General Motors Co. (NYSE:GM) will import LFP batteries from China's Contemporary Amperex Technology Limited, or CATL, until its partner, Korea's LG Energy Solutions, can ramp up domestic battery production in the U.S.

A Stop Gap Arrangement For The Chevrolet Bolt EV

The automaker will import the LFP batteries from China's CATL until GM's partner LG can begin producing batteries in the Tennessee plant from 2027, the Wall Street Journal reported on Thursday.

The imported LFP batteries will power the upcoming Bolt EV, which is the company's most affordable electric vehicle at $30,000.

"For several years, other U.S. automakers have depended on foreign suppliers for LFP battery sourcing and licensing," a spokesperson for the company said before adding that GM will source the batteries from "similar suppliers" to power the Bolt EV in an effort "to stay competitive."

Could Tariffs On Chinese Battery Imports Impact The Chevy Bolt Pricing?

However, batteries from China still carry a heavy tariff cost as companies would have to pay over 80% tariffs on the imports, the report says. However, experts cited in the report, like Sam Abuelsamid, think that the bolt could still be profitable.

"It may be that the economics work for GM to do this on a temporary basis," he said, adding that GM could also be cutting costs in other ways.

Trump Tariffs May Impact Battery Demand, Domestic Production Push

The news comes as LG had earlier warned that President Donald Trump's tariffs could impact the demand for EV batteries in the U.S. "Tariffs and an early end to EV subsidies will put a burden on automakers," the company said.

GM's rivals, like Ford Motor Co. (NYSE:F), are pushing ahead with battery production efforts in the U.S., with the Michigan automaker greenlighting plans to invest $3 billion in a battery production plant.

Elsewhere, Tesla Inc. (NASDAQ:TSLA) signed a deal with LG Energy Solutions worth $4.3 billion to supply LFP batteries for the EV giant's energy storage solutions in the U.S.

Axing EV credits, Relaxing Emissions Norms

What could further impact the sales of EVs in the U.S. is the decision by the Trump administration to axe the $7,500 EV credit, which ends on September 30, 2025.

Besides this, Trump's EPA also proposed rescinding the 2009 Endangerment Finding, which forms the basis of most emissions standards in the U.S. Doing so could take legal pressure off automakers to follow emissions norms.

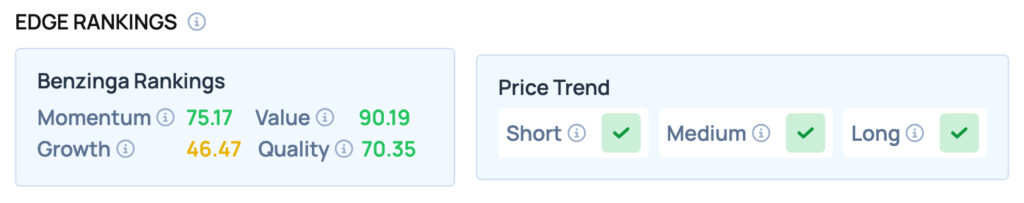

GM scores well on Momentum, Value and Quality metrics while offering satisfactory Growth. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock