Gold prices surged to fresh record highs on Tuesday as Federal Reserve Chair Jerome Powell's cautious economic outlook fueled investor demand for the precious metal. Powell's warning that "near-term risks to inflation are tilted to the upside and risks to employment to the downside" created what he called a "challenging situation" with "no risk-free path" ahead.

The metal has now posted five consecutive weekly gains, driven by expectations of continued Federal Reserve rate cuts and growing economic uncertainty. Gold has gained nearly 40% so far this year, benefiting from lower interest rates that reduce the opportunity cost of holding non-yielding assets.

With analysts targeting $4,000 before year-end and strong ETF inflows supporting the rally, investors are increasingly turning to gold mining stocks to capitalize on the momentum. Here are two top-rated gold stocks positioned to benefit from this historic bull run.

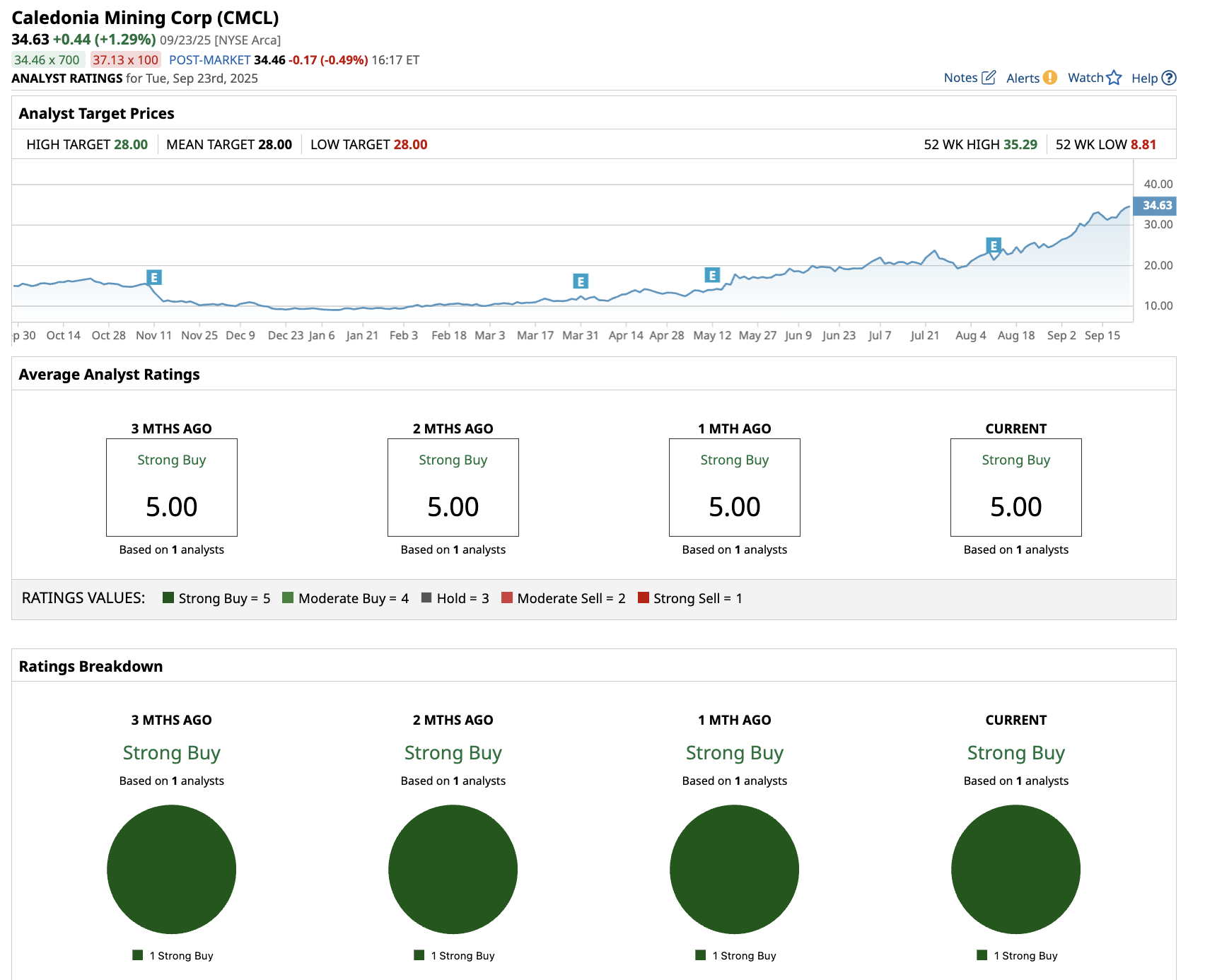

Caledonia Mining Corporation (CMCL)

Caledonia Mining Corporation (CMCL) delivered exceptional Q2 results, with its flagship Blanket Mine in Zimbabwe achieving a record production of 21,070 ounces, the highest second-quarter output in the company's history. This performance drove revenue up 30% to $65 million, and net profit attributable to shareholders surged 147% to $20 million.

The miner’s operational excellence is evident across key metrics. Blanket Mine processed a record 204,915 tonnes at an improved grade of 3.31 grams per tonne, while achieving a record recovery rate of 94.41% through plant optimization initiatives. Management raised full-year production guidance to 77,500-79,500 ounces, reflecting continued strong performance.

CMCL strengthened its position with operating cash flows of $28 million and a net cash position of $26 million after including fixed-term deposits. The strategic sale of its solar plant for $22.4 million provided the company with capital for its core mining operations while securing a long-term power supply for Blanket.

