Minneapolis, Minnesota-based General Mills, Inc. (GIS) is a global manufacturer and marketer of branded consumer foods. It operates through North America Retail, International, Pet, and North America Foodservice segments. With a market cap of nearly $24.7 billion, General Mills boasts an extensive portfolio of 100+ brands.

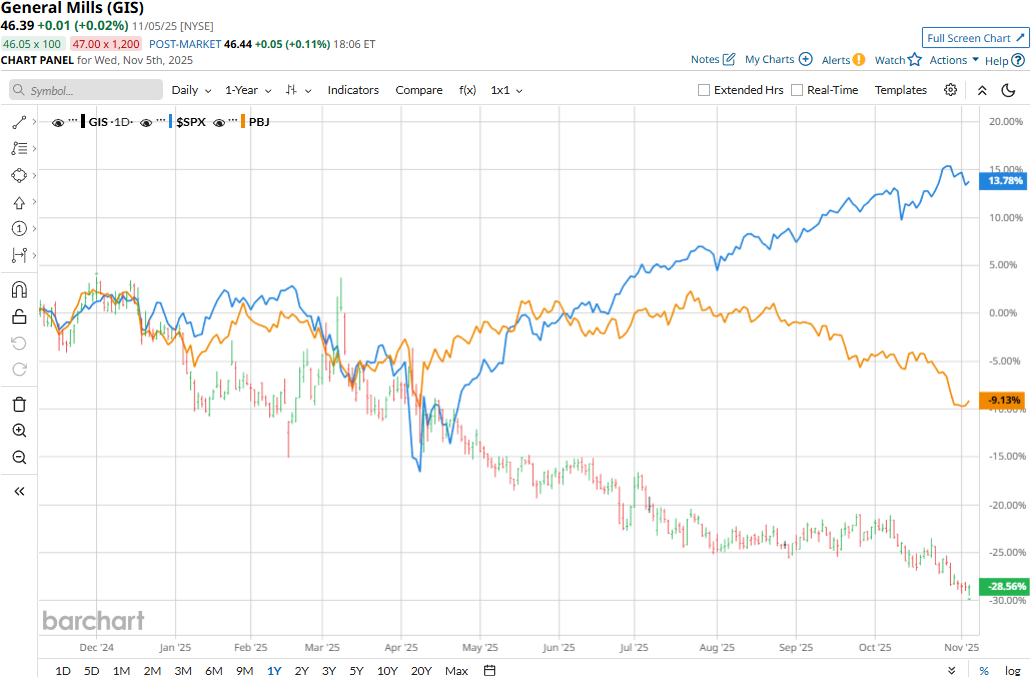

Despite its notable strengths, GIS has notably underperformed the broader market over the past year. The stock has plunged 27.3% on a YTD basis and tanked 32.1% over the past 52 weeks, notably lagging behind the S&P 500 Index’s ($SPX) 15.6% gains on a YTD basis and 17.5% returns over the past year.

Narrowing the focus, General Mills has also lagged behind the industry-focused Invesco Food & Beverage ETF’s (PBJ) 6.4% decline in 2025 and 8.4% dip over the past 52 weeks.

General Mills’ stock prices observed a marginal dip in the trading session following the release of its Q2 results on Sept. 17. The company has continued to face pressure on its topline; its net sales for the quarter dropped 7% year-over-year to $4.5 billion. This included a 4% decline due to the net impact of divestitures and acquisitions and a 3% drop in organic net sales due to unfavorable pricing. Nonetheless, the topline figure surpassed the Street’s expectations by 42 bps. Excluding the impact of gains from divestitures and other non-recurring items, General Mills’ margins have continued to suffer. Its adjusted EPS for the quarter dropped 19.6% year-over-year to $0.86, but surpassed the consensus estimates by 6.2%.

For the full fiscal 2026, ending in May, analysts expect GIS to deliver an adjusted EPS of $3.65, down 13.3% year-over-year. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line expectations in each of the past four quarters.

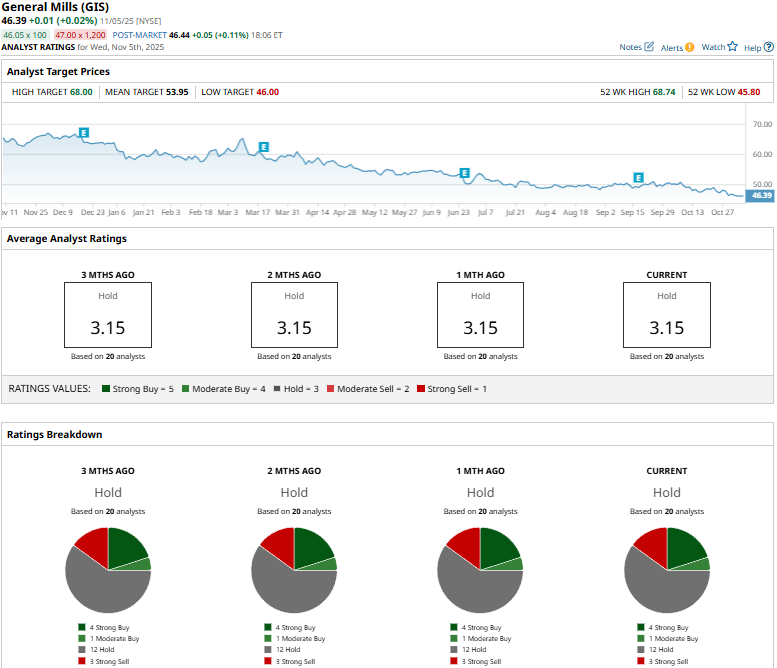

Among the 20 analysts covering the GIS stock, the consensus rating is a “Hold.” That’s based on four “Strong Buys,” one “Moderate Buy,” 12 “Holds,” and three “Strong Sells.”

This configuration has remained stable in recent months.

On Sept. 19, Mizuho analyst John Baumgartner maintained a “Neutral” rating on GIS, but lowered the price target from $57 to $52.

General Mills’ mean price target of $53.95 suggests a 16.3% premium to current price levels. Meanwhile, its street-high target of $68 indicates a 46.6% upside potential.