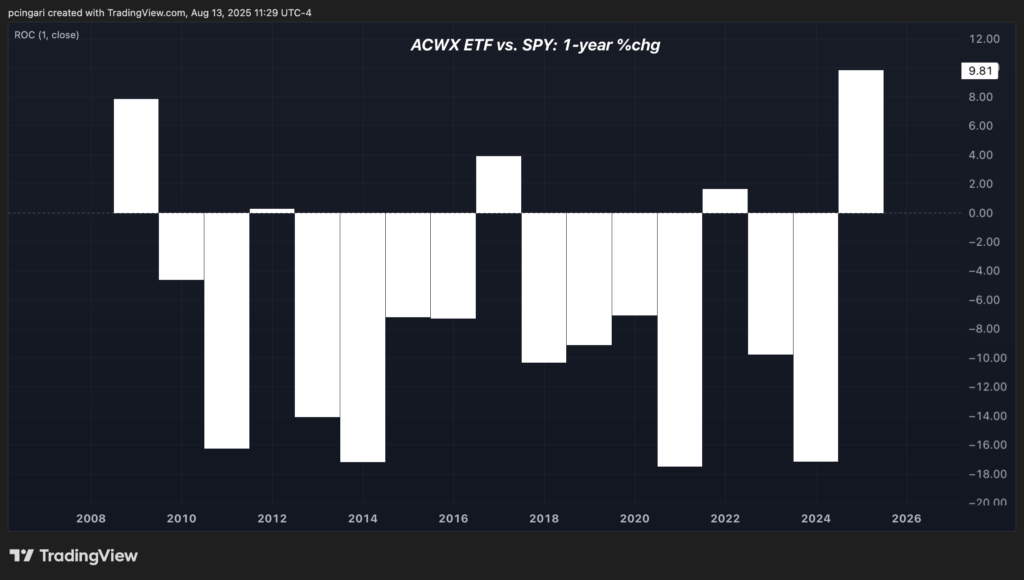

Global equities are crushing Wall Street in 2025, posting their strongest outperformance since the Great Recession, as trade deals, a sliding dollar and looser monetary policy overseas help fuel a historic reversal.

Through Aug. 13, the iShares MSCI All Country World Index Ex U.S. ETF (NYSE:ACWX) has surged 20.5% year-to-date, outperforming the SPDR S&P 500 ETF Trust (NYSE:SPY) by nearly 10 percentage points.

Global Stocks Eye Best Year Vs. US Stocks Since 2009

If that gap holds, it would mark the largest annual outperformance of international stocks over U.S. equities since 2009, when ACWX gained 33.2% versus the S&P 500's 23.5%.

Since the financial crisis, U.S. stocks have consistently led global markets—outpacing them in all but two years, 2017 and 2022.

Over those 15 years, Wall Street has outperformed by a cumulative 115 percentage points, a trend widely referred to as “U.S. exceptionalism” trade.

7 Global Stocks Crushing Palantir in 2025 With Over 150% Gains

While Palantir Technologies Inc. (NYSE:PLTR) leads the S&P 500 with an impressive 144% gain year to date, several global stocks are doing even better—posting returns north of 150% in 2025, thanks to surging defense demand, energy investments and commodity-driven gains.

Here are seven global stocks included in the ACWX ETF that have outperformed Palantir as of Aug. 13:

| Company | Country | YTD Price Change |

|---|---|---|

| Doosan Enerbility Co., Ltd. (OTCPK: DOSEF) | South Korea | +273.22% |

| Hyundai Rotem Company (OTCPK: HYROF) | South Korea | +258.75% |

| Hanwha Ocean Co., Ltd. (OTCPK: HOCPF) | South Korea | +178.45% |

| Hanwha Aerospace Co., Ltd. (OTCPK: HWAIF) | South Korea | +160.64% |

| Lundin Gold Inc. (OTCPK: LUGDF) | Canada | +159.75% |

| PT Barito Pacific Tbk (OTCPK: BPTNF) | Indonesia | +154.35% |

| Rheinmetall AG (OTCPK: RNMBF) | Germany | +154.31% |

Trump’s Tariffs Look Scary, But Markets Say Otherwise

Despite headline risk from President Donald Trump's aggressive trade rhetoric, international equities have surged in 2025.

After winning the election in November 2024, Trump's America First agenda initially lifted U.S. stocks, with the S&P 500 outperforming ACWX by nearly 10% through the end of the year.

But the surprise came after April 2, when Trump unveiled sweeping tariffs on global trading partners under the banner of “Liberation Day.”

Rather than fueling a trade war, the move opened the door to new trade deals with major partners like the U.K., Canada, Japan and the European Union.

Tariff threats with China were also defused. Instead of jumping to triple-digit levels, U.S. tariffs on Chinese goods remain capped at 30%, while China's duties stay at 10%, thanks to a double 90-day extension announced by both governments.

Weak Dollar Supercharges Foreign Assets

A plunging dollar gave global equities another lift. The U.S. Dollar Index has fallen 10% year to date, its worst performance since 2003, driven by tariff-related uncertainty and ongoing political pressure on the Federal Reserve to lower rates.

A weaker dollar boosts the value of overseas assets for U.S.-based investors and signals relative strength in non-U.S. economies.

International markets are also benefiting from stronger monetary and fiscal stimulus. While the Federal Reserve has held off on rate cuts so far in 2025, global central banks—including the European Central Bank and the Bank of Japan—have slashed rates as inflation trends lower.

According to Bank of America strategist Michael Hartnett, the "flip from U.S. to EU/China fiscal excess" signals a reversal of a 15-year trend. In late June, Hartnett said this shift could mark the end of the “exceptional secular outperformance of U.S. vs international stocks.”

Read now:

Photo: Shutterstock