With a market cap of $18.1 billion, GoDaddy Inc. (GDDY) is a leading Arizona-based internet services company, specializing in domain registration, web hosting, website building, online marketing, and digital commerce tools for small businesses and entrepreneurs. Founded in 1997 by Bob Parsons, it now serves over 20 million customers and manages more than 80 million domain names worldwide.

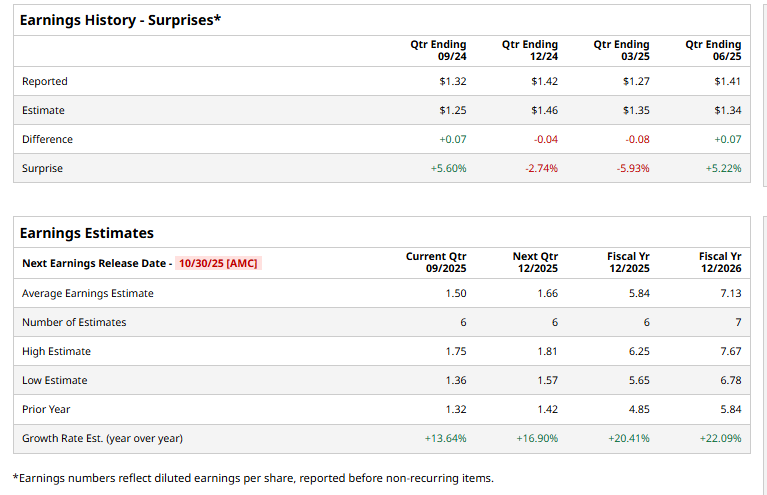

The company is expected to release its Q3 2025 earnings on Thursday, Oct. 30, after the market closes. Ahead of this event, analysts project GDDY to report earnings of $1.50 per share, which represents a 13.6% growth from $1.32 in the same quarter last year. The company has surpassed Wall Street’s bottom-line estimates in two of the past four quarters, while missing on two other occasions.

For fiscal 2025, analysts forecast GDDY to report an EPS of $5.84, marking a 20.4% increase from $4.85 reported in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to grow 22.1% annually to $7.13 per share.

GDDY stock has declined 18.8% over the past 52 weeks, underperforming the Technology Select Sector SPDR Fund’s (XLK) 23.6% surge and the S&P 500 Index’s ($SPX) 14.4% uptick during the same time frame.

On Aug. 7, GoDaddy reported second-quarter results for fiscal 2025. It reported revenue of $1.22 billion, marking an 8.3% year-over-year increase and exceeding Wall Street’s estimate of $1.20 billion. The company’s EPS rose 39.6% year-over-year to $1.41, also coming in ahead of analysts’ expectations of $1.34.

However, shares of GoDaddy fell about 3% after the company announced it would cease operating as the registry service provider for the .CO top-level domain (TLD), a move expected to create roughly a 50-basis-point headwind to bookings and revenue, primarily impacting the fourth quarter.

Analysts' consensus view on GDDY is moderately optimistic, with an overall "Moderate Buy" rating. Out of 18 analysts covering the stock, opinions include nine "Strong Buys," one “Moderate Buy,” and eight "Holds.” Its mean price target of $191.60 suggests a 44.7% upside potential from current price levels.