Nissan Motor Co. put off choosing a replacement for former Chairman Carlos Ghosn at its board meeting Monday. Should top Nissan shareholder Renault SA of France heighten its demands regarding the appointment of a chairman, in a bid to retain its influence over Nissan, the battle between the two firms is certain to intensify.

Swift shareholders meeting

When asked at a press conference after the board meeting why the appointment of a new chairman had been put off, Hiroto Saikawa, president and chief executive officer of Nissan, said: "I want to fully hear Renault's opinions. We should not make a hasty decision."

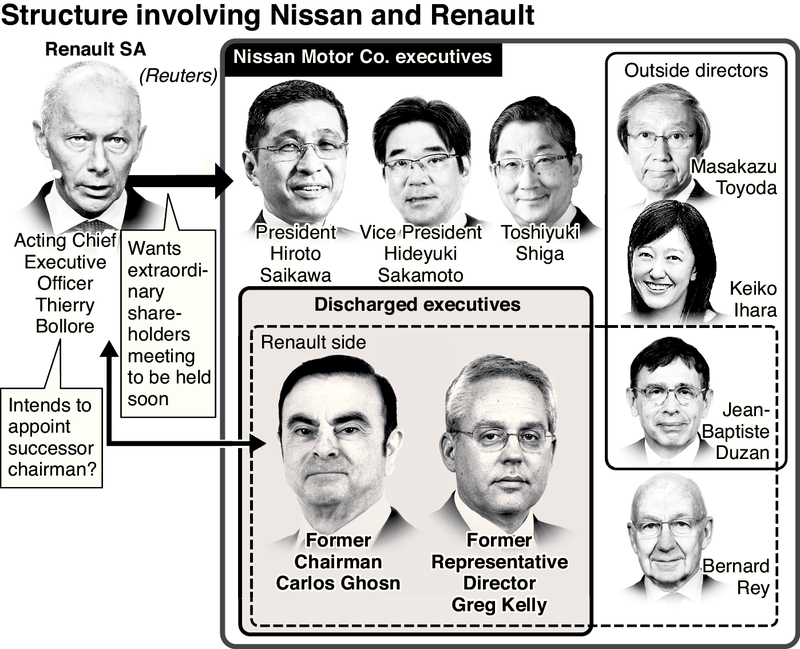

Seven people can attend Nissan board meetings, not counting Ghosn and former Representative Director Greg Kelly, both of whom have been charged with violating the Financial Instruments and Exchange Law.

Of the seven, only two come from Renault: Bernard Rey, 72, and outside director Jean-Baptiste Duzan, 72.

Renault, which cannot form a majority in the board on its own, is demanding the right to fill a top post within Nissan as a replacement for Ghosn.

According to British newspaper the Financial Times, acting Renault CEO Thierry Bollore called on Saikawa in a letter dated Friday to hold an extraordinary shareholders meeting. Also in the letter, Bollore said the indictment of Ghosn "creates significant risks" to the Renault-Nissan alliance.

"The EGM [extraordinary general meeting] would allow for the appropriate disclosure and discussions of governance and other matters, including the Renault appointees on the Nissan board and in senior management," the letter said.

The letter was said not to stipulate a specific goal for the shareholders meeting, but a source close to Renault was quoted as saying "we just want to have an appropriate forum to discuss the alliance after the indictment."

Buying more shares

The French government, which is the top shareholder in Renault at 15 percent, is said to be increasingly concerned about the future of the three-way tie-up among Renault, Nissan and Mitsubishi Motors Corp., following Ghosn's dismissal as the chairman of Nissan and Mitsubishi Motors.

Renault is said to want an extraordinary shareholders meeting to be held quickly because it holds 43 percent of Nissan's stock and in an open shareholders meeting, it can display its influence.

The focus here of the relationship between Nissan and Renault is the agreement known as RAMA, the Restated Alliance Master Agreement, which the two companies revised in 2015. RAMA stipulates that Nissan can choose the majority of its board members. It also states that should Renault wrongly interfere in Nissan Motor's management, Nissan can purchase more than its current 15 percent stake in Renault.

On the other hand, the agreement allows Renault to dispatch to Nissan a top executive to serve as Nissan's chief operating officer or higher.

RAMA contains agreements that favor one side or the other, and it forms the basis for fierce bargaining regarding Ghosn's successor.

Hard-line position

At the same time, however, Nissan and Renault have deepened their cooperation in such areas as the development of new cars and procuring parts. Massive investments are vital amid the technological revolution now faced by the automobile industry, including self-driving cars and artificial intelligence, and both companies have confirmed the need for their alliance even after Ghosn's arrest.

The dominant opinion at Nissan is therefore that the company will have to accept some of Renault's demands, such as accepting a new director from the French company.

However, strong calls remain within Nissan to review the alliance with Renault. A Nissan executive said that to prevent Renault's strong influence from solidifying in such areas as capital and personnel, "we have to show we're willing to really fight."

Depending on Renault's moves, Nissan may take an increasingly hard line, including using RAMA to purchase more shares in Renault.

Read more from The Japan News at https://japannews.yomiuri.co.jp/