With a market cap of $19 billion, GoDaddy Inc. (GDDY) is a global provider of domain registration, web hosting, and cloud-based products for small businesses, individuals, and professionals. The company operates through its Applications and Commerce and Core Platform segments, offering website-building tools, e-commerce solutions, payment services, domain products, hosting, and online security.

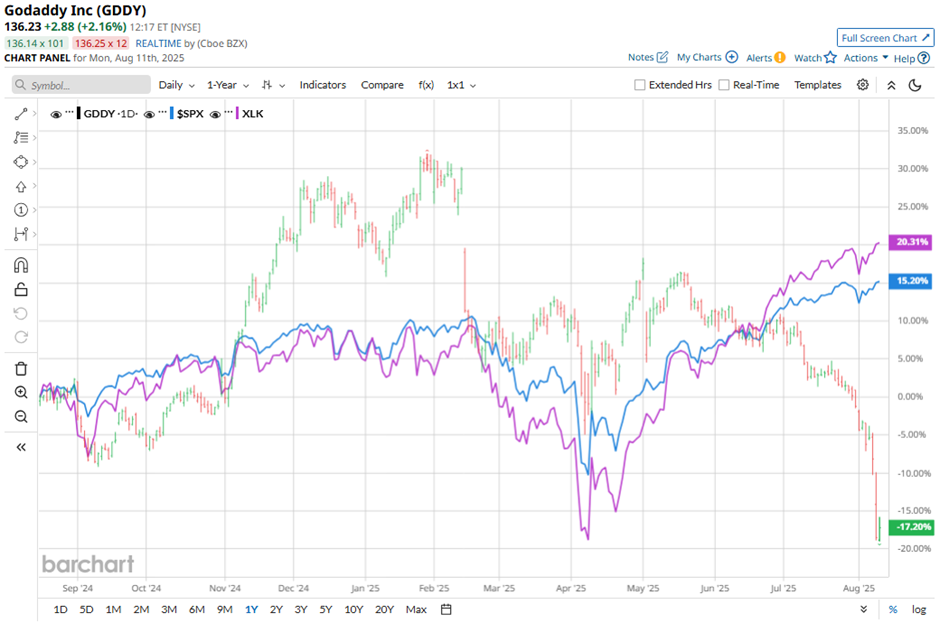

Shares of the Tempe, Arizona-based company have lagged behind the broader market over the past 52 weeks. GDDY stock has dipped 14.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 19.5%. Moreover, shares of GoDaddy have decreased 31.4% on a YTD basis, compared to SPX's 8.6% rise.

Looking closer, GDDY stock has also underperformed the Technology Select Sector SPDR Fund's (XLK) return of 29.4% over the past 52 weeks and a 14.4% gain on a YTD basis.

Despite beating Q2 2025 estimates with EPS of $1.41 and revenue of $1.2 billion on Aug. 7, GoDaddy shares tumbled 11.3% on Aug. 8 as investors reacted to weaker underlying metrics, including a 2.2% year-over-year decline in total customers to 20,409. The company also announced it will exit its role as the registry service provider for the .CO domain starting Q4, which is expected to reduce bookings and revenue by about 50 bps, primarily impacting the fourth quarter.

For the fiscal year ending in December 2025, analysts expect GDDY's EPS to grow 17.3% year-over-year to $5.69. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

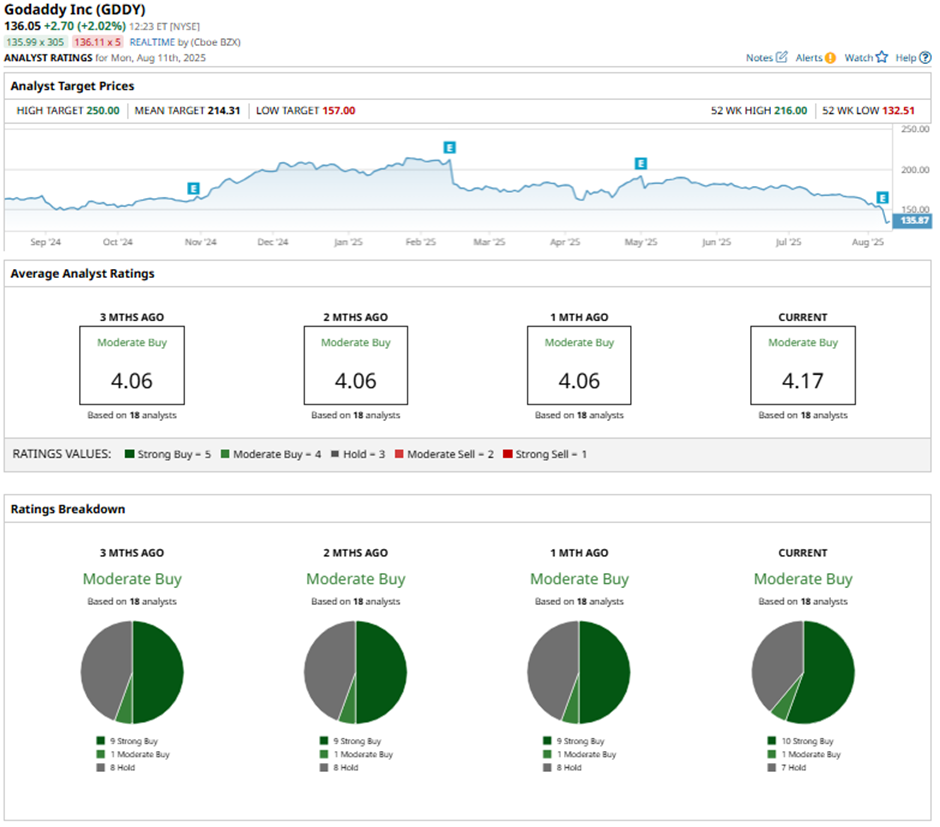

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buys,” one “Moderate Buy” rating, and seven “Holds.”

On Aug. 8, Citi lowered its price target for GoDaddy to $214 while maintaining a “Buy” rating.

As of writing, the stock is trading below the mean price target of $214.31. The Street-high price target of $250 implies a potential upside of 83.8% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.