CMCL's disciplined approach to capital allocation, proven operational capabilities, and strategic focus on minimizing shareholder dilution position it well to capitalize on higher gold prices. The gold mining stock has a 10-year track record of outperforming the GDXJ index, driven by effective cost control and a commitment to creating shareholder value.

A single analyst covering CMCL stock has assigned a “Strong Buy” rating with a target price of $28, which is below the current trading price of $34.60.

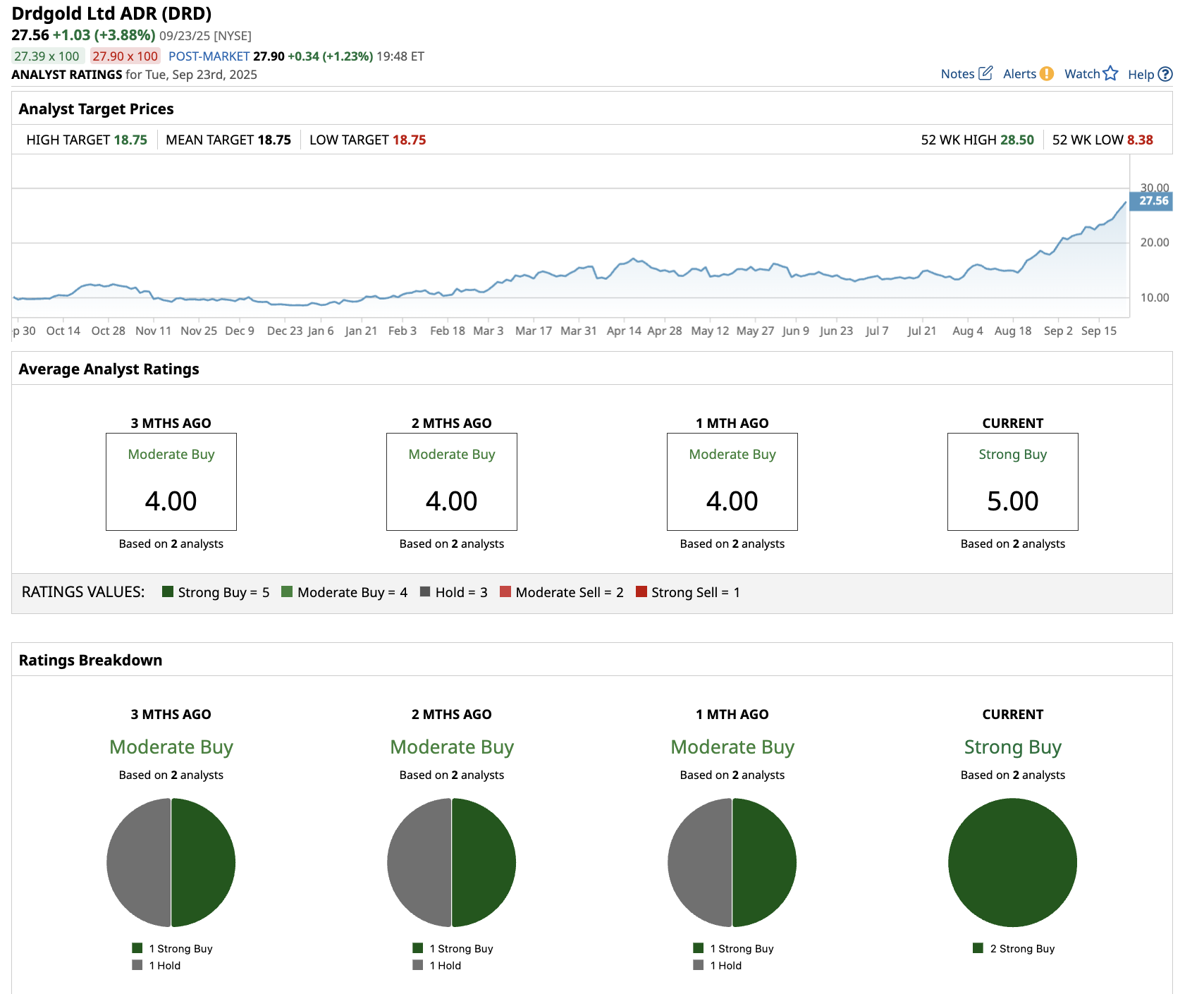

DRDGOLD (DRD)

DRDGOLD (DRD) delivered exceptional results in fiscal 2025 (ended in June), as revenue rose by 26% in fiscal 2025 results, with revenue surging 26% to $446 million. The miner’s operating margin rose 69% as gold prices increased by 31%, coupled with a focus on operational improvements.

The company's unique business model focuses on extracting gold from historical mine tailings around Johannesburg in South Africa, combining environmental remediation with profitable mining.

DRDGOLD operates two main facilities, Ergo and Far West Gold Recoveries, currently producing approximately 150,000 ounces annually while processing 25 million tons of tailings.

Management's ambitious Vision 2028 program represents a transformational growth phase, targeting 200,000 ounces of annual gold production through massive infrastructure investments.

The company has significantly strengthened its operational foundation with a 60-megawatt solar facility and 187-megawatt battery system, generating over $6 million in cost savings while reducing its carbon footprint.

Analysts tracking the gold mining stock forecast revenue to rise from $446 million in fiscal 2025 to $627 million in fiscal 2027. In this period, its free cash flow is forecast to increase from $71 million to $135 million. The mining stock is priced at 20x forward FCF; it could gain over 10% in the next 12 months.

The two analysts covering DRD stock have a “Strong Buy” rating with an average price target of $18.75, which is below the current price of $27.50.