General Dynamics Corporation (NYSE:GD) will release earnings results for the third quarter, before the opening bell on Friday, Oct. 24.

Analysts expect the Reston, Virginia-based company to report quarterly earnings at $3.71 per share, up from $3.35 per share in the year-ago period. The consensus estimate for General Dynamics' quarterly revenue is $12.53 billion, compared to $11.67 billion a year earlier, according to data from Benzinga Pro.

On Oct. 13, General Dynamics Land Systems, a subsidiary of General Dynamics, and Parry Labs announced a strategic teaming agreement aimed at accelerating digital integration across combat platforms.

Shares of General Dynamics rose 1% to close at $341.50 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

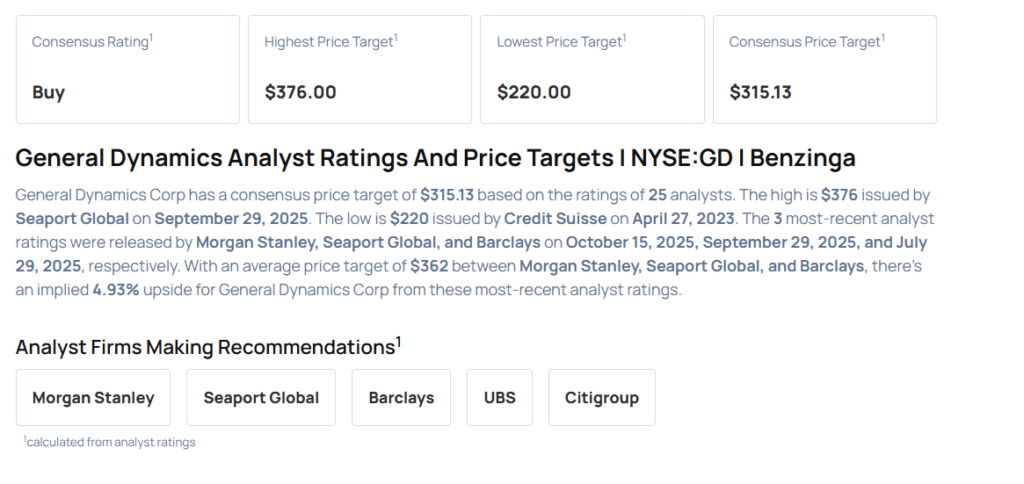

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Kristine Liwag maintained an Equal-Weight rating and raised the price target from $328 to $360 on Oct. 15, 2025. This analyst has an accuracy rate of 73%.

- Barclays analyst David Strauss maintained an Overweight rating and boosted the price target from $285 to $350 on July 29, 2025. This analyst has an accuracy rate of 73%.

- UBS analyst Gavin Parsons maintained a Neutral rating and raised the price target from $309 to $333 on July 24, 2025. This analyst has an accuracy rate of 65%.

- Citigroup analyst Jason Gursky maintained a Buy rating and increased the price target from $348 to $368 on July 24, 2025. This analyst has an accuracy rate of 85%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and boosted the price target from $284 to $345 on July 24, 2025. This analyst has an accuracy rate of 85%

Considering buying GD stock? Here’s what analysts think:

Photo via Shutterstock