A few facts about where we stand for the remainder of the year. There are:

- 68 trading days left in 2022

- 5 trading days left until Q4

- 3 CPI reports (10/13, 11/10, 12/10)

- 2 FOMC meetings (11/02, 12/14)

- Between 100 and 125 basis points of rate hikes to come before the end of the year

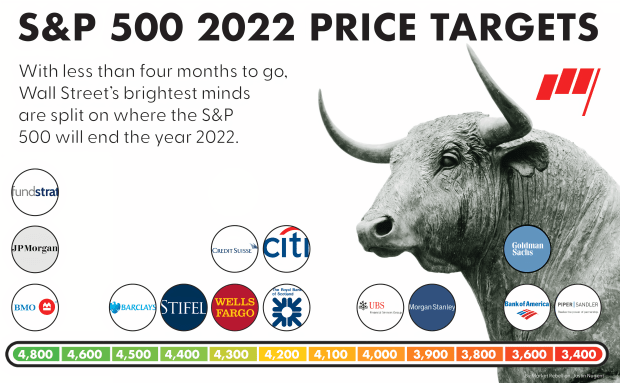

- Several of Wall Street’s top firms, like JPMorgan, Fundstrat, BMO, and more still see a powerful rally in store for the S&P 500 before the end of the year. Goldman Sachs is no longer one of those firms.

- For the S&P 500 to return to reach JPMorgan’s year-end 4,800 price target, it would require a rally of more than 30%.

Goldman Sachs Cuts S&P 500 Price Target For the Fourth Time

It isn’t Goldman Sachs' first time lowering their S&P 500 price target in 2022. Or their second time. Or their third time. It’s their fourth time. Goldman initially saw the S&P 500 finishing the year at 5,100. Then, following a vicious January selloff that doubled the VIX over the course of a few days, Goldman cut their S&P price target to 4,900. That was back when a 50 basis point rate hike was considered “shock and awe”.

Two weeks later, the news broke: Russia had invaded Ukraine. This tragic development led to energy prices (which were already soaring) breaking out to new highs as a wave of sanctions bit the global economy. But it wasn't just the price of oil that felt the heat. Many commodities, like fertilizer, corn, and wheat experienced highly volatile price action. The economic pressure forced Goldman's hand — they issued another cut to their S&P 500 price target just weeks later, this time to 4,700. They cited a heightened risk of recession as part of their reasoning. It was in this March note where the impetus for their current price target began to form:

That potential for a downside of up to 3,600 was reiterated in Goldman's third price target cut from May. The May note added a stark prediction: a 35% chance of a recession within the next two years. Goldman was able to hang onto that 4,300 price target for longer than any of their previous ones, and in August, it almost looked like it would come true. The S&P 500 rallied more than 18% off the June lows of 3,636, briefly bumping up against Goldman’s 4,300 target before rejecting at the 200-day moving average.

From there, a combination of bearish events like Powell’s hawkish Jackson Hole speech and a hotter-than-expected August CPI report drove the S&P 500 right back to the June lows, where it sits currently. This was enough for Goldman Sachs, who finally capitulated Thursday night, turning their bear case into their base case. Analysts at Goldman Sachs now believe that the “3,600 downside potential” that they initially wrote about in March is coming fast.

Discover how we trade the technicals with Rebel Weekly. Led by a Chartered Market Technician and former floor trader, Rebel Weekly leverages short-term options with technical breakouts. Learn more about our strategy in the FREE video above.

Why Analysts At Goldman Sachs Think the S&P 500 is Heading to 3,600

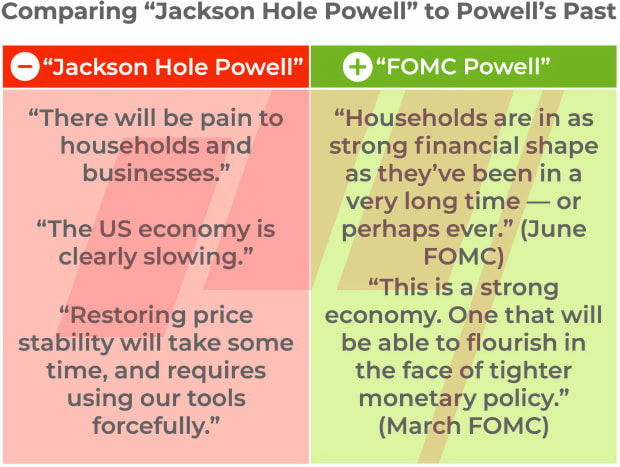

At Jackson Hole, Fed Chair Jerome Powell shocked the market when he repeatedly referenced Paul Volcker's successful fight against inflation. This marked the beginning of a "different Powell" than we had seen before.

On Wednesday, at September's FOMC meeting, Powell reiterated that his message from Jackson Hole had not changed. He was still going to "keep at it" — another subtle homage to Paul Volcker, whose book was titled "Keeping at it".

Powell's renewed resolve to stay hawkish on inflation played into the calculus for Goldman's newest price target. In their latest note, analysts at Goldman Sachs wrote that the path of interest rates by the central bank is now significantly higher than their previous estimate. Goldman analyst David Kostin added to the note:

In a hard landing, the question is no longer "Will we have a recession?", it's "How bad will the recession be?"

S&P 500 Price Targets Elsewhere On the Street

Goldman Sachs isn't alone in having cut their S&P 500 price target in the third quarter. Back in July, Bank of America became the first of Wall Street's major institutions to call for a 3,600 end-of-year price target. At the time, it was called the "lowest on the Street". That title was short-lived. The following day, Michael Kantrowitz at Piper Sandler gave an even lower S&P 500 year-end price target — 3,400. In September, UBS followed the trend — lowering their target from 4,150 to 4,000.

But not everyone is throwing in the towel. Tom Lee, famous market analyst who accurately predicted the "everything rally" of 2021, recently defended his bullish case on September 22nd — the day after the September FOMC report. While Lee conceded that the market had been through a tough few weeks following Jackson Hole, he's looking to the October CPI report for signs of cooling inflation as a potential bullish catalyst for the market. Additionally, Lee believes that the Q4 earnings season could bring with it some positive earnings surprises.

The Fundstrat Co-Founder went on to say,

"Tech companies got really cautious early this year because of signaling about monetary tightening and the risks of inflation. So companies aren't necessarily tripping over their skis right now. More importantly, when tech companies are looking at their OpEx, they've got a lot of room to cut costs. So I think we may be surprised by the profit margin expansion of tech companies, even in a tougher revenue environment."

Tom Lee may be one of the most famous market bulls, but he isn't alone in his bullish thesis. Brian Belski of BMO and Marko Kolanovic of JPMorgan have recently shared similar cases. In addition, all three agree that the out-of-balance bearish positioning that the market is currently experiencing could be a tailwind for stocks given any positive surprise.

But with only 65 trading days left and a lot of ground to cover, there's little room for error in the bull case. In order to have a shot at ending the year in the green, it'll take a perfect combination of improving inflation data, "goldilocks" unemployment data, positive earnings surprises, and a Fed that can read the events with a positive lens. If those catalysts can't come together, 2022 may end up as a lost year for the stock market.