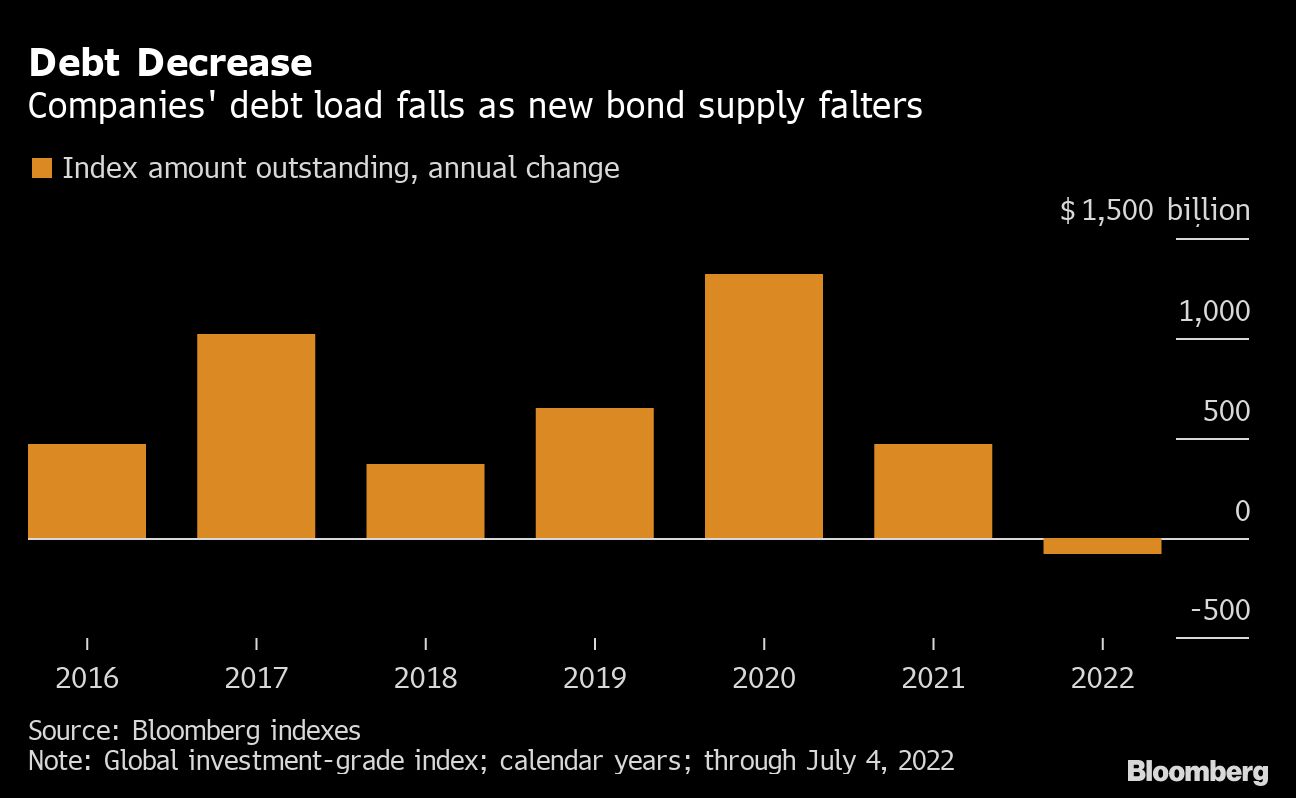

Companies’ global debt load is declining for the first time in eight years as the cost of financing soars and firms limit issuance amid recession fears.

A corporate-debt index by Janus Henderson showed an almost 2% drop in net debt in the 12 months ending in March, marking the first year-on-year fall in indebtedness since 2014. The global $8.15 trillion pile may shrink by a further $270 billion until March 2023, the asset manager predicted on Wednesday, based on levels of maturing debt and its forecasts for issuance.

The decline underscores a lack of debt supply as the soaring cost of new credit, stoked by central bank battles against inflation, keeps companies away from the market.

