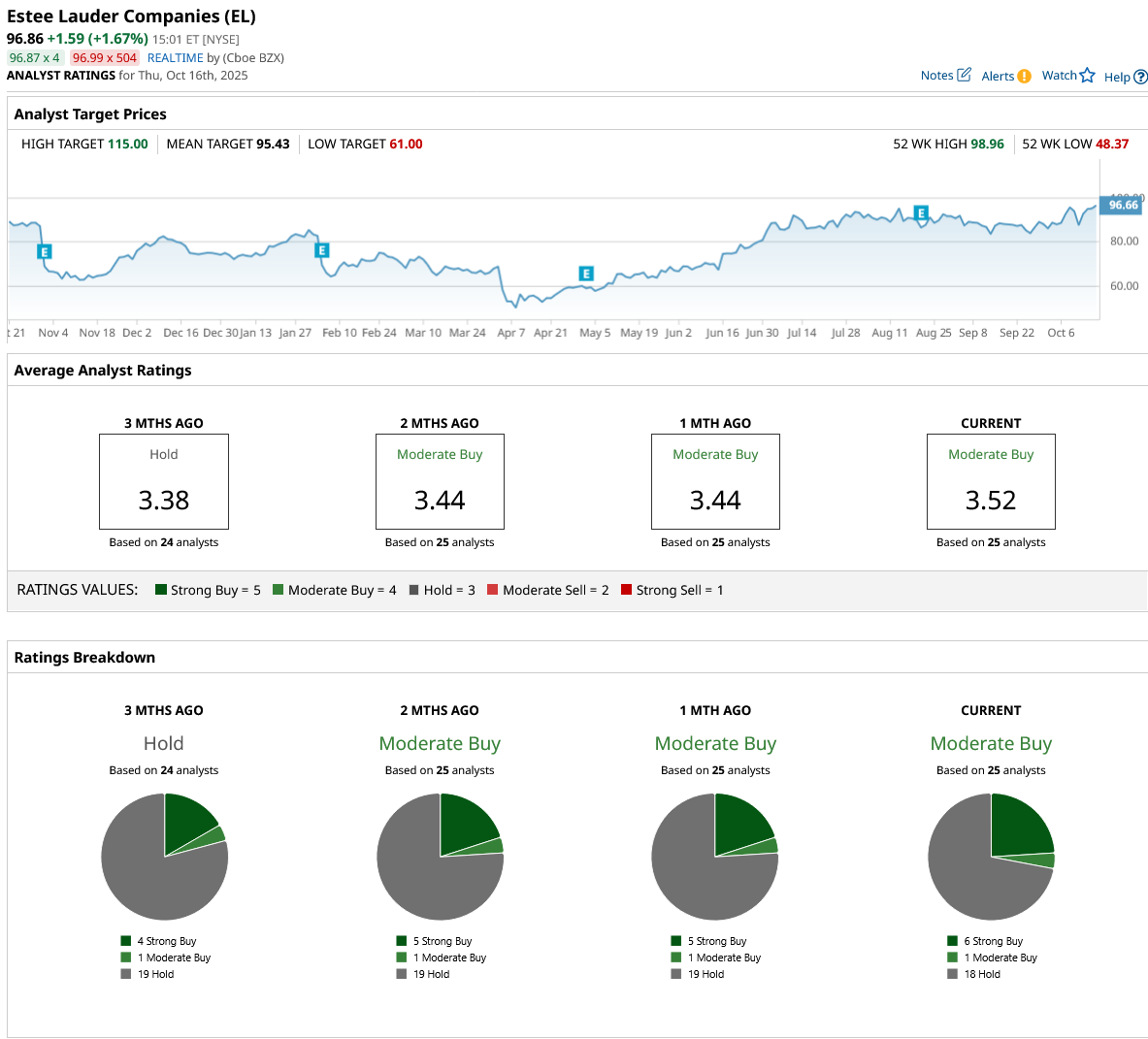

Out of the 25 analysts covering EL stock, six recommend “Strong Buy,” one recommends “Moderate Buy,” and 18 recommend “Hold.” The average Estee Lauder stock price target is $95.43, which is similar to the current trading price.