The trade: Buy put options on Intel ahead of earnings.

Goldman Sachs often issues “tactical trade ideas” to their clients — the most recent of which is this bearish trade in Intel (INTC), issued on Thursday. The trade was discussed on the day’s edition of CNBC’s Halftime Report, with each of the pundits having differing views on the trade.

Gilman Capital’s Jenny Harrington called the trade into question, stating that it was

“...getting bearish at the wrong time [...] here’s the thing. Intel’s already down 36% year-to-date, which I might say is 20% better than Nvidia. It’s trading at 10.5x. To me, it’s way too risky to put a short position on something that’s already down that much. I think the bad news is already baked-in to Intel. [...] That’s part of the reason I own it — it’s just cheap. It’s just producing cash. [...] It’s the 8th largest contributor to S&P 500 earnings.”

Shorthill Capital’s Steve Weiss took the opposing position, disagreeing with Jenny, and siding with Goldman’s bearish trade.

“Companies stockpiled semis. Everybody thought they’d never get them again, so they bought as many as they could from as many places as they could. So now they have that excess inventory. [...] I no longer own any chip names. Haven’t for a long time.”

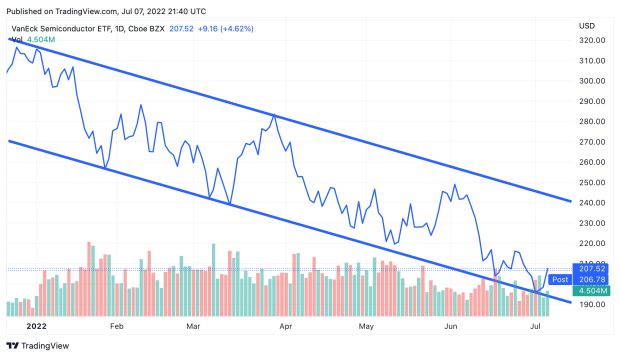

Ritholtz Capital’s Josh Brown agreed with Steve, and added one more piece of bearish evidence: the bearish downtrend in the entire semiconductor sector.

With these different opinions in mind, let’s dig deeper into Goldman Sachs’ Intel trade.

Breaking Down the Trade: Intel Puts

At market close on Thursday (the day of Goldman’s note), Intel was trading at $38.15. A slightly out-of-the-money $37.50 strike put option in Intel expiring at the following monthly expiration date (August 19th) costs $1.84, indicating an implied move of -6.36% by August 19th, and carrying a breakeven of <$35.66. That’s just $0.12 above Intel’s 52-week low (which it hit just two days ago, on July 5th). Other than July 5th, the last time that Intel traded below $35.66 was all the way back on September 18th, 2017.

Notably, that -6.36% move in Intel implies a smaller earnings move than last quarter (which Goldman also bought puts ahead of), where Intel closed -6.93% lower on the day of its earnings release.

Comparing Intel’s IV Rank to its Competitors

Companies within the same industry often report earnings on dates that are close to one another. In this case, two of Intel’s competitors (Advanced Micro Devices (AMD) and Qualcomm (QCOM) report earnings within two days of Intel — AMD reports on July 26th, QCOM reports on July 27th, and Intel reports on July 28th. This means that their IV Rank (the measure of a stock’s implied volatility against itself over the past year) should theoretically be similar. However, a look at the numbers shows that this is not exactly the case.

INTC IV Rank: 94%

QCOM IV Rank: 86%

AMD IV Rank: 79%

These are all rather elevated. However, Intel’s is higher than AMD’s and QCOM’s, indicating higher implied volatility relative to itself on a historic basis.

Why does it matter?

What Happens When You Hold Options Through Earnings

Goldman Sachs is no lightweight when it comes to the stock market. They know exactly what they’re doing by making this trade.

But for those who are new to trading earnings with options, know this:

Holding long options through earnings day is a high-risk, high-reward maneuver. Earnings often come with above-average price movement and above-average volatility to match. When you enter a long option trade like a call or a put with the intention of holding through earnings, you’re saying, “Not only do I think this stock is going to move in my favor — I think this stock is going to move so far in my favor that it will outrun the two factors working against earnings-minded option traders: theta decay and IV crush.”

Ready to start trading? Try Unusual Option Activity Essential. Learn how you can follow the "smart money" with a fresh UOA trade idea each week - including technical levels so that you know where to enter and exit!

What is Theta Decay?