Firms typically responded in a sound way to the coronavirus shock, extending their maturities while debt was cheap, which is allowing them to wait out the historically high market volatility, according to Janus Henderson. This trend is also seen in Bloomberg debt gauges.

“This lack of issuance is a function of many corporates having done the right thing and not overextending themselves when they could have,” said Tom Ross, a portfolio manager at the firm which oversees 274-billion-pound ($326 billion) in assets. “Quite frankly, there is a really low refinancing wall,” he said, referring to the amount of maturing debt borrowers will have to replace in coming years.

Companies in advanced economies repaid more than $2 trillion of dollar, euro and sterling debt annually in the past three years, based on data compiled by Bloomberg. Maturities in 2023 and 2024 amount to about $1.5 trillion and will approach the $2 trillion mark again only in 2026.

Pricey Bonds

The lack of forced selling of new debt has shielded companies from the highest refinancing costs since 2009. Global high-grade bond yields, a proxy of what firms have to pay to raise new debt, stand 125 basis points above coupons -- the actual cost of servicing existing debt, according to Bloomberg indexes.

Yields were indicated lower than coupons as recently as March, before a combination of high inflation, rising fears of a recession in advanced economies and the seismic impact from Russia’s invasion of Ukraine triggered a historic rise in corporate funding costs.

Meanwhile, banks have been cutting their estimates of new debt supply. UniCredit is the latest to reduce its forecast, seeing euro junk bond supply from iBoxx index-eligible firms at 35-40 billion euros ($36-42 billion), down from 50-60 billion euros.

“Although we expect supply to resume going forward, it will be limited in historical terms, given lower investment and M&A funding demand,” strategists Michael Teig and Stefan Kolek wrote.

Elsewhere in credit markets:

EMEA

Four SSA issuers are bringing midweek deals in Europe’s primary market, including sustainability bonds from BNG Bank and OKB AG. Sales for the week will reach about 6.3 billion euros, as a marketwide slowdown continues.

- The latest round of political turmoil engulfing the UK government is adding to an increasingly uncertain UK outlook and leaving investors holding back from big bets on the country’s markets for now. “Credit is much more at the mercy of the Bank of England, who in turn are at the mercy of inflation prints and whether Russia cuts” gas supplies, said Gordon Shannon, a portfolio manager at TwentyFour Asset Management

- Struggling to launch high-yield deals as recession fears swirl, investment bankers in Europe are conducting more business behind closed doors in order to sell big chunks of corporate debt in a market that’s increasingly closed

- Greece’s Piraeus Bank entered in to binding agreements for three synthetic securitizations of performing loans, comprising mortgage, corporate/SME and other exposures, according to stock-exchange filing

Asia

Activity in Asia’s primary dollar bond market ground to a halt Wednesday, as recession fears suppressed appetite for risk assets from stocks to corporate debt.

- Asian investment-grade dollar bond spreads widened at least 1bp Wednesday morning, according to traders, putting them on track for their highest absolute level in about six weeks, a Bloomberg index shows

- Shimao Group Holdings Ltd.’s global creditors are gearing up to organize themselves after the luxury builder defaulted on a $1 billion dollar bond due Sunday. An executive at investment bank Houlihan Lokey Inc. asked Shimao bondholders to join its creditor group, according to people at firms that hold the notes who dialed into a conference call late Tuesday

Americas

All three companies that were considering new bond sales in the US high-grade primary market on Tuesday stood down and will take another look later this week. Tuesday’s blank extends an issuance shutout streak to four days.

- The investment-grade primary market stumbled for most of June as volume projections missed estimates for three consecutive weeks and Celanese delayed their potential jumbo bond offering

- Meanwhile, activity in the region’s structured finance market is slightly more upbeat, with US ABS, CMBS and RMBS sales outpacing last year despite the broader market volatility. ABS sales are up by 4% while CMBS issuance is running 13% higher through June 30

©2022 Bloomberg L.P.