Cryptocurrency scams have been one of the most common ways criminals lure money out of people in the past several years. In fact, security firm Certik has found that investors lost around $2.5 billion in crypto scams and hacks only in the first half of 2025.

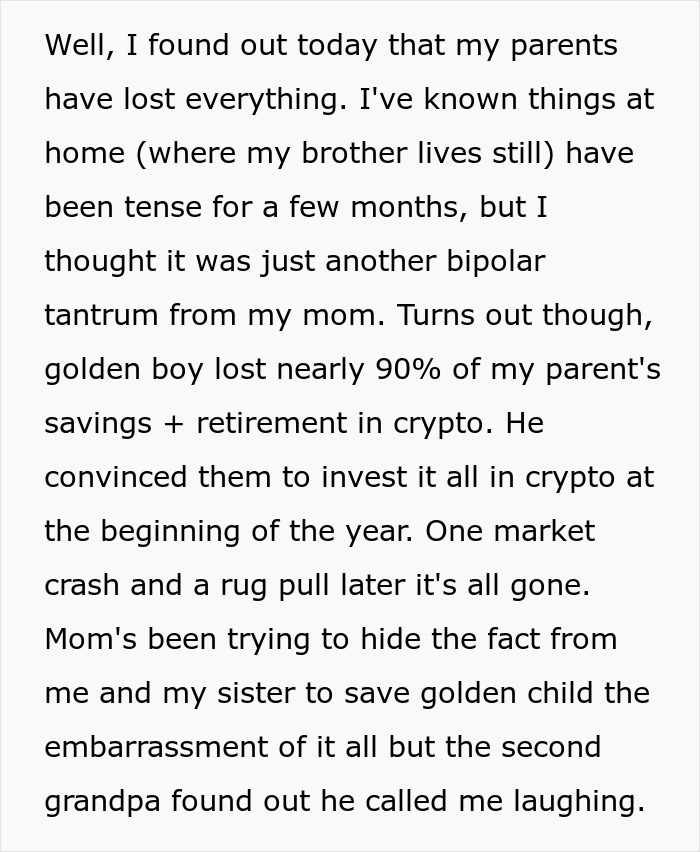

This family fell victim to a crypto scam too, except that it was done by the golden child of the family. The parents, believing that he knew what he was doing, gave him all their life savings and retirement money to invest. After the money was gone, the siblings could only tell them, “I told you so,” but the parents still went out of their way to spare their son the embarrassment.

A crypto bro lost all his parents’ life savings by investing it in a crypto scam

Image credits: Chris Liverani / unsplash (not the actual photo)

Since he was the golden child, the parents didn’t tell the other siblings to spare him from embarrassment

Image credits: voronaman111 / envato (not the actual photo)

Image credits: Popular_Airline_3869

The cryptocurrency investment market is extremely volatile, making it easy to lose large sums of money quickly

Americans aren’t the only ones losing their money to crypto fraudsters. According to The Guardian, the amount that investment scammers take from UK consumers has doubled in a year. So, what is it about cryptocurrency that makes it such a common way to rob people of their money?

If you invest in crypto, it doesn’t automatically mean that you will lose the money. The reality is that the cryptocurrency market is incredibly volatile, making such investments very risky. In this particular story, perhaps the brother wasn’t even a victim of a crypto scam. Sometimes, if not invested correctly, the money might soon be lost.

There is an often-quoted statistic that 90% of investors in cryptocurrency lose their money. While that’s only anecdotal, the risk is still huge. As the co-founder and COO of the crypto risk hedging platform Cork, Anna Stone, told Investopedia, people becoming millionaires from investing in crypto are one in a million lucky stories.

Investing in crypto comes with many risks, including a lack of regulation, software bugs, and scams

Image credits: Jakub Żerdzicki / unsplash (not the actual photo)

Investing in cryptocurrency comes with a lot of risks:

- You can’t reverse or cancel a cryptocurrency transaction. According to the crypto wallet Ledger, somewhere around 11-18% of bitcoins are lost for various reasons, making this investment strategy prone to user risk.

- Regulations differ from country to country and might change suddenly. Countries haven’t adopted universal regulations for cryptocurrencies and their platforms. Some treat them like securities, others like currencies, and some like both. Sudden changes in regulations might cause cryptocurrency values to drop or be challenging to sell as well.

- Unreliable third parties. Some people choose to invest in crypto through exchanges and other third parties. Some of those third parties might be scammers or lose an investor’s money if they put all their eggs in one basket.

- Bugs in software. Programming sometimes fails or gets intercepted by exploiters. No matter how much crypto bros claim that investing in crypto is safe, people still lose their investments due to bugs or scams.

- The market is easy to manipulate. As it’s a fairly new investment strategy, people are easily influenced by famous people, organizations, and other investors on which tokens to buy and invest in.

One of the biggest mistakes when investing is spending what you cannot afford to lose

What are the most common mistakes people make when investing in crypto? Here are a few that Investopedia lists:

- No or very little prior research. When you decide to invest in crypto, you should know where you’re going to hold your currency, whether you will do it through an organization, and which coins it’s best to invest in. It’s important to evaluate and be aware of the risks we’ve listed above as well.

- They’re not prepared for the volatility. Cryptocurrencies might rise and fall by 10%, 20%, or even 30% at times. Some people make the mistake of investing more than they can – just like the golden child in this story. The general rule is: do not invest what you cannot afford to lose. Experts advise crypto investors not to be emotional and follow the rule HODL: “Hold on for dear life.”

- Falling victim to scams. This story is the best example of that. The so-called “rug pull” is when a crypto project seems legit at the start, but, as it attracts investment, the heads cash out before delivering their promises. That leaves other investors with a bunch of worthless shares.

- Not diversifying your portfolio. Putting all your eggs in the crypto basket is incredibly risky. Roland Chow, a financial planner and portfolio manager at Optura Advisors, told Investopedia that investors should dedicate only 5-10% of their portfolios to crypto.

The sibling was adamant about helping the parents out: “No way in hell they’re living here with me”

Some commenters warned the sibling not to give in to guilt-trips

However, a few others called out the sibling’s malicious attitude