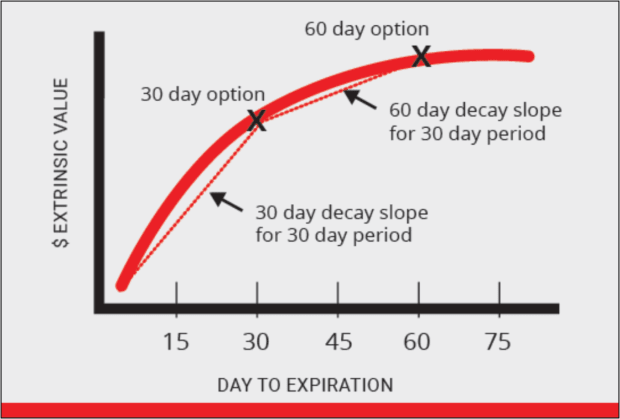

Theta decay is the constant draining effect of time on a long option. Simply put, the less time an option has to expiration (and the further out-of-the-money it is), the faster the rate of decay will be in that option. Theta decay usually begins picking up speed at 30 days to expiration and then once more at 14 days to expiration. The curve of that decay is depicted below:

What is IV Crush?

IV Crush refers to the effect that implied volatility has on an option. Ahead of an earnings event (or other major catalysts) implied volatility will likely be higher than usual as the options market begins to ‘price-in’ the possibility of larger-than-usual price movement in the underlying stock.

You can calculate the implied move of an option by adding or subtracting the premium from the strike price. For instance, a $100 stock with at-the-money ($100 strike) call options that cost $10.00 has an implied move of 10%, with a breakeven price of $110. If this were a $10.00 put option, the breakeven would be $90.00.

Note: calculating the implied move of an option is different from calculating the implied move of a stock. To calculate the implied move of a stock, simply add the premium of the call and put together ($20 in the case of the example above).

If the implied move of an option ahead of earnings is 10%, and the stock only moves in your favor by 1%, your option may end up trading lower the next day even though you were directionally right. The closer to expiration your option is, the higher the risk of IV crush.

Understanding IV crush and theta decay are crucial to trading options on earnings.

How Goldman’s Previous Earnings Put Trade in Intel Performed

Now that you understand the potential pitfalls of holding an option through earnings, let’s talk about Goldman’s previous Intel trade: a similar bearish trade in Intel ahead of their April 28th earnings.

Goldman issued the note with Intel trading at $47.01, with the trade idea being a slightly-out-of-the-money $45 strike put expiring at the following monthly expiration in May. The implied move of that option was 7%, meaning that the breakeven on this trade was roughly <$43.71 by the May expiration date. When earnings came around (April 28th), the stock closed roughly 7% lower (Intel closed at $43.59 that day) — satisfying the option’s expected move with more than 2 weeks remaining until expiration.

Long story short: Goldman was right, and the trade was profitable. The stock moved enough in their direction to outrun the theta decay and IV crush associated.

However, a long put isn’t the only way that Goldman could have used options to make a bearish prediction in Intel.

How to Use Vertical Spreads to Trade Earnings

In the case of Goldman’s previous trade in Intel, if they wanted to take a bearish view using the $45 strike options, they could have chosen to use a vertical spread. Vertical spreads involve buying an option while simultaneously selling another option against it using the same expiration.

For example, Goldman could have bought the $45 strike put options and sold the $40 strike put options against them. This would have altered a few key things about the structure of the trade:

- Less theta decay

Short options are theta-positive. That means that when time passes, short options become more profitable. While the person you sold them to is losing money with the passing of time, you are on the opposite end of that trade, hoping that the option expires worthless.

- Lower cost-basis

By selling an option against your long option, you are lowering the total amount of premium you must outlay to enter the trade. If the long put option would have cost $1.30, and the short put option costs $0.80, now you have a strategy that costs $0.50! Alongside the change in cost basis comes another welcome change…

- Higher breakeven

This is straightforward: If your $45 strike put option originally cost $1.30, the breakeven would have been <$43.70. If your position is now a $45/$40 put debit spread that costs $0.50, your breakeven is now <$44.50! This means the stock needs to move less in order for the position to become profitable. But everything has a catch, and in this case, the catch is…

- Capped returns

A long $45.00 strike put technically has a max value of $4,500 — a dollar for every penny that the stock drops below $45, potentially all the way down to $0. However, by selling an option against your long put, you are now capping the maximum value of your position at the short strike. In this case, if you were using a $45/$40 put spread, the maximum value of your spread is $500 apiece at expiration— a dollar for every penny that the stock drops below $45, until it reaches $40.

In short: vertical spreads allow traders to mitigate some of the risk associated with holding options through earnings, in exchange for missing out on some of the potential reward.

The Bottom Line

Hindsight is 20/20. We know that last quarter, Goldman may have been better off using a vertical put spread rather than a long put for their bearish Intel prediction. However, this quarter could prove different. The breakeven for near-the-money puts is just above a multi-year low in Intel’s share price. If Intel falls below that point on earnings, it may need to enter a period of price discovery in order to find a new bottom — which could be a part of why Goldman Sachs is so bearish on this name.

Just remember: holding long options through earnings and other known catalysts can come with a heavy amount of risk.. If you’re new to trading options, or you don’t have a strong opinion on Intel’s post-earnings price action, this “deep-end of the pool” trade may not be for you. However, you’re the master of your own domain. So, you be the judge.