/Generac%20Holdings%20Inc%20portable%20generator%20by-%20Lissandra%20Melo%20via%20Shutterstock.jpg)

Generac Holdings Inc. (GNRC), headquartered in Waukesha, Wisconsin, designs, manufactures, and distributes various energy technology products and solution. With a market cap of $12.7 billion, the company offers generators to serve the residential, commercial, industrial, and telecommunications markets.

Shares of this backup power giant have outperformed the broader market over the past year. GNRC has gained 41.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.9%. In 2026, GNRC stock is up 58.2%, surpassing the SPX’s marginal fall on a YTD basis.

Zooming in further, GNRC’s outperformance is also apparent compared to the Industrial Select Sector SPDR Fund (XLI). The exchange-traded fund has gained about 25.4% over the past year. Moreover, GNRC’s returns on a YTD basis outshine the ETF’s 11.4% gains over the same time frame.

GNRC's strong performance is driven by data center demand and partnerships with hyperscale clients, with double-digit growth in its C&I segment. The company is investing in new products and expanding its dealer network, including a new Wisconsin facility to boost large megawatt generator capacity.

On Feb. 11, GNRC shares surged 17.9% after reporting its Q4 results. Its adjusted EPS of $1.61 missed Wall Street expectations of $1.81. The company’s revenue was $1.1 billion, missing Wall Street forecasts of $1.2 billion.

For fiscal 2026, ending in December, analysts expect GNRC’s EPS to grow 27.9% to $8.11 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

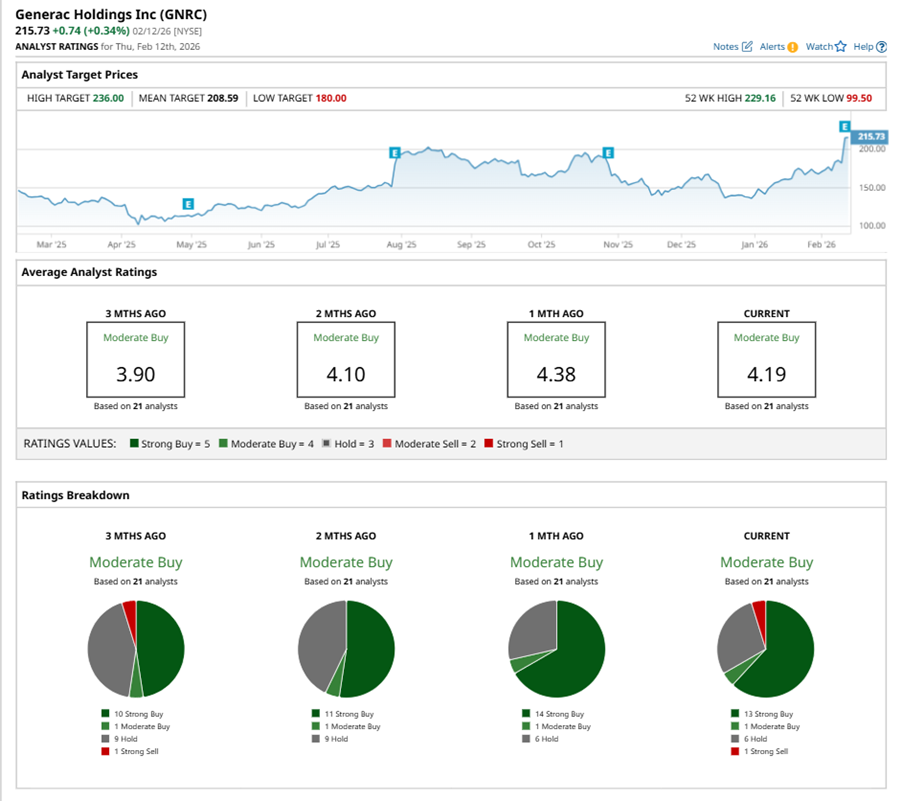

Among the 21 analysts covering GNRC stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Strong Sell.”

This configuration is less bullish than a month ago, with 14 analysts suggesting a “Strong Buy.”

On Feb. 11, TD Cowen analyst Jeff Osborne maintained a “Buy” rating on GNRC and set a price target of $255, implying a potential upside of 18.2% from current levels.

While GNRC currently trades above its mean price target of $208.59, the Street-high price target of $236 suggests an upside potential of 9.4%.