GoDaddy Inc. (GDDY) operates from its headquarters in Tempe, Arizona, offering a broad spectrum of internet services tailored for entrepreneurs and small businesses globally. The company specializes in domain name registration, web hosting, cloud solutions, and digital tools that enable users to build, market, and manage their online presence.

With a market capitalization of $19.84 billion, the company is considered a “large cap” stock. Currently, GoDaddy supports over 81 million domains and empowers more than 20 million customers through its continuous innovation in digital commerce.

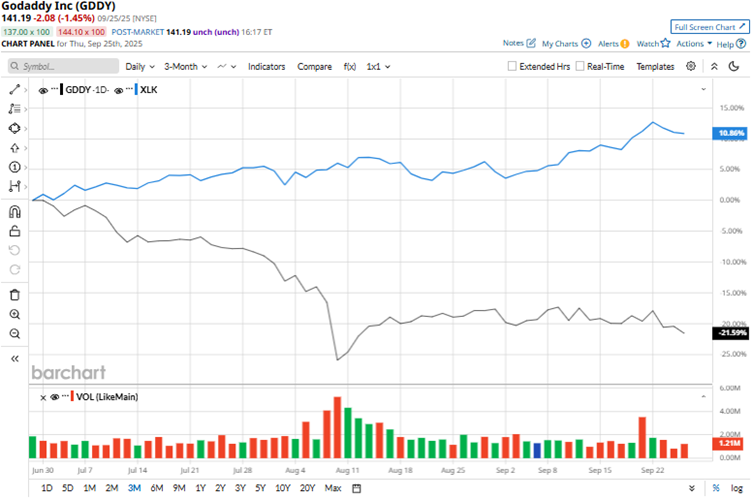

GoDaddy’s stock reached a 52-week high of $216 in January, but is down 34.6% from this high. It reached a 52-week low of $132.51 in August, but is up 6.6% from this low. The stock is facing pessimistic investor sentiment and is down 20.4% over the past three months. On the other hand, the Technology Select Sector SPDR Fund (XLK) is up 11.5% over the same period, underscoring that the stock is underperforming the sector.

Over the longer term, this underperformance persists. Over the past 52 weeks, GoDaddy’s stock has dropped 11.1%, while it is down 28.5% year-to-date (YTD). The Technology Select Sector SPDR Fund has gained 24% and 19.6% over the same period, respectively. The stock has been trading below its 50-day and 200-day moving averages since early July, indicating a bearish price trend.

On Aug. 7, GoDaddy reported stronger-than-expected second-quarter results for fiscal 2025. The company’s revenue increased 8.3% year-over-year (YOY) to $1.22 billion, surpassing the $1.20 billion that Wall Street analysts had expected. Its EPS was $1.41, up 39.6% YOY and higher than the $1.34 EPS that Wall Street analysts were expecting.

Despite this, GoDaddy’s stock dropped almost 3% intraday on Aug. 7 and 11.3% on Aug. 8. This was likely due to the company's announcement that it will no longer operate as the registry service provider for the .CO top-level domain (TLD), which is expected to have an approximate 50 basis point headwind to bookings and revenue, mainly in the fourth quarter.

We examine another software infrastructure company, F5, Inc. (FFIV), to compare GoDaddy's performance against it. F5’s stock has gained 47.5% over the past 52 weeks and 28.8% YTD. Therefore, GDDY has underperformed FFIV over the past year.

Wall Street analysts are moderately bullish on GoDaddy’s stock. The stock has a consensus rating of “Moderate Buy” from the 19 analysts covering it. The mean price target of $195.19 indicates a 38.2% upside compared to current levels. Moreover, the Street-high price target of $250 indicates a 77.1% upside.

.jpg?w=600)